During periods of rampant excess in financial markets, we move from valuations based on the present value of future cash flows to valuations based on stories.

How compelling is your story?

Is it one of future growth and revolutionized economic reform all powered by smart contracts?

Sounds pretty neat.

But what is the underlying utility of the system? Is it based on measurable output or is it based on confidence?

I believe in the early days of anything new and exciting there is always a bunch of hype as we tend to overreact in either direction.

We’ve had this run-up in crypto along with flash crashes along the way, but this one feels a bit different. It feels much less like short-term volatility and much more like a loss of confidence in a system.

A loss of confidence causes contagion.

What we’re seeing now is a modern-day bank run on a lot of digital assets. We are now entering a Crypto Winter.

This one has it all - murky collateralization, hedge fund blow-ups, massive layoffs, and sketchy billionaires.

Throughout my criticism of this side of the story - I do want to express upfront that I am extremely bullish on the future of crypto. There will always be bad actors in fast-moving systems and this is a story about the bad apples.

This week, in <5 minutes, we’ll cover the current Crypto Winter:

-

Structural Overview 👉 Stablecoins (pegged cryptos): USDT, USDC

-

Where it started 👉 What happened at Terra/Luna (CRYPTO: LUNA)

-

More Cracks in the System 👉 Celsius(CRYPTO: CEL), 3AC

-

Loss in Confidence 👉 Perception matters

-

Where to from here? 👉 Structural failure or growing pains?

Let’s get started!

1. Structural Overview 👉 Stablecoins (pegged cryptos): USDT, USDC

To start off this story there are a couple of key components that we need to define in order to lay the groundwork.

Stablecoins

Stablecoins are cryptocurrencies whose value is pegged or tied to another currency, commodity, or financial instrument. A common reference point is a peg to the US Dollar.

Stablecoins aim to provide an alternative to the highly volatile nature of the most popular cryptocurrencies like Bitcoin (CRYPTO: BTC). The idea here is that this will serve primarily as a medium of exchange due to its attributes of lower volatility and stability.

These coins aim to pursue price stability by maintaining reserve assets as collateral or through algorithmic formulas that are supposed to control supply.

Stablecoins can be split into three different categories:

-

Fiat-Collateralized: maintaining a reserve of fiat like the US Dollar, but can include commodities like gold or silver. Reserves are maintained by supposedly independent custodians and regularly audited. Tether (CRYPTO: USDT) and USD Coin (CRYPTO: USDC) are examples of this.

-

Crypto-Collateralized: backed by other cryptocurrencies in reserve. The problem here is that the reserve can fluctuate and has high volatility which can lead to the over/under collateralization of reserves vs. value of stablecoins issued.

-

Algorithmic Stablecoins. Here comes the shitstorm. These may or may not hold reserve assets and they aim to keep the stablecoin’s value stable by controlling the supply through smart contract algorithms stored on a blockchain. However, unlike central banks, these don’t have direct control over the underlying monetary policy mechanics or full confidence in being the issuer of the underlying currency (which we’ll get into).

The top three stablecoins, in terms of both market capitalization and volume, are all centralized fiat-collateralized stablecoins – Tether (USDT), USD Coin (USDC), and Binance USD (BUSD) – which together account for about 90% of stablecoin market capitalization.

A common attribute of all of these mechanics is that “losing the peg” to the underlying is a kiss of death. I also find it somewhat ironic that most of these are pegged to the US Dollar because I thought crypto was all about decentralization and distrust of the existing monetary system? But I digress…

Tether (USDT)…not to be confused with UST

Tether is a fiat-backed stablecoin pegged to the US Dollar and is owned by iFinex, the Hong Kong-registered company that also owns crypto exchange BitFinex.

It’s the third-largest cryptocurrency (behind Bitcoin and Ethereum) and the largest stablecoin with a market cap of $83 Billion. It also accounts for two-thirds of exchanges out of Bitcoin.

We know the premise of fiat-backed stablecoins is to hold the underlying, but how collateralized is USDT really?

As of May 12, 2022, Tether was reporting assets of $81.3 billion for USDT. As of the same date, it reported holding 83.74% of its reserves in cash, cash equivalents, short-term deposits, and commercial paper, 4.61% in corporate bonds, 5.27% in secured loans to unaffiliated entities, and 6.38% in other investments including digital tokens.

It looks like it does indeed do what it promises…kind of…but why not just hold the underlying 100% so there is no tracking error or room for volatility?

Also, did it hold up during the recent scare we saw surrounding Luna? Uh oh…

USD Coin (USDC)

USDC, also a fiat-backed stablecoin, is fully backed by US dollar assets and is pegged 1:1 with reserve assets held in segregated accounts with US-regulated financial institutions. It’s an open-source project managed by Centre, a consortium co-founded by Coinbase and Circle.

To maintain the 1:1 peg, when initiating a transaction to buy one USD Coin using fiat currency, that fiat currency is deposited and stored as one U.S. dollar and the new USDC is minted.

If you sell a USD Coin in exchange for fiat currency, then the USDC is "burned" when the fiat money is transferred back to your bank account.

USD Coin’s (USDC) stablecoin reserves are 77.1% in US Treasuries and 22.9% in Cash. This is according to a recent update by the team at Circle that also pointed out that the reserves were worth $50.6 billion ($39 billion in US Treasuries and $11.6 billion in cash).

This seems troublesome to me as US Treasuries still have underlying volatility…

So we’ve covered the fiat-backed stablecoins but what happens when you introduce an algorithm to the system?

2. Where it started 👉 What happened at Terra/Luna

If you are already familiar with the Terra/Luna collapse, feel free to skip to section 3, but it is at the heart of the recent structural pullback.

TerraUSD (UST) (Terra)

Terra is an algorithmic stablecoin that has a built-in arbitrage mechanism between UST and the Terra blockchain native coin, Luna. At its peak, Terra swelled to a size above $18 billion. Using our example above, to create UST, you need to burn Luna.

1 UST can always be exchanged for $1 worth of Luna. If UST slips to 99 cents, traders could arbitrage this by buying UST and exchanging it for Luna, profiting 1 cent per token. This has two components:

-

Buying UST drives the prices up

-

UST being burned during its exchange into Luna deflates the supply

Bitcoin Exposure in Reserves

However, the Luna Foundation Guard, whose job it is to protect the peg (on top of the algorithmic component) held about $3 billion in Bitcoin reserves.

If UST dipped below $1, Bitcoin reserves would be sold and UST would be bought with the proceeds. If UST goes above $1, creators will sell UST until it goes back to $1, with the profit being used to buy more Bitcoin to increase the reserve value.

You can see how this reserve balance also now has exposure to pricing risk when it comes to the volatility of Bitcoin.

Yield on Staking

Banks make money mostly through a yield spread. The concept is simple. Lend out money (bank inflow through receiving mortgage or loan payments) at a higher interest rate than that at which you borrow money (bank outflow through paying interest on savings accounts.

To entice traders to burn Luna and create UST, the creators of Terra blockchain offered a 19.5% yield on staking (interest on deposit), through what they called the Anchor protocol.

The Anchor protocol is a kind of crypto bank created by developers at Terra founder Do Kwon’s firm Terraform Labs. This is the platform where investors would park their cash in order to lend out these coins and earn a yield.

By early May, investors had deposited more than $14 billion of TerraUSD in Anchor, according to the platform’s website. This is where the bulk of the stablecoin’s supply was parked.

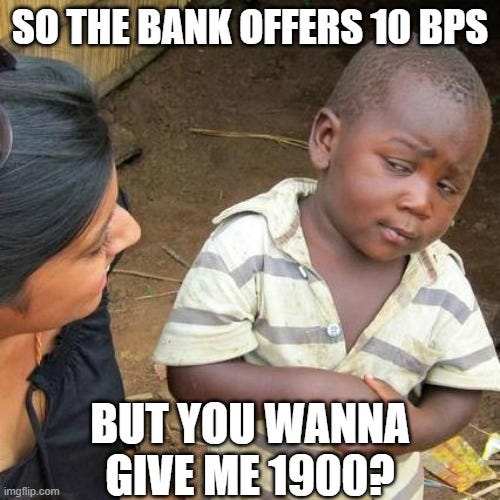

While bank accounts were giving 10bps on deposit interest, surely you’d be a fool to do that instead of 1900bps!

When something sounds too good to be true, it most certainly is.

Such a high-interest rate is simply not sustainable. Someone has to borrow at such a rate or above for the lender to receive 19.5% interest. Who is taking the other side of this trade?

I’ll tell you who…Bagholders. The last guy out. Retail crypto traders.

Anchor facilitated this.

The Trigger Event

On May 7, over $2 billion worth of UST was unstaked (taken out of the Anchor protocol) and hundreds of millions of that was immediately sold. The result of this selling pressure was that the price was pushed down to 91 cents.

A loss in the peg.

Traders tried to take advantage of this arbitrage by buying 90 cents worth of UST and exchanging it for $1 worth of Luna. However, according to Terra’s protocol, only $100 Million worth of UST can be burned for Luna per day.

This made investors PANIC because 1) They could not take advantage of the arbitrage opportunity, and 2) The fundamental mechanics needed in order to keep the peg were violated.

Cue insanity.

As a result of this violation, confidence was lost and everyone panic sold their UST, crushing the currency to 20-30 cents in the week following the initial de-peg. It is currently trading at 1 UST = 0.03289 USD.

It's worse for Luna holders. The value of Luna has completely disappeared – after reaching a high of just under $120 in April, it is now effectively zero (as of this writing, it is worth $0.00005874).

The Ripple Effect

Remember that $3 billion portion of reserves held in Bitcoin? This had to be largely depleted amid an emergency effort to maintain the peg for TerraUSD in mid-May, according to the fund’s data dashboard.

The fund’s selling of large amounts of Bitcoin contributed to a sharp drop in Bitcoin’s price, affecting the overall system.

Leverage in a house of cards…

Before we continue, let’s check in with our Outrageous Chartered FinMEME Analyst Dr. Patel!

3. More Cracks in the System 👉 Celsius, 3AC, Layoffs

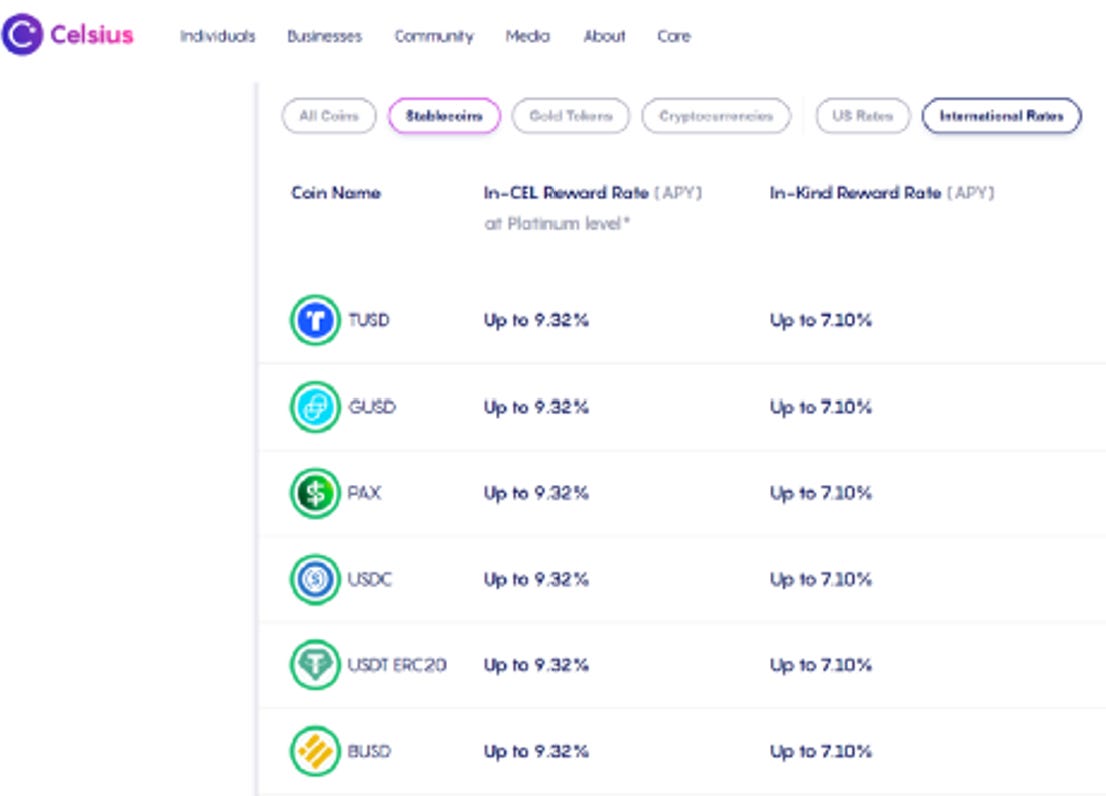

Celsius

On June 13, Celsius Network announced they were halting all withdrawals, transfers, and asset swaps on the platform. The reasons given were “extreme market conditions” and to put Celsius in a “better position” to honor (over time) its withdrawal obligations

Another yield trap blowup.

Celsius was another institution that offered yield on parked (lended) cryptocurrencies.

How were they able to pay these yields? Good question. One that even their CEO Alex Mahinsky couldn’t really answer other than saying “they generate revenue through lending crypto to credible institutions.” Whatever that means…

At Celsius, it appears that at some point in the late fall of 2021, the dynamic of lending crypto to credible institutions shifted to investing customers’ crypto assets into increasingly exotic and risky instruments in order to earn yield for depositors.

AKA chasing yield under the guise of guaranteed returns…until it collapses.

Celsius had a major loss during a hack back in December 2021 where the hacker drained over $40 million of Celsius CEL token from the Network. They would then go on to get caught up in the Anchor protocol, with further losses after the TerraUSD collapse - again chasing yield.

Their final undoing was investing customer tokens through staking ETH (CRYPTO: ETH) with Lido Finance, which went under a similar de-pegging debacle against the crypto volatility backdrop, further amplifying the losses at Celsius.

What a shitshow.

Three Arrows Capital (3AC)

This is an interesting one. This is not some yield farming scheme but rather what is supposed to be considered the “smart money”.

3AC is a crypto VC that was managing around $3 billion in assets at its peak which ranks them in the top 3. They found early success in cryptos like ETH, AXAV, and NEAR.

Although not yield farming, this one is also a collateral problem. It was revealed that 3AC had $245M of ETH deposited at lending platform Aave and they borrowed $189M in USDC and USDT against this, putting their LTV at 77%.

This may seem like a drop in the bucket compared to the overall AUM, but it soon became evident that 3AC was levered long everywhere. With the underlying crypto prices starting to freefall, they started getting margin called.

With their crypto commitments locked up, rather than posting more collateral they were essentially “ghosting” their commitments. This forced liquidation at a certain lending platform, further exacerbating the selloff.

It then came to light that 3AC was right in the thick of it with the Luna/UST collapse too. 3AC bought $560M worth of locked Luna (unable to take out), which collapsed to $600 dollars (not a typo).

The problem here is how widespread 3AC’s loan book was. They borrowed from almost every major lender: FTX, Celsius, BlockFi, Nexo, and BitMex.

4. Loss in Confidence 👉 Perception matters

The major issue with the catastrophe of Terra/Luna was that many held what they considered to be bullet-proof 1-to-1 digital currency: Fiat USD. They held these stable coins to allow for fast trading and easy settlement rather than switching back and forth between crypto and fiat.

This caused an entire wipeout of some traders’ net worth in something they believed to be 100% secure. Terra/Luna was around $18 billion at the peak, but all stablecoins account for closer to $180 billion. What happens if USDT/USDC gets wiped out next?

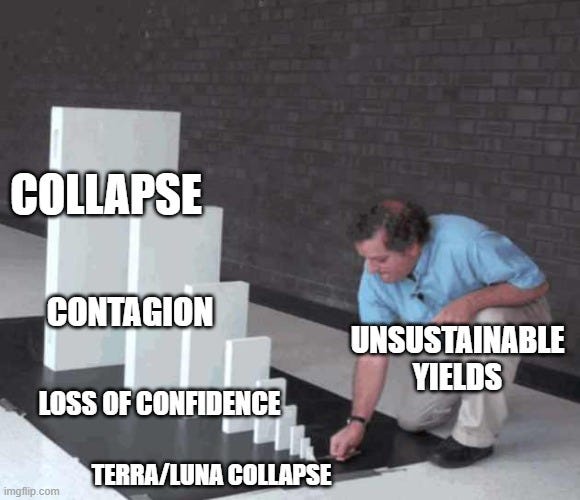

What we had here was contagion in a fragile system: because there are so many intertwined players in the ecosystem, the collapse of one can bring about the default of tiered obligations which exacerbates selling pressure.

Loss of confidence breeds contagion.

5. Where to from here? 👉 Structural failure or growing pains?

Let’s go back to our premise on bank yield spreads. What you are paying out has to be LOWER than what you are receiving from your own asset base.

The bank is able to do this due to a massive balance sheet, the backing of a fiat currency that is monitored by a central bank with the power to issue the currency, and because of all the economic and personal data points that it collects in order to underwrite this risk.

I’m not saying this system is perfect, I’m simply saying we have more data on the underlying.

When crypto lending platforms are promising yields that are extremely aggressive, they then have to go out and take even higher risks in order to be able to pay off the yield.

When one domino falls—without much underlying utility (yet)—the others fall as well and then yield is funded over the short term by the bagholders that end up bankrupt at the end of it all.

Wrapping Up…

While these collapses are currently a black eye in the overall ecosystem, I would encourage everyone not to conflate bad actors on the system with the overall prospects for cryptocurrencies in the future.

There are still many incredibly interesting use cases for decentralization, but to me, a lending platform with flaws in its construction is not one of them.