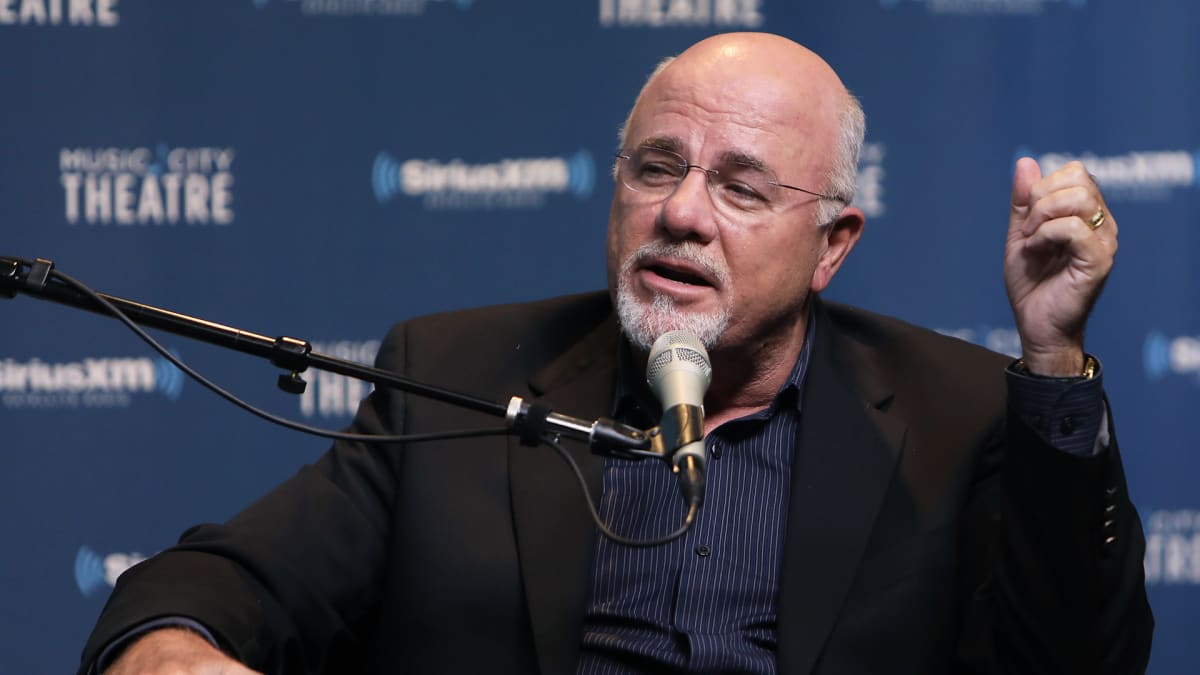

Personal finance personality Dave Ramsey has some advice for people who want to make extra income apart from their regular day jobs.

The author and radio show host says there are ways to do it, but some effort must be put in up front.

DON'T MISS: Dave Ramsey Warns Homebuyers About a Crucial Pitfall to Avoid

Ramsey listed a number of methods to generate passive income in a recent column on the Ramsey Solutions website.

"Passive income is a way to earn steady money with little to no daily effort," the article explains. "Note that we didn’t say no effort at all. Earning passive income isn’t a sit-on-your-butt-and-make-money-fast gig. You’ll need to put in the work -- at least on the front end. So if you’re expecting passive income to be some kind of get-rich-quick thing, you’re out of luck."

"Some passive income ideas -- like building a blog or an app -- take time (and sometimes money) to get up and running," it continues. "But if you play your cards right, they could eventually earn you money while you sleep."

The 15 methods of earning passive income the column lists are the following:

1. Buy real estate.

2. Rent out your house.

3. Store people’s stuff.

4. Rent out useful items.

5. Rent out your vehicles.

6. Start a blog or YouTube channel.

7. Write an e-book or digital guide.

8. Create an online course.

9. Sell stock photos or music.

10. Design custom products.

11. Use affiliate marketing.

12. Advertise on your car.

13. Invest in low-turnover funds.

14. Invest in real estate investment trusts (REITs).

15. Take advantage of high-yield savings accounts.

Regarding the first item in the list -- buying real estate -- one view about debt is emphasized.

"One way to build passive income (after you’re debt-free and have some cash saved up) is to buy real estate and rent it out to tenants," the column states. "But before you buy a rental property, pay off your own home first and purchase your investment property with cash. Don’t ever go into debt to buy rental property."

On investing, a couple other points are made.

"When some people hear passive income, they tend to think of investing because it can produce the largest results with the least amount of work," the story says. "And that’s true! Compared to the other options on this list, investing may be the easiest way to kick back, relax and earn."

"But we want to be clear about one thing," it adds. "Investing is a long-term strategy -- and investing for retirement is way more important than investing for passive income."

Investing in real estate is also addressed.

"What if you’re not interested in being a landlord? There is another way to invest in real estate with something called a real estate investment trust (REIT)," the story suggests. "A REIT (pronounced 'reet') is a type of investment that pools your money with other investors’ money to buy properties -- it’s basically a mutual fund that buys real estate instead of stocks."

"But you should only consider investing in REITs once you’re on Baby Step 7 and maxing out all of your tax-advantaged retirement accounts," it continues. "And be careful. While there are some good REITs out there, there are still a lot of bad ones that use debt to purchase properties -- which means more risk for you as an investor."

Get exclusive access to portfolio managers and their proven investing strategies with Real Money Pro. Get started now.