KEY POINTS

- Bitcoin crashed below $54,000 Sunday night, while Ethereum plunged to around $2,200

- Many other top tokens on CoinGecko bled Sunday night, including $ADA and $DOGE

- Crypto maximalists urged the community to stay calm and buy the dip

The cryptocurrency market experienced a free-fall Sunday night as several financial headwinds hit the burgeoning industry hard, including news about Republican presidential candidate Donald Trump's sliding odds, continuing MtGox distributions, and U.S. recession fears.

Bitcoin dips below $54K

The almighty Bitcoin shed some $6,000 in less than a day, as per data from CoinGecko. The world's top digital asset by market cap was trading around $60,000 Saturday before it started making a plunge Sunday night. It has been down by over 11% in the last 24 hours and has been in the red by over 21% in the past week.

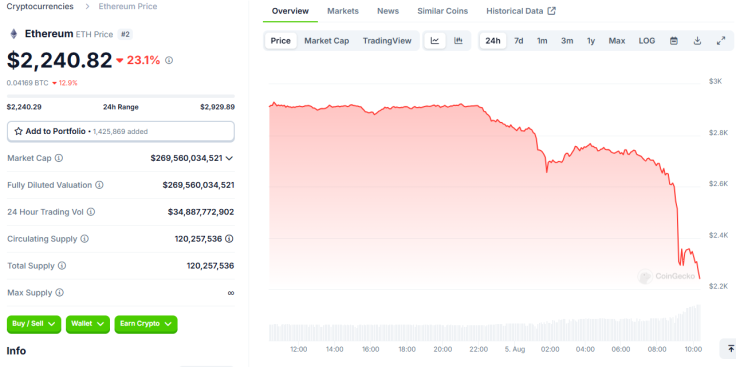

Ethereum in free-fall

Ether, the native token of the Ethereum blockchain, is also experiencing a decline. The digital coin was trading near $3,000 Saturday but saw a sharp drop to around $2,200 Sunday night. It has been on a significant 22% decline in the last day and has been down by more than 31% in the past seven days.

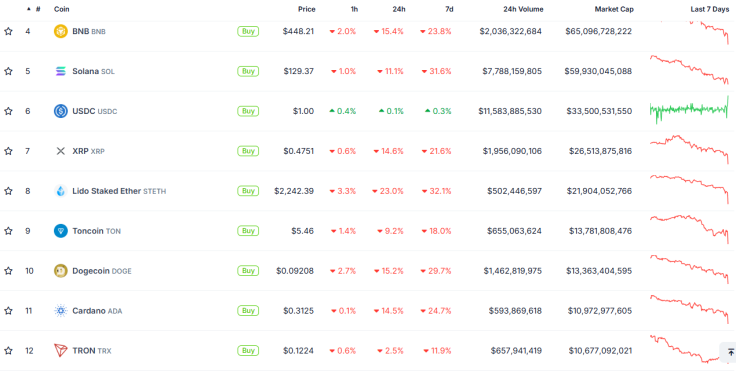

Other tokens dragged down

Bitcoin and Ether didn't go down alone late Sunday night, as other cryptocurrencies on CoinGecko's Top 12 ranks were also in the red. $ADA, $BNB, $XRP, $TON, $TRX, and $STETH were all in decline. Popular memecoin $DOGE also dipped by some 2.7% in the past day.

What triggered the market crash?

Prominent crypto analyst Miles Deutscher suggested that there are at least nine issues within the broader financial market that have been affecting crypto prices over the weekend, including the reported decrease in Trump's odds of winning in November, continuing creditor repayments by collapsed Japanese crypto exchange titan MtGox, and lingering fears about a potential U.S. recession.

He called the various economic and political headwinds a "perfect storm" that's triggered a bloodbath in the crypto market.

Reasons why crypto is crashing:

— Miles Deutscher (@milesdeutscher) August 4, 2024

• Trump presidency odds decreasing

• Recession fears

• Stock market correction

• Yen unwind

• Geopolitical tensions

• Jump unwinding positions

• Gox distributions

• Recent pump trapped fresh longs

• Altcoin dispersion

Perfect storm.

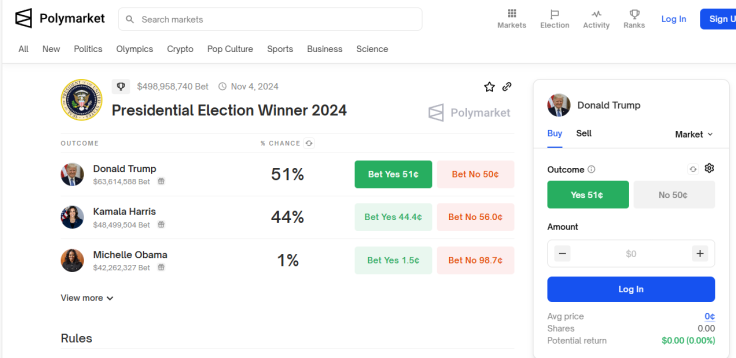

Trump's Polymarket odds down

Within just days, Trump's chances of winning the 2024 presidential race, at least among Polymarket traders, dipped from 54% to 51%, as of late Sunday night. Late last week, Polymarket reported that Trump's odds have plunged by 18% among traders in the decentralized platform, which allows users to buy and sell crypto to bet on future events.

MtGox distributions continue

MtGox, which is attempting to meet an October deadline for repaying creditors, has been sending repayments to customers in recent weeks. Just last week, the fallen Bitcoin exchange moved some $3 billion worth of $BTC, shaking the crypto market amid fears that prices may fall as creditors begin cashing out their Bitcoins.

UPDATE: MT. GOX MOVES $3.1B BTC

— Arkham (@ArkhamIntel) July 31, 2024

Last night Mt. Gox addresses moved 33.96K BTC ($2.25B) to addresses we believe are most likely BitGo:

bc1q26tsxc0ge7phvcr2kyczexqf5pcj8rk79cqk90h34c30dn9dskeq3gmw3f

bc1q48a5tjhdjtkfv8zv6tj68767h8lgep9dpx0emrkx0yhhmum7wscs95ft36

BitGo is the 5th… pic.twitter.com/XWNiZ2boAN

US reports lackluster employment figures

Wall Street slumped by roughly 1.5% Friday following the U.S. Labor Department's report that non-farm payrolls only increased by 114,000 in the past month – figures well below the 185,000 initially projected by economists. It also marks a sharp plunge from June's 179,000 jobs.

The jobs data triggered concerns that the world's largest economy may be stepping closer to a recession, especially as the report also revealed that American unemployment rates spiked to 4.3% in July – the highest since October 2021.

Maxis attempt to calm users down

On X, where many crypto users engage in discussions about market trends, maximalists – crypto holders who believe crypto's only path is upward regardless of market sentiment – are attempting to lift the community's spirits.

Prominent Bitcoin investor Lark Davis posted a video of how long-time crypto holders supposedly react to market storms. The video shows a man nonchalantly sipping wine and eating as a storm brews and a fire breaks out behind him.

When you've been in crypto for 6 years:pic.twitter.com/szIagslOzb

— Lark Davis (@TheCryptoLark) August 4, 2024

Another well-followed maximalist, @CryptoGodJohn, said the current market crash is the "best buying opportunity" since the COVID-19 pandemic and the spectacular collapse of Sam Bankman-Fried's FTX.

Best buying opportunity in the market since COVID & FTX crash imo

— Johnny (@CryptoGodJohn) August 5, 2024

Controversial businessman Robert Kiyosaki said it is a time when "cowards get poorer." He urged the crypto community to "grow some b*lls, stay calm, and invest when the cowards are quitting."

My apologies. Having a drink. Continuing on…. Crashes are times

— Robert Kiyosaki (@theRealKiyosaki) August 5, 2024

When the brave get richer and the cowards get poorer…. Because they sell or do nothing. The world is filled with poor cowards. Be smart. Grow

Some balls, stay calm, and invest when the cowards are quitting.…