Deep-pocketed investors have adopted a bearish approach towards CrowdStrike Holdings (NASDAQ:CRWD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CRWD usually suggests something big is about to happen.

We gleaned this information from our observations today when Benzinga's options scanner highlighted 35 extraordinary options activities for CrowdStrike Holdings. This level of activity is out of the ordinary.

The general mood among these heavyweight investors is divided, with 31% leaning bullish and 40% bearish. Among these notable options, 12 are puts, totaling $1,397,234, and 23 are calls, amounting to $1,618,418.

What's The Price Target?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $240.0 and $580.0 for CrowdStrike Holdings, spanning the last three months.

Insights into Volume & Open Interest

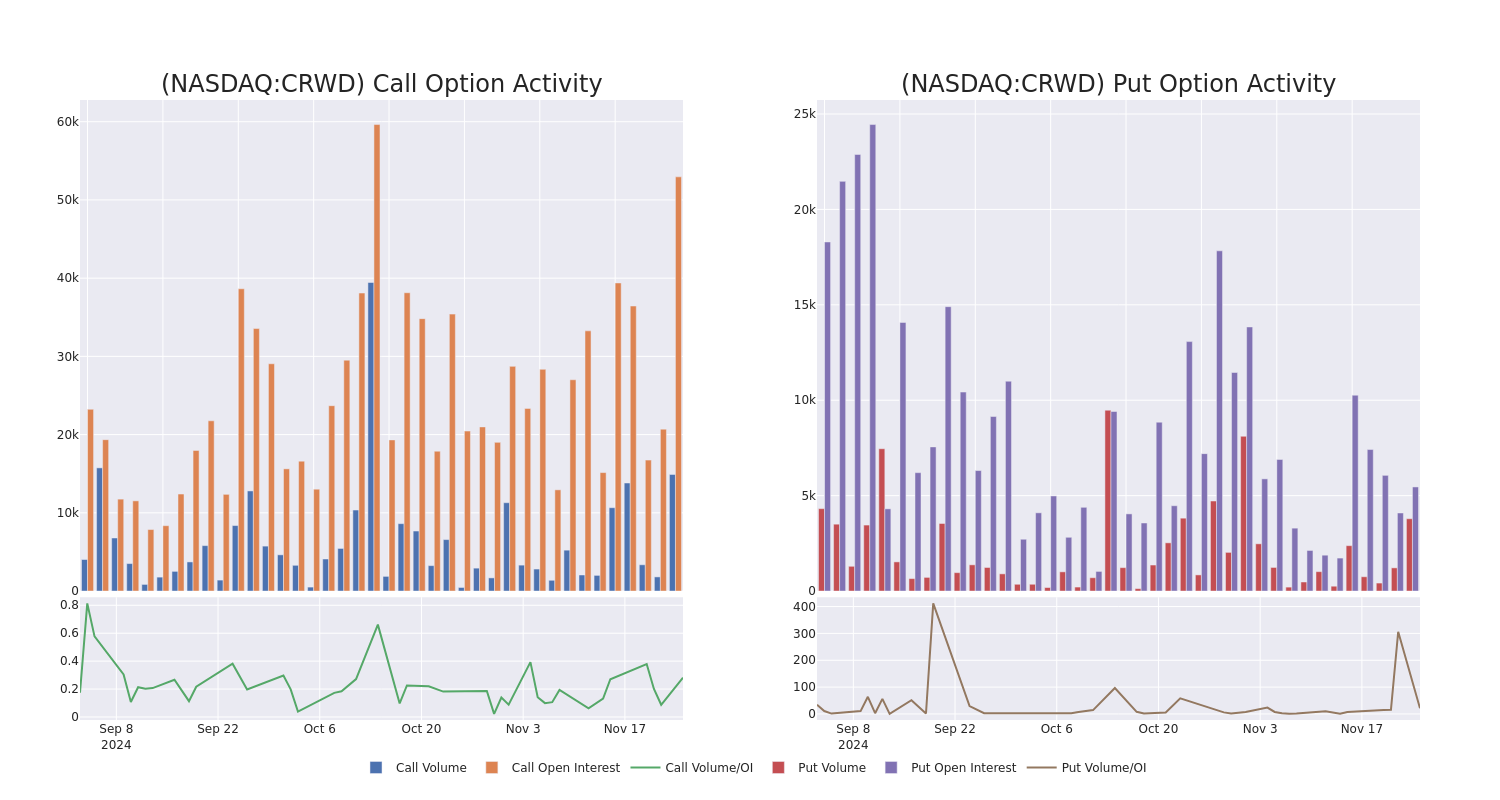

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for CrowdStrike Holdings's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CrowdStrike Holdings's whale trades within a strike price range from $240.0 to $580.0 in the last 30 days.

CrowdStrike Holdings Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | PUT | SWEEP | NEUTRAL | 01/17/25 | $3.75 | $3.65 | $3.75 | $300.00 | $733.6K | 3.0K | 2.0K |

| CRWD | PUT | SWEEP | BEARISH | 03/21/25 | $11.6 | $11.5 | $11.6 | $300.00 | $218.0K | 978 | 283 |

| CRWD | CALL | TRADE | BEARISH | 01/15/27 | $104.85 | $104.2 | $104.2 | $340.00 | $208.4K | 23 | 22 |

| CRWD | CALL | TRADE | BEARISH | 04/17/25 | $45.25 | $44.6 | $44.6 | $340.00 | $151.6K | 195 | 35 |

| CRWD | CALL | TRADE | BULLISH | 01/17/25 | $23.15 | $22.7 | $23.15 | $340.00 | $138.9K | 1.4K | 113 |

About CrowdStrike Holdings

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

In light of the recent options history for CrowdStrike Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

Present Market Standing of CrowdStrike Holdings

- With a volume of 5,525,767, the price of CRWD is down -5.48% at $344.34.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 97 days.

Expert Opinions on CrowdStrike Holdings

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $365.4.

Unusual Options Activity Detected: Smart Money on the Move

Benzinga Edge's Unusual Options board spots potential market movers before they happen. See what positions big money is taking on your favorite stocks. Click here for access. * An analyst from BMO Capital has decided to maintain their Outperform rating on CrowdStrike Holdings, which currently sits at a price target of $380. * Consistent in their evaluation, an analyst from Barclays keeps a Overweight rating on CrowdStrike Holdings with a target price of $372. * Consistent in their evaluation, an analyst from Cantor Fitzgerald keeps a Overweight rating on CrowdStrike Holdings with a target price of $370. * Maintaining their stance, an analyst from Oppenheimer continues to hold a Outperform rating for CrowdStrike Holdings, targeting a price of $410. * In a cautious move, an analyst from CICC downgraded its rating to Market Perform, setting a price target of $295.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest CrowdStrike Holdings options trades with real-time alerts from Benzinga Pro.