Ratings for Ulta Beauty (NASDAQ:ULTA) were provided by 28 analysts in the past three months, showcasing a mix of bullish and bearish perspectives.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 6 | 8 | 12 | 1 | 1 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 4 | 4 | 7 | 1 | 1 |

| 2M Ago | 0 | 4 | 3 | 0 | 0 |

| 3M Ago | 1 | 0 | 2 | 0 | 0 |

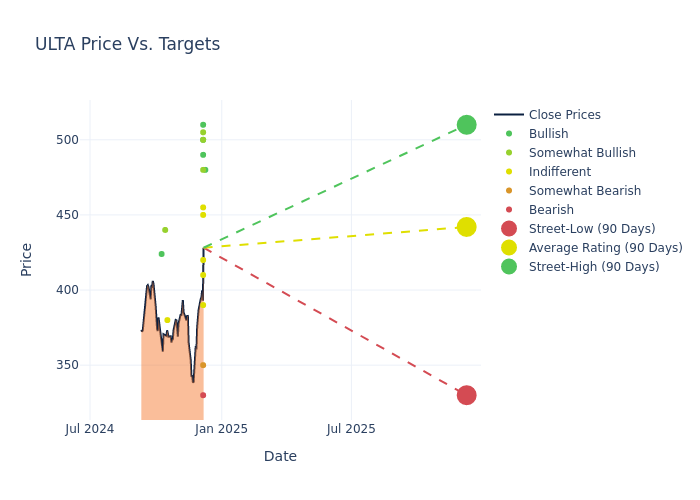

The 12-month price targets assessed by analysts reveal further insights, featuring an average target of $431.57, a high estimate of $510.00, and a low estimate of $330.00. Marking an increase of 6.09%, the current average surpasses the previous average price target of $406.81.

Interpreting Analyst Ratings: A Closer Look

The analysis of recent analyst actions sheds light on the perception of Ulta Beauty by financial experts. The following summary presents key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Anthony Chukumba | Loop Capital | Raises | Buy | $480.00 | $450.00 |

| Michael Lasser | UBS | Raises | Buy | $490.00 | $470.00 |

| Kelly Crago | Citigroup | Raises | Neutral | $450.00 | $390.00 |

| Adrienne Yih | Barclays | Raises | Equal-Weight | $410.00 | $335.00 |

| Michael Baker | DA Davidson | Raises | Buy | $510.00 | $435.00 |

| Anna Glaessgen | B. Riley Securities | Raises | Sell | $330.00 | $300.00 |

| Simeon Siegel | BMO Capital | Raises | Market Perform | $420.00 | $385.00 |

| Rupesh Parikh | Oppenheimer | Raises | Outperform | $505.00 | $435.00 |

| Christopher Horvers | JP Morgan | Raises | Overweight | $480.00 | $472.00 |

| Mark Astrachan | Stifel | Raises | Hold | $455.00 | $395.00 |

| Ike Boruchow | Wells Fargo | Raises | Underweight | $350.00 | $300.00 |

| Korinne Wolfmeyer | Piper Sandler | Raises | Neutral | $390.00 | $360.00 |

| Susan Anderson | Canaccord Genuity | Raises | Buy | $500.00 | $476.00 |

| Dana Telsey | Telsey Advisory Group | Raises | Outperform | $500.00 | $450.00 |

| Korinne Wolfmeyer | Piper Sandler | Raises | Neutral | $360.00 | $357.00 |

| Susan Anderson | Canaccord Genuity | Raises | Buy | $476.00 | $442.00 |

| Kelly Crago | Citigroup | Raises | Neutral | $390.00 | $345.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $450.00 | $450.00 |

| Christopher Horvers | JP Morgan | Raises | Overweight | $472.00 | $450.00 |

| Oliver Chen | TD Cowen | Lowers | Hold | $380.00 | $390.00 |

| Mark Astrachan | Stifel | Raises | Hold | $395.00 | $385.00 |

| Dana Telsey | Telsey Advisory Group | Maintains | Outperform | $450.00 | $450.00 |

| Korinne Wolfmeyer | Piper Sandler | Raises | Neutral | $357.00 | $356.00 |

| Rupesh Parikh | Oppenheimer | Maintains | Outperform | $435.00 | $435.00 |

| Olivia Tong | Raymond James | Lowers | Outperform | $440.00 | $450.00 |

| Krisztina Katai | Deutsche Bank | Lowers | Buy | $424.00 | $426.00 |

| Oliver Chen | TD Cowen | Lowers | Hold | $390.00 | $395.00 |

| Oliver Chen | TD Cowen | Announces | Hold | $395.00 | - |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to Ulta Beauty. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Ulta Beauty compared to the broader market.

- Price Targets: Analysts explore the dynamics of price targets, providing estimates for the future value of Ulta Beauty's stock. This examination reveals shifts in analysts' expectations over time.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Ulta Beauty's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Ulta Beauty analyst ratings.

Unveiling the Story Behind Ulta Beauty

With 1,385 stores at the end of fiscal 2023 and a partnership with Target, Ulta Beauty is the largest specialized beauty retailer in the US. The firm offers makeup (41% of 2023 sales), fragrances, skin care (19% of sales), and hair care products (19% of sales), and bath and body items. Ulta offers private-label products and more than 600 individual brands. It also offers salon services, including hair, makeup, skin, and brow services, in all stores. Most Ulta stores are approximately 10,000 square feet and are in suburban strip centers. Ulta was founded in 1990 and is based in Bolingbrook, Illinois.

Unraveling the Financial Story of Ulta Beauty

Market Capitalization Analysis: The company's market capitalization is above the industry average, indicating that it is relatively larger in size compared to peers. This may suggest a higher level of investor confidence and market recognition.

Revenue Growth: Ulta Beauty's remarkable performance in 3 months is evident. As of 31 October, 2024, the company achieved an impressive revenue growth rate of 1.65%. This signifies a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Consumer Discretionary sector.

Net Margin: Ulta Beauty's net margin excels beyond industry benchmarks, reaching 9.57%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Ulta Beauty's financial strength is reflected in its exceptional ROE, which exceeds industry averages. With a remarkable ROE of 10.36%, the company showcases efficient use of equity capital and strong financial health.

Return on Assets (ROA): Ulta Beauty's ROA surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 4.14% ROA, the company effectively utilizes its assets for optimal returns.

Debt Management: The company maintains a balanced debt approach with a debt-to-equity ratio below industry norms, standing at 0.92.

What Are Analyst Ratings?

Experts in banking and financial systems, analysts specialize in reporting for specific stocks or defined sectors. Their comprehensive research involves attending company conference calls and meetings, analyzing financial statements, and engaging with insiders to generate what are known as analyst ratings for stocks. Typically, analysts assess and rate each stock once per quarter.

Analysts may supplement their ratings with predictions for metrics like growth estimates, earnings, and revenue, offering investors a more comprehensive outlook. However, investors should be mindful that analysts, like any human, can have subjective perspectives influencing their forecasts.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.