KEY POINTS

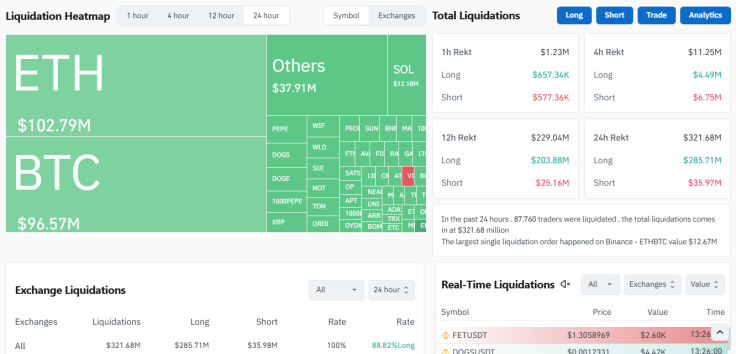

- Ethereum liquidations topped $102 million Tuesday, while Bitcoin traders liquidated over $96 million

- The largest single liquidation order occurred on the Binance exchange, at $12.67 million

- Solana, XRP and other top cryptocurrencies also bled overnight

The cryptocurrency market saw another bloodbath Tuesday as the majority of the top digital assets by market value plummeted. The red wave that blanketed the industry triggered over $320 million in liquidations in the last 24 hours, most of them long positions.

Ethereum Leads Overnight Liquidations

Data from CoinGlass showed that Ether (ETH), the native cryptocurrency of the Ethereum blockchain, led Tuesday's liquidations, with more than $102 million swiped. Bitcoin, the world's top digital asset by market cap, closed in, seeing over $96 million liquidated in the past day.

Solana (SOL) users liquidated more than $12 million overnight, while liquidations among $XRP users breached the $3 million-mark. Still reeling from news over Telegram CEO and The Open Network (TON) co-founder Pavel Durov's arrest in France, $TON traders liquidated over $2 million in the last 24 hours.

The biggest take from Tuesday's bloodbath is that the majority of the liquidations were long positions. CoinGlass notes that 88.82% were long positions. Furthermore, a staggering 87,760 traders were liquidated, with the largest single order coming in at $12.67 million on cryptocurrency exchange titan Binance. Overall, the crypto market lost $321.68 million in the last day.

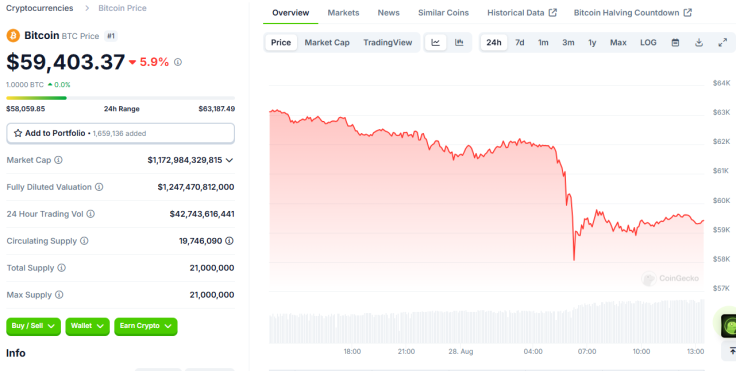

Bitcoin Sheds Some $4,000

$BTC prices were trading at around $63,400 Tuesday when the digital currency started a downward spiral and ultimately plunged below $60,000. At one point Tuesday night, the world's first decentralized digital asset traded at $58,000, as per data from CoinGecko.

As of early Wednesday, Bitcoin was trading at around $59,300 – a price range that's over 19% lower than its all-time high of $73,737.94 in mid-March.

Other Crypto Coins Follow Suit

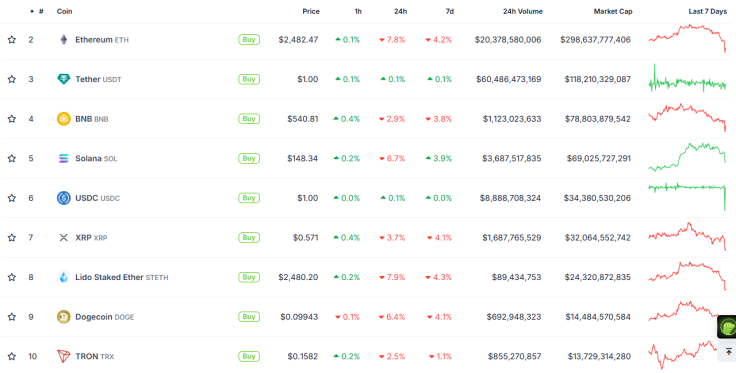

In a stellar display of "following the leader," other top cryptocurrencies on CoinGecko's list of the largest digital assets by market cap also plummeted to the red line.

Ethereum, the world's second-largest crypto asset, shed 7.8% in the last 24 hours, while Binance's $BNB lost nearly 3%. Solana (SOL) was down by 6.7%, and XRP bled 3.7% overnight.

The remaining coins in the top 10 were also down in the past day: Lido Staked Ether (STETH) by 7.9%, Dogecoin (DOGE) by 6.4%, and TRON (TRX) by 2.5%.

Why is Crypto Down Today?

The crypto market previously crashed earlier this month, as affected by the broader financial market downturn. Multiple economic headwinds hit the burgeoning yet volatile market, leading to Bitcoin shedding $6,000 in one day.

This time, among the key reasons for the crypto market's entry into the red line is the cautious atmosphere among AI token traders as they wait for tech giant Nvidia's earnings report. The company is leading the boom in artificial intelligence, and its quarterly report may affect the burgeoning subsector of AI crypto tokens, especially amid looming headwinds that could hit the tech giant's stock, including the potential delay of its next-gen Blackwell AI chips.

Crypto whales may also have affected the prices of digital assets. Whales, or crypto holders who have held their crypto stashes for a long time, are well-followed figures and entities in the digital assets space, as their transactions can move prices.

Overnight, multiple Bitcoin and Ether whales transferred their assets to crypto exchanges and other digital wallets, including a whale that moved 12,573 ETH worth over $32.5 million to Coinbase. Another whale moved 7,288 Bitcoins worth over $451 million to another wallet Tuesday.