9 analysts have expressed a variety of opinions on Kodiak Gas Services (NYSE:KGS) over the past quarter, offering a diverse set of opinions from bullish to bearish.

The following table encapsulates their recent ratings, offering a glimpse into the evolving sentiments over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 4 | 1 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 2 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

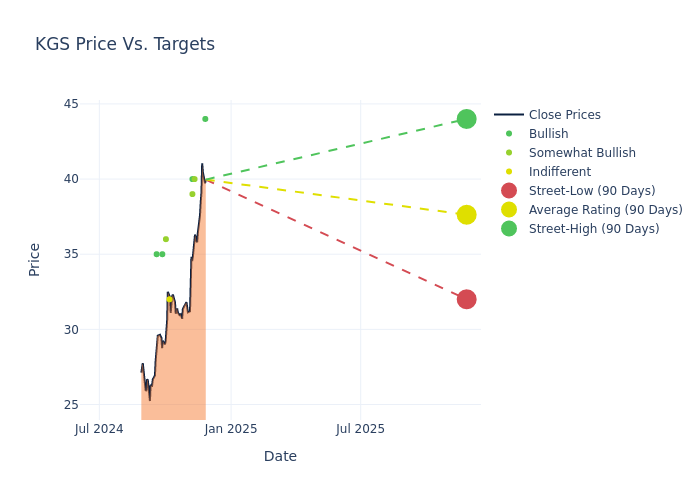

Analysts have recently evaluated Kodiak Gas Services and provided 12-month price targets. The average target is $37.33, accompanied by a high estimate of $44.00 and a low estimate of $32.00. This upward trend is apparent, with the current average reflecting a 13.71% increase from the previous average price target of $32.83.

Breaking Down Analyst Ratings: A Detailed Examination

The standing of Kodiak Gas Services among financial experts becomes clear with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| John Mackay | Goldman Sachs | Raises | Buy | $44.00 | $32.00 |

| Elvira Scotto | RBC Capital | Raises | Outperform | $40.00 | $35.00 |

| James Rollyson | Raymond James | Raises | Outperform | $39.00 | $35.00 |

| Neal Dingmann | Truist Securities | Raises | Buy | $40.00 | $35.00 |

| Elvira Scotto | RBC Capital | Raises | Outperform | $35.00 | $31.00 |

| Theresa Chen | Barclays | Raises | Equal-Weight | $32.00 | $29.00 |

| Gabriel Moreen | Mizuho | Announces | Outperform | $36.00 | - |

| Douglas Irwin | Citigroup | Announces | Buy | $35.00 | - |

| Sebastian Erskine | Redburn Atlantic | Announces | Buy | $35.00 | - |

Key Insights:

- Action Taken: In response to dynamic market conditions and company performance, analysts update their recommendations. Whether they 'Maintain', 'Raise', or 'Lower' their stance, it signifies their reaction to recent developments related to Kodiak Gas Services. This insight gives a snapshot of analysts' perspectives on the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Kodiak Gas Services compared to the broader market.

- Price Targets: Analysts navigate through adjustments in price targets, providing estimates for Kodiak Gas Services's future value. Comparing current and prior targets offers insights into analysts' evolving expectations.

Navigating through these analyst evaluations alongside other financial indicators can contribute to a holistic understanding of Kodiak Gas Services's market standing. Stay informed and make data-driven decisions with our Ratings Table.

Stay up to date on Kodiak Gas Services analyst ratings.

Get to Know Kodiak Gas Services Better

Kodiak Gas Services Inc is an operator of contract compression infrastructure in the United States. It manages business through two operating segments namely Compression Operations and Other Services. Compression Operations consist of operating company-owned and customer-owned compression infrastructure for customers, pursuant to fixed-revenue contracts to enable the production, gathering and transportation of natural gas and oil. Other Services consist of a full range of contract services to support the needs of customers, including station construction, maintenance and overhaul and other ancillary time and material-based offerings.

Breaking Down Kodiak Gas Services's Financial Performance

Market Capitalization Analysis: The company exhibits a lower market capitalization profile, positioning itself below industry averages. This suggests a smaller scale relative to peers.

Revenue Growth: Kodiak Gas Services's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 40.55%. This indicates a substantial increase in the company's top-line earnings. As compared to its peers, the company achieved a growth rate higher than the average among peers in Energy sector.

Net Margin: Kodiak Gas Services's net margin surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive -1.74% net margin, the company effectively manages costs and achieves strong profitability.

Return on Equity (ROE): Kodiak Gas Services's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -0.44%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): Kodiak Gas Services's ROA falls below industry averages, indicating challenges in efficiently utilizing assets. With an ROA of -0.13%, the company may face hurdles in generating optimal returns from its assets.

Debt Management: Kodiak Gas Services's debt-to-equity ratio is below industry norms, indicating a sound financial structure with a ratio of 2.13.

The Basics of Analyst Ratings

Benzinga tracks 150 analyst firms and reports on their stock expectations. Analysts typically arrive at their conclusions by predicting how much money a company will make in the future, usually the upcoming five years, and how risky or predictable that company's revenue streams are.

Analysts attend company conference calls and meetings, research company financial statements, and communicate with insiders to publish their ratings on stocks. Analysts typically rate each stock once per quarter or whenever the company has a major update.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.