On Sunday night, the futures made it pretty clear that the stock market was not going to have an easy open on Monday morning. However, because cryptocurrencies trade 24 hours a day, seven days a week, we already knew that bitcoin, ethereum and others were enduring a painful start to the week.

At one point on Monday, bitcoin was down 15% and ethereum was lower by 18.8%. Both are now down about 12% on the day, as bulls look to stir up some sort of bounce.

We talked about bitcoin fairly recently, noting that new lows could be in play soon if support didn’t hold.

We also noted that bitcoin proved to be insufficient as a dependable and long-term hedge against inflation. Instead, it performed best against rising inflation provided that other “risk-on” assets were rising as well.

The recent decline has been weighing on companies that have exposure to the cryptocurrency, including Tesla (TSLA), Block (SQ), Microstrategy (MSTR) and others.

Today’s decline is also creating issues on the brokerage end, as Binance had to pause withdrawals due to a “stuck” transaction.

Trading Bitcoin

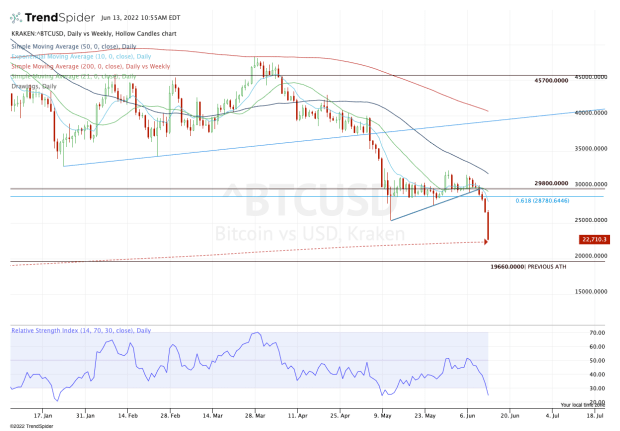

Chart courtesy of TrendSpider.com

Bulls are scrambling now, as bitcoin is down 67% from the all-time high in November. Hundreds of billions of dollars have been wiped out in the process.

Now investors want to know if capitulation could be around the corner — and that’s a real possibility.

Last week, my biggest concern was bitcoin’s inability to bounce. For it to be sitting on such a key area that had been so responsive in the past, it couldn’t really muster up much of a gain.

The rallies were short-lived and quickly sold and while it wasn’t breaking down, we weren’t seeing the robust bounce out of the $30,000 area that we needed to.

Once uptrend support broke and bitcoin began rotating below key levels — like the 61.8% retracement near $28,750 and the May low at $25,400 — then the decline accelerated.

Now coming into the 200-week moving average, this is the first line of significant support for the bulls. It doesn’t mean it will tag this measure to the penny and roar higher, but it's a general area of potential support.

An overshoot to the downside could put the psychologically-relevant $20,000 level in play, followed by the prior all-time high near $19,660.

This general area — $19,500 to $22,500 — is a place where patient bulls can consider taking on some risk and initiating a position.

However, realize that buying this dip without proof of an upside rotation is an aggressive strategy. Should support fail to hold, buyers will be saddled with losses and should approach this volatile asset with a stop-loss in mind.

On the upside, look for a move back up to $25,000 and the May low near $25,400. Above that puts $28,750 to $30,000 back in play.

Trading Ethereum

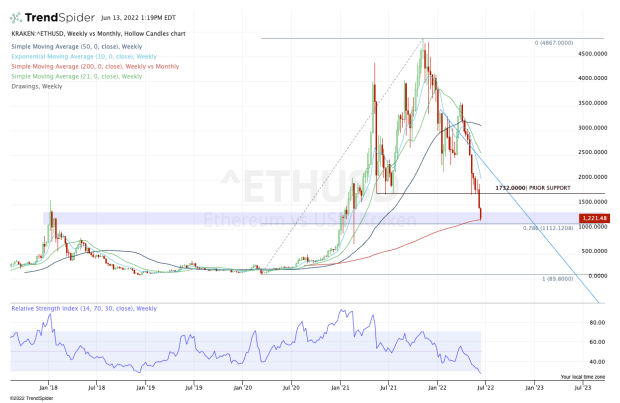

Chart courtesy of TrendSpider.com

As for ethereum, it has done worse than bitcoin as it has fallen more than 76% from its all-time high.

Just as bitcoin has a wide range of potentially significant support between $19,500 and $22,500, ethereum also has a wide range to focus on: $1,000 to $1,200.

That range would be wider — from $1,000 to $1,350 — but Monday’s decline has already thrust ether through the top portion of this area. It’s worth noting that the ranges are so wide because the volatility is so high.

Like bitcoin, ethereum is now testing the rising 200-week moving average. Investors would like to see the 78.6% retracement hold as support near $1,110, along with the psychologically-relevant $1,000 level.

If all of these levels fail, investors could see a decline into the $700s. If support does hold and ethereum bounces, let’s see if we can get a retest of the $1,700 area.