American workers planning for retirement have several important financial details to consider.

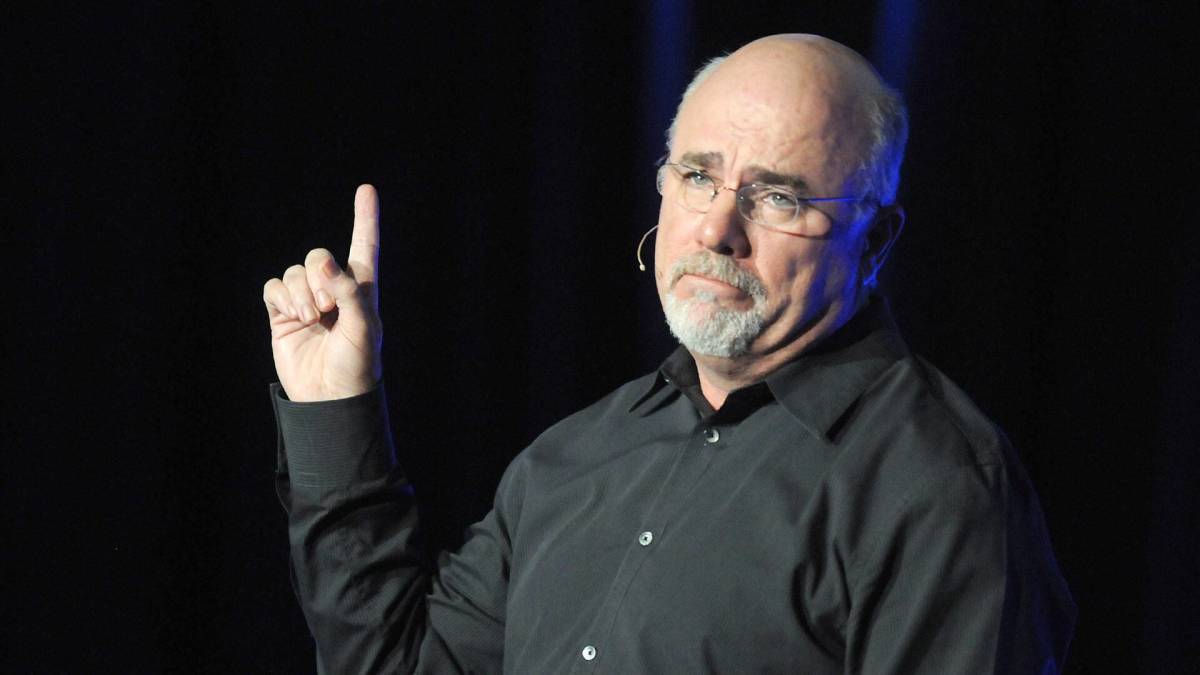

Personal finance bestselling author and radio host Dave Ramsey offers a warning and some key advice about retiring and Social Security benefits that he says people would be wise to understand and examine.

🎁 Buy 1 Year and Get 1 Year FREE on TheStreet Pro. Act now before it's gone ⏰

First, it's important to begin saving as early as possible, including by contributing to retirement accounts such as employer-sponsored 401(k)s and IRAs. The earlier one begins saving and investing for retirement, the more time that money has to grow in value.

Another major priority is for people to understand and familiarize themselves with health insurance, including making key decisions about Medicare.

One of those choices involves whether to enroll in Original Medicare or the increasingly popular Medicare Advantage, which is offered by private insurance companies.

Related: Dave Ramsey warns Americans on a major Medicare mistake to avoid

Original Medicare includes Part A (coverage for hospitalization) and Part B (medical insurance for doctor visits and preventive care). It also requires a separate plan to cover prescription drug costs, called Part D.

Medicare Advantage (also known as Part C) usually includes those coverage parts and can also have added benefits such as coverage for dental services, vision and hearing.

Many people choose Medicare Advantage because of those additional benefits and because it has the potential for lower out-of-pocket costs — and sometimes offers other perks such as fitness programs.

Monthly Social Security payments are a major component of most retirement income plans. Dave Ramsey has a few points to make about that federal program and how it plays a role in retirees' financial well-being.

Shutterstock

Dave Ramsey explains the average Social Security benefit

Ramsey emphasizes that one's monthly Social Security paycheck should not be relied upon as a sole source of retirement income.

The Social Security Administration (SSA) reported that, as of July 2024, the average monthly Social Security payment was $1,918 per month. That works out to just more than $23,000 per year, only slightly above the national poverty level for a household of two people.

"That’s not the best way to spend your golden years," Ramsey wrote.

More on Dave Ramsey

- Dave Ramsey sounds alarm on Social Security for retired Americans

- Ramsey explains some key tips on Medicare for retirees

- Dave Ramsey has a warning for people buying a home now

The personal finance personality explains that your monthly Social Security payment is based on how much you earned during your career. The more a person makes in lifetime earnings, the more they get from Social Security.

Retirees will need additional income sources to live comfortably in retirement. Ramsey suggests that, during their working years, people try to invest 15% of their income in their company's 401(k) plan and a Roth IRA (in growth stock mutual funds).

Related: Dave Ramsey has blunt words on Medicare for retired Americans

Dave Ramsey discusses the age at which one should claim Social Security benefits

People born in 1960 or later reach Full Retirement Age at age 67 (it's between their 66th and 67th birthdays for most people born before 1960).

Ramsey examines the question of whether one should claim Social Security benefits when they are first eligible at age 62, or if they should wait for the higher payouts one would receive if they were to wait a few more years.

The personal finance coach explains why he believes people often are better advised to take their payments earlier rather than later.

Ramsey cites the Centers for Disease Control and Prevention (CDC), which reports that the average life expectancy for Americans is 77.5 years old.

"You might be surprised to find you actually end up receiving more money from Social Security over the course of your retirement if you start taking benefits on your 62nd birthday instead of waiting for the higher monthly benefit," Ramsey wrote.

"Social Security payments die when you die, so it’s best to take them early and often."

Related: Veteran fund manager sees world of pain coming for stocks