Brinker International (NYSE:EAT) underwent analysis by 18 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

Summarizing their recent assessments, the table below illustrates the evolving sentiments in the past 30 days and compares them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 2 | 2 | 12 | 2 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 0 | 0 | 0 |

| 2M Ago | 1 | 2 | 12 | 2 | 0 |

| 3M Ago | 0 | 0 | 0 | 0 | 0 |

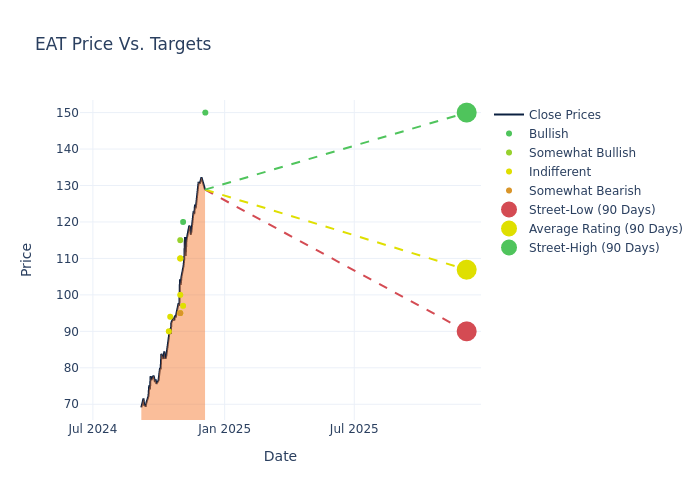

Analysts provide deeper insights through their assessments of 12-month price targets, revealing an average target of $100.06, a high estimate of $150.00, and a low estimate of $76.00. Observing a 28.58% increase, the current average has risen from the previous average price target of $77.82.

Diving into Analyst Ratings: An In-Depth Exploration

A clear picture of Brinker International's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Christine Cho | Goldman Sachs | Announces | Buy | $150.00 | - |

| Nicole Miller Regan | Piper Sandler | Raises | Neutral | $97.00 | $62.00 |

| Chris O'Cull | Stifel | Raises | Buy | $120.00 | $110.00 |

| Jon Tower | Citigroup | Raises | Neutral | $110.00 | $83.00 |

| Zachary Fadem | Wells Fargo | Raises | Underweight | $95.00 | $85.00 |

| Eric Gonzalez | Keybanc | Raises | Overweight | $115.00 | $100.00 |

| Jeffrey Bernstein | Barclays | Raises | Equal-Weight | $95.00 | $76.00 |

| Katherine Griffin | B of A Securities | Raises | Neutral | $110.00 | $97.00 |

| John Ivankoe | JP Morgan | Raises | Neutral | $100.00 | $67.00 |

| Katherine Griffin | B of A Securities | Raises | Neutral | $97.00 | $94.00 |

| Jeffrey Bernstein | Barclays | Raises | Equal-Weight | $76.00 | $66.00 |

| Katherine Griffin | B of A Securities | Raises | Neutral | $94.00 | $90.00 |

| Jon Tower | Wells Fargo | Raises | Underweight | $85.00 | $50.00 |

| Eric Gonzalez | Keybanc | Raises | Overweight | $100.00 | $72.00 |

| Dennis Geiger | UBS | Raises | Neutral | $94.00 | $70.00 |

| David Palmer | Evercore ISI Group | Raises | In-Line | $90.00 | $69.00 |

| Katherine Griffin | B of A Securities | Raises | Neutral | $90.00 | $63.00 |

| Jon Tower | Citigroup | Raises | Neutral | $83.00 | $69.00 |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Brinker International. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Offering a comprehensive view, analysts assess stocks qualitatively, spanning from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Brinker International compared to the broader market.

- Price Targets: Analysts predict movements in price targets, offering estimates for Brinker International's future value. Examining the current and prior targets offers insights into analysts' evolving expectations.

Analyzing these analyst evaluations alongside relevant financial metrics can provide a comprehensive view of Brinker International's market position. Stay informed and make data-driven decisions with the assistance of our Ratings Table.

Stay up to date on Brinker International analyst ratings.

All You Need to Know About Brinker International

Brinker International Inc operates casual dining restaurants under the brand's Chili Grill and Bar (Chili's) and Maggiano's Little Italy (Maggiano's). Chili's falls in the Bar and Grill category of casual dining. Its menu features Fresh Mex and Fresh Tex favorites including signature items such as slow-smoked baby back ribs, craft burgers, fajitas, and bottomless chips and salsa paired with tableside guacamole. Maggiano's is an Italian restaurant brand with a full lunch and dinner menu offering chef-prepared, such as appetizers, chicken, seafood, veal and prime steaks, and desserts. The company generates maximum revenue from Chili's segment.

A Deep Dive into Brinker International's Financials

Market Capitalization Analysis: The company's market capitalization is below the industry average, suggesting that it is relatively smaller compared to peers. This could be due to various factors, including perceived growth potential or operational scale.

Revenue Growth: Brinker International's revenue growth over a period of 3 months has been noteworthy. As of 30 September, 2024, the company achieved a revenue growth rate of approximately 12.49%. This indicates a substantial increase in the company's top-line earnings. When compared to others in the Consumer Discretionary sector, the company excelled with a growth rate higher than the average among peers.

Net Margin: Brinker International's net margin is below industry standards, pointing towards difficulties in achieving strong profitability. With a net margin of 3.38%, the company may encounter challenges in effective cost control.

Return on Equity (ROE): Brinker International's ROE excels beyond industry benchmarks, reaching 147.79%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Brinker International's ROA stands out, surpassing industry averages. With an impressive ROA of 1.5%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: Brinker International's debt-to-equity ratio is notably higher than the industry average. With a ratio of 158.19, the company relies more heavily on borrowed funds, indicating a higher level of financial risk.

The Significance of Analyst Ratings Explained

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.