During the last three months, 4 analysts shared their evaluations of Turning Point Brands (NYSE:TPB), revealing diverse outlooks from bullish to bearish.

The table below provides a snapshot of their recent ratings, showcasing how sentiments have evolved over the past 30 days and comparing them to the preceding months.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 3 | 1 | 0 | 0 | 0 |

| Last 30D | 1 | 0 | 0 | 0 | 0 |

| 1M Ago | 1 | 1 | 0 | 0 | 0 |

| 2M Ago | 0 | 0 | 0 | 0 | 0 |

| 3M Ago | 1 | 0 | 0 | 0 | 0 |

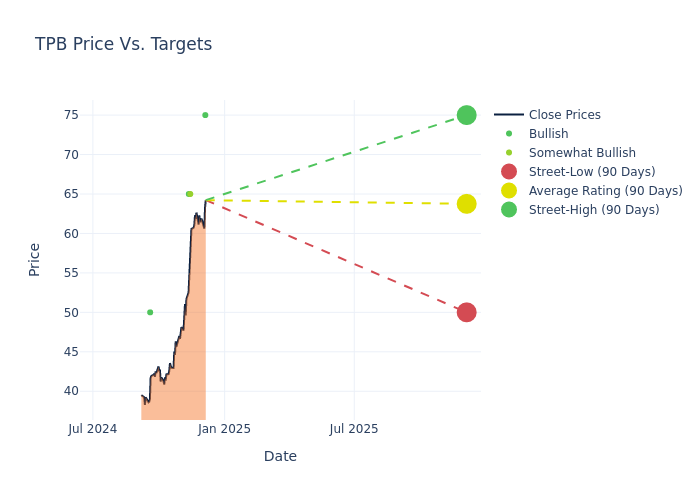

The 12-month price targets, analyzed by analysts, offer insights with an average target of $63.75, a high estimate of $75.00, and a low estimate of $50.00. Observing a 21.43% increase, the current average has risen from the previous average price target of $52.50.

Breaking Down Analyst Ratings: A Detailed Examination

In examining recent analyst actions, we gain insights into how financial experts perceive Turning Point Brands. The following summary outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Eric Des Lauriers | Craig-Hallum | Raises | Buy | $75.00 | $60.00 |

| Ian Zaffino | Oppenheimer | Announces | Outperform | $65.00 | - |

| Michael Legg | Benchmark | Raises | Buy | $65.00 | $45.00 |

| Scott Fortune | Roth MKM | Announces | Buy | $50.00 | - |

Key Insights:

- Action Taken: Analysts respond to changes in market conditions and company performance, frequently updating their recommendations. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Turning Point Brands. This information offers a snapshot of how analysts perceive the current state of the company.

- Rating: Delving into assessments, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings communicate expectations for the relative performance of Turning Point Brands compared to the broader market.

- Price Targets: Analysts set price targets as an estimate of a stock's future value. Comparing the current and prior price targets provides insight into how analysts' expectations have changed over time. This information can be valuable for investors seeking to understand consensus views on the stock's potential future performance.

For valuable insights into Turning Point Brands's market performance, consider these analyst evaluations alongside crucial financial indicators. Stay well-informed and make prudent decisions using our Ratings Table.

Stay up to date on Turning Point Brands analyst ratings.

If you are interested in following small-cap stock news and performance you can start by tracking it here.

About Turning Point Brands

Turning Point Brands Inc operates as manufacturer, marketer, provider of consumer products that include Other Tobacco Products (OTP) in the U.S. The company offers a wide variety across the OTP spectrum including moist snuff tobacco (MST), loose-leaf chewing tobacco, premium cigarette papers, make- your-own (MYO) cigar wraps, cigars, liquid vapor products, and tobacco vaporizer products. It operates in three segments namely Zig-Zag products; Stoker's products and NewGen products. The company generates maximum revenue from the Zig-Zag products segment.

Turning Point Brands's Financial Performance

Market Capitalization: Surpassing industry standards, the company's market capitalization asserts its dominance in terms of size, suggesting a robust market position.

Revenue Growth: Over the 3 months period, Turning Point Brands showcased positive performance, achieving a revenue growth rate of 3.83% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. As compared to competitors, the company surpassed expectations with a growth rate higher than the average among peers in the Consumer Staples sector.

Net Margin: Turning Point Brands's net margin excels beyond industry benchmarks, reaching 11.72%. This signifies efficient cost management and strong financial health.

Return on Equity (ROE): Turning Point Brands's ROE excels beyond industry benchmarks, reaching 6.9%. This signifies robust financial management and efficient use of shareholder equity capital.

Return on Assets (ROA): Turning Point Brands's ROA stands out, surpassing industry averages. With an impressive ROA of 2.29%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 1.4, caution is advised due to increased financial risk.

Understanding the Relevance of Analyst Ratings

Analysts are specialists within banking and financial systems that typically report for specific stocks or within defined sectors. These people research company financial statements, sit in conference calls and meetings, and speak with relevant insiders to determine what are known as analyst ratings for stocks. Typically, analysts will rate each stock once a quarter.

Analysts may enhance their evaluations by incorporating forecasts for metrics like growth estimates, earnings, and revenue, delivering additional guidance to investors. It is vital to acknowledge that, although experts in stocks and sectors, analysts are human and express their opinions when providing insights.

Which Stocks Are Analysts Recommending Now?

Benzinga Edge gives you instant access to all major analyst upgrades, downgrades, and price targets. Sort by accuracy, upside potential, and more. Click here to stay ahead of the market.

This article was generated by Benzinga's automated content engine and reviewed by an editor.