No matter how old U.S. workers are when they decide to retire and collect Social Security benefits, they automatically become eligible for Medicare at age 65.

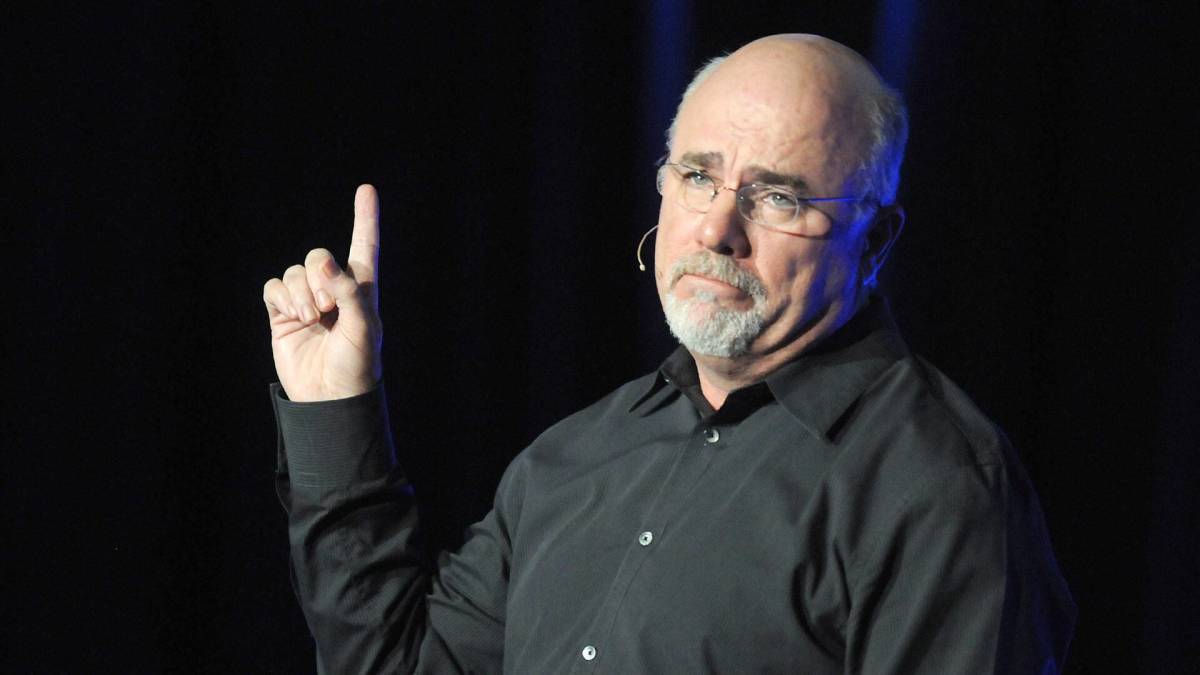

Personal finance bestselling author Dave Ramsey has a few key opinions and some important notes for Americans planning to enroll (or already enrolled) in the federal health care program for retirees.

🚨 Don’t miss this amazing Black Friday Move! Get 60% off TheStreet Pro. Act now before it’s gone.😲

The first step for Medicare enrollees is assessing their health insurance needs. This includes potential hospital stays, visits to their doctor, prescription drug coverage and other services such as dental and vision care.

Costs for Medicare coverage need to be considered, including premiums, copayments and deductibles. Depending on the plans one chooses from, there may be higher or lower premiums and out-of-pocket costs, so Ramsey emphasizes the importance of comparing them carefully.

Related: Dave Ramsey has a warning for Americans buying a home now

Hospital insurance is covered by Medicare Part A. As long as enrollees paid Medicare taxes during their working years, a premium is not required. But deductibles are required for Part A.

Medicare Part B covers outpatient and preventive costs. In 2024, the standard monthly premium is $174.70, but that cost can increase for retirees with higher incomes. The Part B premium will increase from $174.70 in 2024 to $185 in 2025.

Medicare Advantage (Medicare Part C), another option, is a health plan offered by private companies that includes the benefits generally covered by Part A and Part B.

And Medicare Part D is Medicare coverage for prescription drug costs.

Ramsey takes some time to explain his pointed views on Medicare and some ways retirees can get a handle on its various complexities.

Shutterstock

Dave Ramsey says Medicare can be 'confusing'

By the time workers reach retirement age, Ramsey acknowledges the fact that they have gained a lot of experiences and knowledge about the impact of personal finances on their lives.

The Ramsey Show host has some blunt thoughts about why the federal program seems difficult to navigate.

"So, why does this dang Medicare feel so confusing?" Ramsey asks. "Well, it was created by the government so that might be your first clue. And second, it’s just a lot to understand."

More on Dave Ramsey

- Ramsey reveals blunt new Social Security payment warning

- Dave Ramsey discusses one big money mistake to avoid

- The surprising way your mortgage is key to early retirement

To help enrollees understand the basics, Ramsey explains some key differences between Original Medicare and Medicare Advantage.

First, while the regular health insurance people often have while they are working has an annual limit on what they must pay out of their pockets, Original Medicare does not.

Enrollees in Original Medicare can see any doctor or visit any hospital they choose — and they usually do not need a referral to visit a specialist.

They will also need to add Medicare Part D to cover their prescription drugs. Fortunately, Part D usually renews automatically, removing one potential hassle to deal with on a yearly basis.

Related: Don't make this Medicare mistake if you wait to file for Social Security benefits

But in cases where retirees find that Original Medicare does not meet all of their needs, supplemental insurance can also be added.

Ramsey explains how Medicare Advantage can be an important piece of the puzzle

As mentioned above, Medicare Part C is also known as Medicare Advantage. It offers all the pieces of Medicare in one one plan. Some even cover dental, vision and hearing services through private companies.

For prescription drugs under Medicare Advantage, automatic re-enrollment depends on the plan, meaning an enrollee may have to renew this coverage annually.

Medicare Advantage is much like traditional health care coverage, Ramsey explains, in that recipients are faced with limits to providers in a network.

In a worst-case scenario, an insurance company in an advantage plan can deny an enrollee the ability to see a specialist to which they have been referred. This involves the requirement to pay out-of-pocket for the entire specialist bill.

Recipients also must pay a separate premium for Part B in addition to the one for their advantage plan. Also, it's important to note that, while some regular health insurance plans cover overseas treatment, Medicare generally does not.

Considering these specific requirements, Ramsey notes that Medicare Advantage can sometimes be the best alternative for Medicare enrollees, but that is not the case for everyone.

Related: Veteran fund manager sees world of pain coming for stocks