The S&P 500 has been all over the place, but why shouldn’t it be?

A banking crisis was sparked late last week with the collapse of SVB Financial (SIVB). Over the weekend, Signature Bank (SBNY) failed, inflaming the situation.

We’re seeing travel stocks and crude oil under significant selling pressure — signaling a potential recession.

The CBOE Volatility Index, or VIX, the so-called fear gauge, rallied more than 50% from last Thursday’s low to Friday’s high and it has remained elevated all this week. Gold prices have rocketed, Treasury securities have seen a strong bid and bond yields have been volatile.

It takes more than a day or two to absorb an expansion of volatility this size.

Don't Miss: Is Microsoft Stock a Buy? Here's the Hurdle It Must Clear.

Now adding to the mess is news out of Europe, as Credit Suisse (CS) shares plunge and weigh on other European banks.

On the one hand, tech stocks have been relatively isolated from the situation, and so the stock market has not completely rolled over. On the other hand, the SPDR S&P 500 ETF Trust (SPY) does look vulnerable.

Let’s revisit the key levels.

Trading the S&P 500 ETF (SPY)

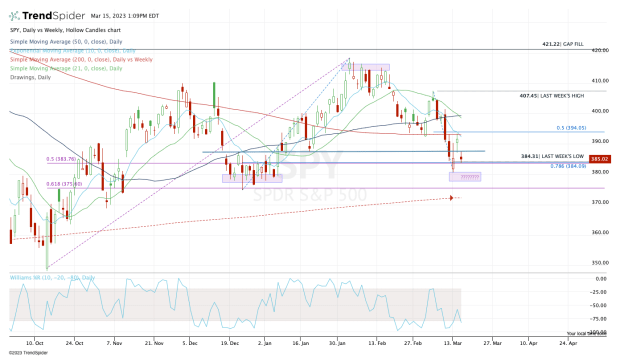

Chart courtesy of TrendSpider.com

The chart above looks complicated, but let’s simplify some of the observations.

For instance, the SPY ETF is trading below all its daily moving averages. Second, it’s teetering on last week’s low and the 78.6% retracement from the December low to the 2023 high.

We saw the SPY find support in the low-$380s earlier this week, which is not surprising. That’s as it found heavy support in the $377 to $382 area for several weeks in December.

If that area continues to hold, the bulls will need to see the SPY regain the $388 level, opening the door to the 200-day moving average and the $394 area.

I am curious to see how the SPY ETF behaves from here. If we can hold the $384 area and turn higher, the S&P 500 will buck a lot of bad news, trends and volatility. But if support crumbles, the $377 to $380 area will become vital.

Below it and the $372 to $375 area will be key, since it's where we find the 61.8% retracement from the 2023 high down to the 2022 low, as well as the 200-week moving average.

This is the nub of it: If you are trading the SPY ETF — or any other index-related ETF — keep the current volatility in mind. Take smaller positions when you trade and follow the levels. If your trade is correct, take profit into the preplanned zones, and if you're wrong, don’t be afraid to stop-out and wait for a better setup.