iRhythm Technologies (NASDAQ:IRTC) has been analyzed by 7 analysts in the last three months, revealing a diverse range of perspectives from bullish to bearish.

In the table below, you'll find a summary of their recent ratings, revealing the shifting sentiments over the past 30 days and comparing them to the previous months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 4 | 1 | 2 | 0 | 0 |

| Last 30D | 0 | 0 | 1 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 3 | 1 | 1 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

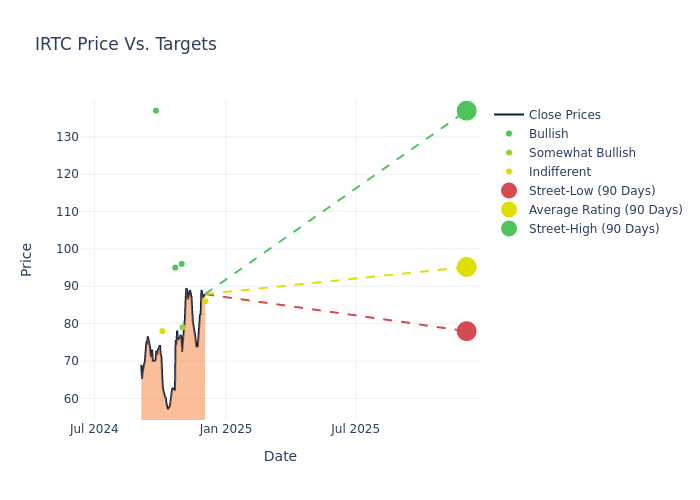

In the assessment of 12-month price targets, analysts unveil insights for iRhythm Technologies, presenting an average target of $93.0, a high estimate of $137.00, and a low estimate of $78.00. Observing a downward trend, the current average is 13.57% lower than the prior average price target of $107.60.

Decoding Analyst Ratings: A Detailed Look

The standing of iRhythm Technologies among financial experts is revealed through an in-depth exploration of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Nathan Treybeck | Wells Fargo | Announces | Equal-Weight | $86.00 | - |

| Mike Polark | Baird | Lowers | Outperform | $79.00 | $100.00 |

| David Saxon | Needham | Lowers | Buy | $96.00 | $119.00 |

| Richard Newitter | Truist Securities | Raises | Buy | $95.00 | $80.00 |

| Richard Newitter | Truist Securities | Lowers | Buy | $80.00 | $117.00 |

| David Roman | Goldman Sachs | Announces | Neutral | $78.00 | - |

| William Plovanic | Canaccord Genuity | Raises | Buy | $137.00 | $122.00 |

Key Insights:

- Action Taken: Analysts adapt their recommendations to changing market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their response to recent developments related to iRhythm Technologies. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Providing a comprehensive analysis, analysts offer qualitative assessments, ranging from 'Outperform' to 'Underperform'. These ratings reflect expectations for the relative performance of iRhythm Technologies compared to the broader market.

- Price Targets: Understanding forecasts, analysts offer estimates for iRhythm Technologies's future value. Examining the current and prior targets provides insight into analysts' changing expectations.

Assessing these analyst evaluations alongside crucial financial indicators can provide a comprehensive overview of iRhythm Technologies's market position. Stay informed and make well-judged decisions with the assistance of our Ratings Table.

Stay up to date on iRhythm Technologies analyst ratings.

Unveiling the Story Behind iRhythm Technologies

iRhythm Technologies Inc is a commercial-stage digital healthcare company redefining the way cardiac arrhythmias are clinically diagnosed by combining wearable biosensing technology with cloud-based data analytics and machine-learning capabilities. The company's portfolio includes ambulatory cardiac monitoring services on a platform, called the Zio service, which combines an easy-to-wear and unobtrusive biosensor that can be worn for several days with powerful proprietary algorithms that distill data from millions of heartbeats into clinically actionable information. The company derived its revenue from the United States.

iRhythm Technologies's Financial Performance

Market Capitalization Analysis: Below industry benchmarks, the company's market capitalization reflects a smaller scale relative to peers. This could be attributed to factors such as growth expectations or operational capacity.

Revenue Growth: Over the 3 months period, iRhythm Technologies showcased positive performance, achieving a revenue growth rate of 18.41% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Health Care sector.

Net Margin: iRhythm Technologies's net margin is below industry averages, indicating potential challenges in maintaining strong profitability. With a net margin of -31.3%, the company may face hurdles in effective cost management.

Return on Equity (ROE): iRhythm Technologies's ROE is below industry standards, pointing towards difficulties in efficiently utilizing equity capital. With an ROE of -54.03%, the company may encounter challenges in delivering satisfactory returns for shareholders.

Return on Assets (ROA): iRhythm Technologies's ROA lags behind industry averages, suggesting challenges in maximizing returns from its assets. With an ROA of -5.05%, the company may face hurdles in achieving optimal financial performance.

Debt Management: iRhythm Technologies's debt-to-equity ratio surpasses industry norms, standing at 10.25. This suggests the company carries a substantial amount of debt, posing potential financial challenges.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Some analysts publish their predictions for metrics such as growth estimates, earnings, and revenue to provide additional guidance with their ratings. When using analyst ratings, it is important to keep in mind that stock and sector analysts are also human and are only offering their opinions to investors.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.