One of the biggest financial commitments people make is deciding when the right time is to buy a home.

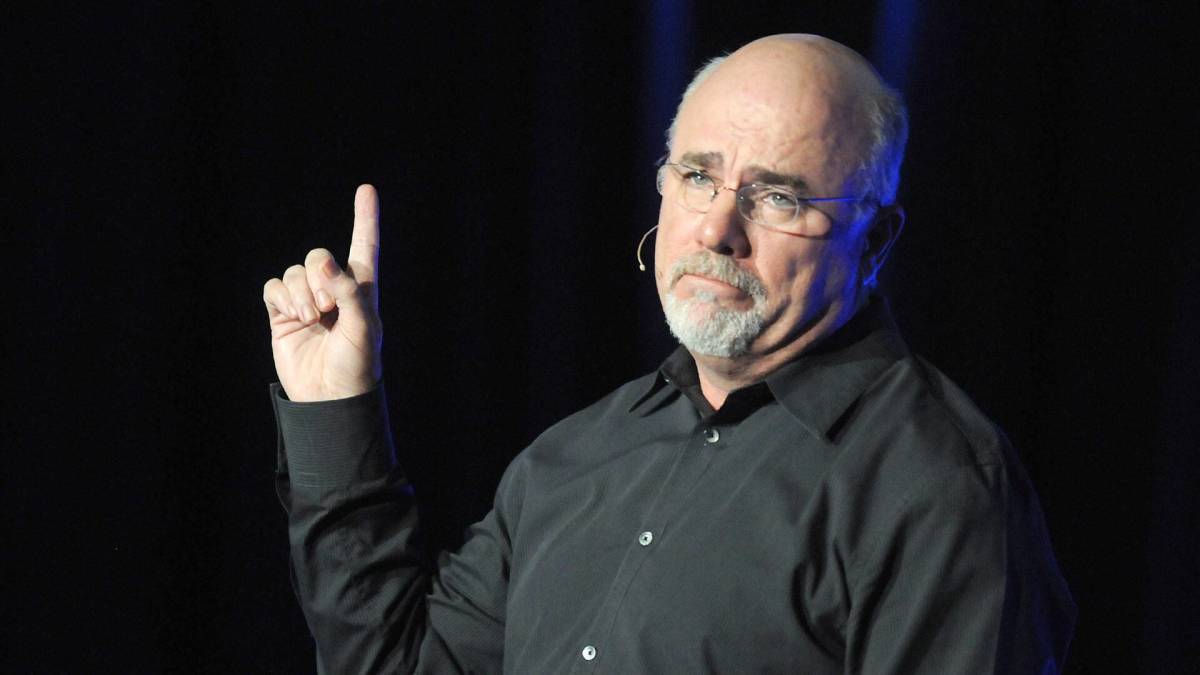

In an effort to reduce the stress involved when making the decision to purchase a house, bestselling author and radio host Dave Ramsey says there are some simple questions people should ask of themselves.

Related: Another company files for bankruptcy and Dave Ramsey has words

First among them involves people grappling with and understanding how much money they can afford. Ramsey offers a calculation that he says can help homebuyers avoid problems related to overspending.

Keeping mortgage payments to 25% of one's take-home pay is something Ramsey suggests, for starters.

This includes property taxes, homeowners association fees, and insurance.

"That way, you'll have breathing room in your budget and enough money left over every month to put toward other important financial goals, like investing for retirement," wrote Ramsey Solutions.

Dave Ramsey has aspirational thoughts on making a down payment

Next, Ramsey offers an idea about how to figure out a plan for a down payment on a home.

The best way to avoid interest payments, Ramsey wrote, is paying 100% in cash for a house. But that's unreachable for most people.

A more realistic goal when taking out a mortgage is to shoot for a down payment of 20% of a home's value. That amount enables purchasers to avoid paying for private mortgage insurance (PMI).

"If you're buying your first home, it’s okay to put 5% to 10% down as long as the monthly payments are still 25% or less of your take-home pay," Ramsey wrote. "Just be ready to pay for PMI if you go down that route."

Another consideration is closing costs. Ramsey estimates these expenses as being about three to four percent of a home's purchase price.

David McNew/Getty Images

Dave Ramsey lists other questions homebuyers need to ask themselves

Of course, there are more things to think about when choosing the right home to buy.

Ramsey lists a number of them like this:

Do I need to save for moving expenses?

How will I furnish and decorate?

What’s the location like?

What are the schools like?

Is the location prone to natural disasters?

Are there any problems with the house?

How old is the roof?

How old are the appliances?

What’s included when I buy?

What are similar homes selling for?

What’s the reason for selling?

How many days has the house been on the market?

This last point deserves some extra scrutiny, Ramsey indicated. There are two considerations that have importance.

One is that a home sitting on the market for a long while generally tends to force a seller to have some flexibility on the purchase price.

On the other hand, a house that is encountering difficulties being sold might mean there are problems with the property that a potential homebuyer would be wise to investigate.

"So, if a house you're interested in has been sitting on the market for a while, dig in with your agent and see if you can get to the bottom of why," Ramsey wrote. "If there are no red flags, you may have stumbled on a chance to get a discount."

Ramsey added an additional thought.

"There you have it, folks," he wrote. "Now you know the top questions to ask when buying a house — which is like having a secret weapon for a stress-free home-buying experience in your back pocket. But here's the deal: It'll only work if you use it."

"So, go ask these questions!"

Related: Veteran fund manager picks favorite stocks for 2024