KEY POINTS

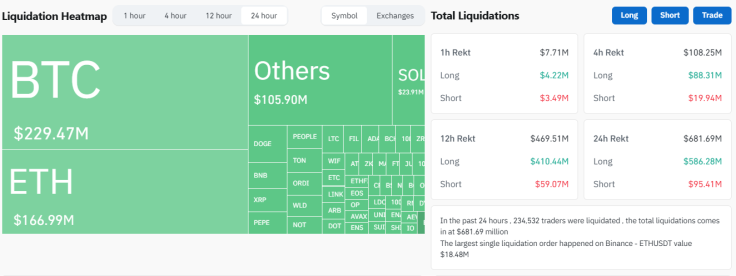

- Over $681 million in crypto has been liquidated in the past 24 hours, with $BTC leading the way

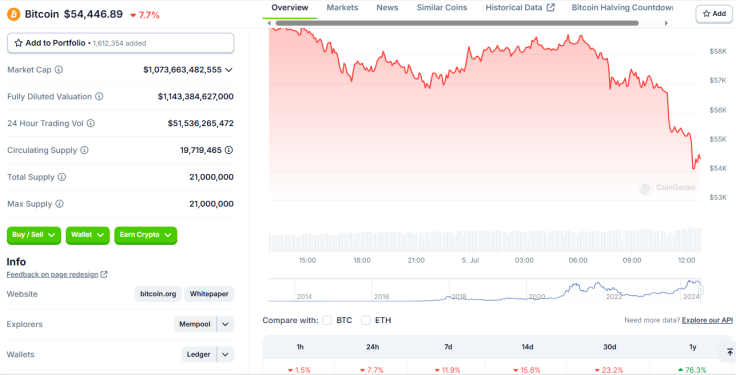

- $BTC was trading at $58,000 during the July 4th holiday before it plunged to start the day at the $54,000 lows

- Samson Mow said the current plunge is a 'scam dip' and there is 'artificial price suppression' going on

- Justin Sun has offered to purchase all of the German government's seized $BTC off-market

Bitcoin, the world's first decentralized cryptocurrency and the largest digital asset by market value, has crashed below $55,000, and experts in the crypto community have had a mix of wild, negative, hopeful, and defensive reactions to the coin's volatility play – some suggested something "artificial" is going on behind the scenes.

Bitcoin sheds $4,000 overnight

The leading digital currency went from $58,000 Thursday night to starting Friday at around $54,400, triggering a wave of liquidations among holders of $BTC and a host of other cryptocurrencies.

Data from CoinGecko shows that Bitcoin plummeted by over 7% in the last 24 hours and has been down by nearly 12% in the past week.

Holders liquidate nearly $230 million

CoinGlass data further showed that a total of $681.69 million has been cashed out by digital asset holders in the last 24 hours. Bitcoin holders led the pack, liquidating a whopping $229.47 million, followed by Ether ($ETH) holders, who cashed out $166.99 million. In the last four hours alone, over $150 worth of $BTC has been liquidated.

Many crypto users have reacted negatively to the digital coin's plunge, and while many others agreed that the price correction during this cycle is "historically very small," a sticking point in the crypto space overnight was the German government's continuous dumping of its seized Bitcoin stash.

UPDATE: German Government selling up to $175M BTC

— Arkham (@ArkhamIntel) July 4, 2024

In the past 2 hours the German Government has moved 1300 BTC ($76M) to exchange deposits at Kraken, Bitstamp and Coinbase.

They have also moved 1700 BTC ($99M) to address 139Po. These funds are likely moving to a deposit for an… pic.twitter.com/ZMTxoipo5d

Talks of 'artificial price suppression' proliferate

Prominent investor Mike Alfred said he has set an alert "if/when we hit zero so I can pick up some free sats." Satoshis, or sats, are the smallest units of Bitcoin. He noted that "if Germany and the U.S. want to crash Bitcoin to zero," they should at least move faster before American markets open.

I’m going to go to sleep soon but I set an alert if/when we hit zero so I can pick up some free sats. Not guaranteed but if Germany and the US want to crash Bitcoin to zero they need to do it fast before US markets open and professional market makers are back at their desks.

— Mike Alfred (@mikealfred) July 5, 2024

Former Blockstream executive Samson Mow argued that the current price slump is a "scam dip," and is an "artificial price suppression," considering how the coincidences of the German government's dump, the holiday liquidity, and the repayments of collapsed crypto giant MtGox are "too perfect."

I stand by what I said on @PunterJeff and @ryQuant’s pod that this is artificial price suppression. The timing of it all to coincide with wallet movements from Germany and Gox, at a low liquidity holiday period is too perfect.

— Samson Mow (@Excellion) July 5, 2024

Is the German government's dump to blame?

For pseudonymous investor Whale Panda, it is "completely inaccurate" to promote a narrative that $BTC crashed because of the German government's massive dump. He argued that a significant amount of cryptocurrencies that were "sent out yesterday to exchanges came back from exchanges." Whale Panda is a well-followed figure in the crypto community.

The narrative that the German government just dumped the coins on the market and caused this crash is completely inaccurate.

— WhalePanda (@WhalePanda) July 5, 2024

In fact you see that a large amount of coins that were sent out yesterday to exchanges... came back from exchanges. pic.twitter.com/y4J8cWfTIn

Will Germany bite Tron founder's offer?

In a bid to "minimize the impact" of Germany's latest Bitcoin sell-off spree on the overall crypto market, Justin Sun, the founder of blockchain-based decentralized system Tron, offered to snap up the government's $BTC treasury off-market. It is unclear if the German government has started negotiating with the crypto magnate.

I am willing to negotiate with the German government to purchase all BTC off-market in order to minimize the impact on the market.

— H.E. Justin Sun 孙宇晨 (@justinsuntron) July 4, 2024

To sell or to buy?

Meanwhile, Bitcoin maximalists – sometimes described as "extreme" holders – are unfazed, believing that the coin's crash will only pave the way for a giant leap to the top. Mow said the time will come when the current selling pressure will be "negligible and we just Godzilla straight up past the ATH (all-time high)" at over $73,700, which was achieved in mid-March.

reminder, zoom out. prior bull runs had half a dozen -30% draw downs too. we're at about -26% (-27% earlier).

— Adam Back (@adam3us) July 5, 2024

in fact if anything, recent draw-downs seem to be less deep, but people forget the normal bull market pattern. don't panic, buy the dip. or buy a bit of $CMSTR with… pic.twitter.com/vBOjFN1TOn

Blockstream CEO Adam Back urged Bitcoiners to not panic and to "buy the dip" instead. He also noted that during such pricing slumps, it is important to "zoom out" and see how previous cycles have had bigger issues.