Let's say you work at a successful company with stock values that improve consistently over time.

Maybe you spend your time giving all you have to a technology business such as Google (GOOGL), Amazon (AMZN), Microsoft (MSFT) or Meta (META).

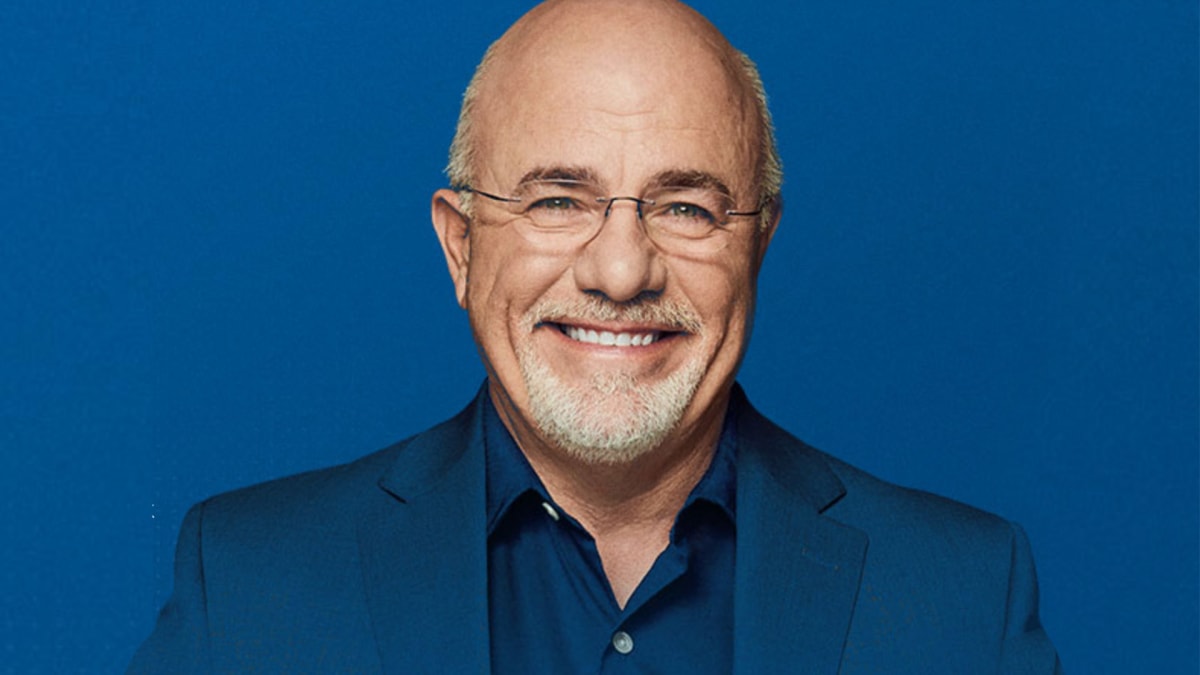

DON'T MISS: Dave Ramsey Has a Blunt Warning On a Key Homeowner Mistake

Perhaps you toil away in the retail sector for Walmart (WMT), Home Depot (HD), or Costco (COST).

Many of these companies have attractive stock purchase options. But a question is always present: Should one invest entirely in a stock because it's also the place where one works?

Radio host and author Dave Ramsey discussed this with a person who asked for his advice.

"Dear Dave," he asked, identifying himself as John, according to KTAR News in Phoenix. "My employer offers an employee stock purchase plan at a 15% discount. I’m usually the kind of guy who buys stocks and holds on to them forever. But when it comes to an opportunity like this, should I buy it and wait for a year to sell it, or should I buy it and sell right away?"

Ramsey responded with a warning about putting too much money into an individual stock.

"Dear John," he wrote. "Generally, I don't recommend buying single stocks at all. Single stocks are way too risky, and a 15% discount is nothing special in this kind of scenario. Virtually every single company out there that has an employee stock option plan offers a 15% discount."

The personal finance personality then began doing some math, which he explained.

"In most situations like this, if you pull up a 52-week chart on the stock's performance, you'll find a variance of as much as 15% in those 52 weeks," he wrote. "In other words, you could lose any or all of that discount in one move of the stock. Plus, it's not like 15% is a big discount to begin with. Fifteen percent off a single stock, considering how volatile they are, is no big deal. But hey, if you love your company that much, they have a great track record, and the stock has a good history, go ahead. Just don’t allow single stocks as a category to make up more than 10% of your net worth."

Ramsey pivoted to a discussion about the importance of diversification.

"The core issue here is a lack of diversification. When you put all your eggs in one basket, there’s always some clown twirling the basket," he said.

"The first time I ran into that was a long time ago with a lady who was 70 years old," Ramsey recalled. "She had worked for a large company for 40 years. On top of that, she invested all her 401(k), all her wealth -- $800,000 total -- in that one company. Well, this company experienced a crisis. It lost nearly half of its value, and her $800,000 was suddenly worth about $400,000. She left herself vulnerable with a high-risk play, John."

Ramsey closed by reiterating his warning.

"I'll say it again. Don’t bet the farm on one horse, and don’t have more than 10% of your net worth wrapped up in single stocks," he said. "Hundreds of research projects have been done that show individuals who buy individual stocks and think they know what they're doing actually lose money much more often than they make money."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.