The annual directors' survey lays down a challenge to board chairs to dismantle 'frankly racist and sexist settings', says Pathfinder NZ independent director Anya Satyanand

Most NZX-listed organisations in this week's Strategic Pay directors' survey are reporting on their environmental, social and governance (ESG) strategy – but studies show directors in this part of the world are still driven more by investment returns.

Increasingly, boards are setting in place incentives for their executives to address climate concerns, in part because of the risk businesses will face in terms of financial losses, in part because of a focus on product lifecycle and sustainable supply chains.

READ MORE: * Jo Brosnahan: Stale boards pushed to think deeper than bottom line * Rob Campbell: Bored with boards – plotting a better way to employ people * Surprise survey: Gender pay gap worsening on boards of directors

"The North Island’s extreme weather events this summer have further highlighted the need for organisations to make real improvements in achieving net zero emissions to avoid some of the worst impacts of climate change," says Strategic Pay managing director Cathy Hendry.

Annual reporting for most surveyed NZX-listed organisations already contains details on ESG framework and strategy, she says, but the introduction of new External Reporting Board standards this year is accelerating progress.

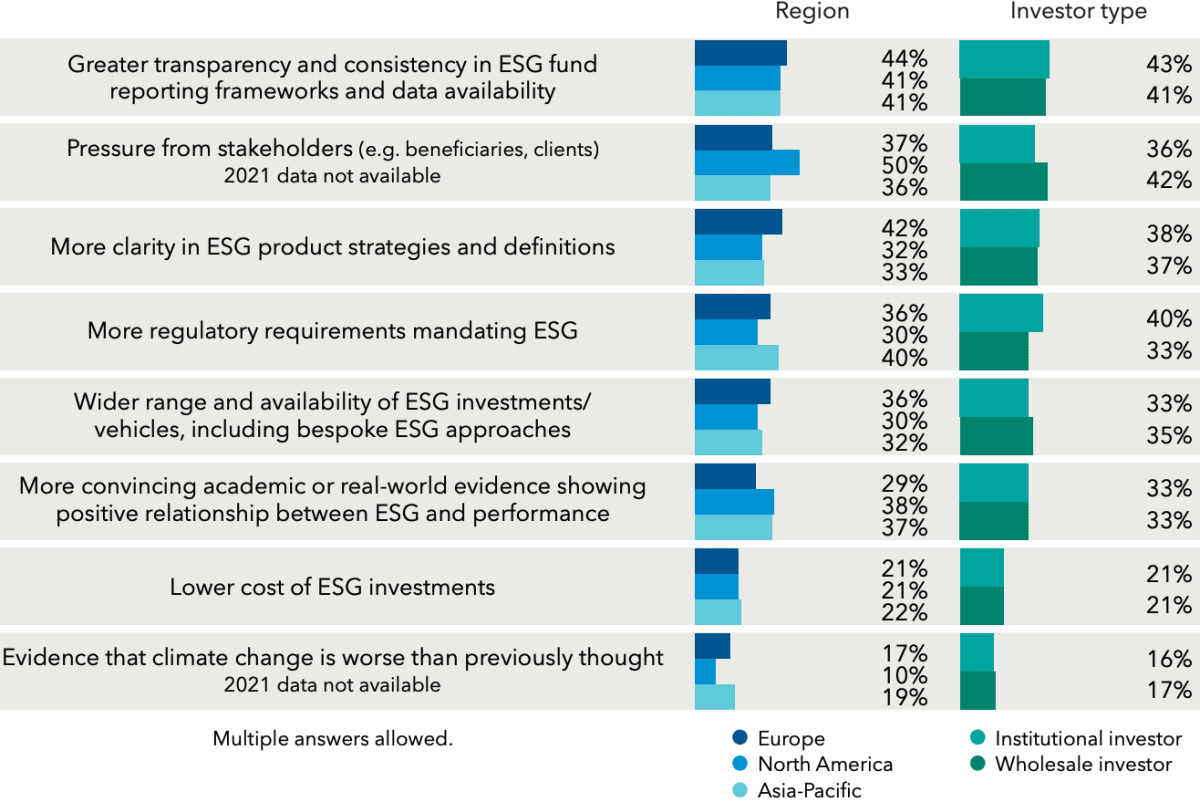

This is consistent with the Capital Group ESG Global Study, published by the Harvard Law School Forum on Corporate Governance, which shows Asia-Pacific companies are driven more by regulatory requirements, and less by customer pressure.

That's changing, Hendry says. There's a shift in power from the board to stakeholders, who she believes are applying pressure to New Zealand companies to improve their ESG performance and reporting.

The ESG Global Study finds Asia-Pacific investors are less sceptical about the motives of asset managers. "Fewer this year think asset managers mainly use ESG as a marketing and PR tool to generate sales."

Law firm ChapmanTripp says it's already seeing first-hand how the early adopters have been able to deploy capabilities developed through climate-related disclosure to manage other risks, such as stakeholder management, supply chain disruption, geopolitical risk, technological shifts, and reputational risks.

“Boards without the talents, worldviews and expertise of tāngata whenua, younger, those of colour more broadly, and gender-diverse directors simply don't have the breadth of perspective that might mean we succeed.” – Anya Satyanand, independent director

Anya Satyanand is an independent director at Pathfinder, an asset manager focused on ethical investment, and former chief executive of Leadership NZ.

"The thing that strikes me most about the report is how depressingly slowly our board tables are changing to reflect Aotearoa's demographic reality, and how depressingly stubborn the gap in pay between gender seems."

The 45-year-old says diversity around board tables matters, especially in relation to New Zealand stakeholders' increasing engagement and concern about environmental, social and governance issues.

"Whether – as businesses, as a nation, as a species – we survive the climate crisis depends on activating super-diverse thought around our board tables," she explains.

"The decisions being made around the board tables will affect every one of us, and yet those who're in the room on our behalf – according to this report – represent a pretty narrow set of worldviews, technical skills and expertise.

"Boards without the talents, worldviews and expertise of tāngata whenua, younger, those of colour more broadly, and gender-diverse directors simply don't have the breadth of perspective that might mean we succeed."

She says the directors' survey report lays down a challenge for board chairs and those involved with board recruitment: "To dismantle the frankly racist and sexist settings that currently exist, and widen their field to include the extraordinary pool of governance talent that exists in Aotearoa."