Ford Motor (NYSE:F) underwent analysis by 10 analysts in the last quarter, revealing a spectrum of viewpoints from bullish to bearish.

The table below provides a concise overview of recent ratings by analysts, offering insights into the changing sentiments over the past 30 days and drawing comparisons with the preceding months for a holistic perspective.

| Bullish | Somewhat Bullish | Indifferent | Somewhat Bearish | Bearish | |

|---|---|---|---|---|---|

| Total Ratings | 1 | 3 | 5 | 1 | 0 |

| Last 30D | 0 | 0 | 0 | 0 | 0 |

| 1M Ago | 0 | 0 | 1 | 0 | 0 |

| 2M Ago | 0 | 2 | 2 | 0 | 0 |

| 3M Ago | 1 | 1 | 2 | 1 | 0 |

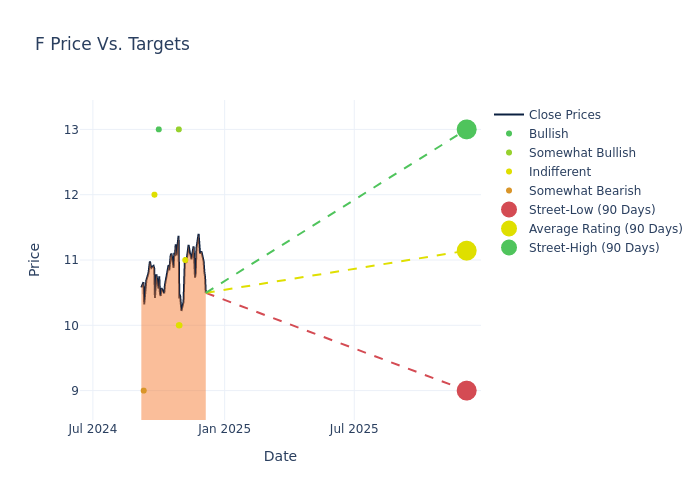

In the assessment of 12-month price targets, analysts unveil insights for Ford Motor, presenting an average target of $11.9, a high estimate of $16.00, and a low estimate of $9.00. Experiencing a 9.3% decline, the current average is now lower than the previous average price target of $13.12.

Breaking Down Analyst Ratings: A Detailed Examination

A clear picture of Ford Motor's perception among financial experts is painted with a thorough analysis of recent analyst actions. The summary below outlines key analysts, their recent evaluations, and adjustments to ratings and price targets.

| Analyst | Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Daniel Roeska | Bernstein | Announces | Market Perform | $11.00 | - |

| Edison Yu | Deutsche Bank | Lowers | Hold | $10.00 | $11.00 |

| Tom Narayan | RBC Capital | Maintains | Sector Perform | $10.00 | $10.00 |

| Dan Levy | Barclays | Lowers | Overweight | $13.00 | $14.00 |

| Dan Levy | Barclays | Lowers | Overweight | $14.00 | $16.00 |

| Mark Delaney | Goldman Sachs | Raises | Buy | $13.00 | $12.00 |

| Adam Jonas | Morgan Stanley | Lowers | Equal-Weight | $12.00 | $16.00 |

| Adam Jonas | Morgan Stanley | Maintains | Overweight | $16.00 | $16.00 |

| Colin Langan | Wells Fargo | Lowers | Underweight | $9.00 | $10.00 |

| Edison Yu | Deutsche Bank | Announces | Hold | $11.00 | - |

Key Insights:

- Action Taken: Analysts frequently update their recommendations based on evolving market conditions and company performance. Whether they 'Maintain', 'Raise' or 'Lower' their stance, it reflects their reaction to recent developments related to Ford Motor. This information provides a snapshot of how analysts perceive the current state of the company.

- Rating: Offering insights into predictions, analysts assign qualitative values, from 'Outperform' to 'Underperform'. These ratings convey expectations for the relative performance of Ford Motor compared to the broader market.

- Price Targets: Analysts provide insights into price targets, offering estimates for the future value of Ford Motor's stock. This comparison reveals trends in analysts' expectations over time.

Capture valuable insights into Ford Motor's market standing by understanding these analyst evaluations alongside pertinent financial indicators. Stay informed and make strategic decisions with our Ratings Table.

Stay up to date on Ford Motor analyst ratings.

Unveiling the Story Behind Ford Motor

Ford Motor Co. manufactures automobiles under its Ford and Lincoln brands. In March 2022, the company announced that it will run its combustion engine business, Ford Blue, and its BEV business, Ford Model e, as separate businesses but still all under Ford Motor. The company has nearly 13% market share in the United States, about 11% share in the UK, and under 2% share in China including unconsolidated affiliates. Sales in the US made up about 66% of 2023 total company revenue. Ford has about 177,000 employees, including about 59,000 UAW employees, and is based in Dearborn, Michigan.

Unraveling the Financial Story of Ford Motor

Market Capitalization: With restricted market capitalization, the company is positioned below industry averages. This reflects a smaller scale relative to peers.

Revenue Growth: Over the 3 months period, Ford Motor showcased positive performance, achieving a revenue growth rate of 5.47% as of 30 September, 2024. This reflects a substantial increase in the company's top-line earnings. In comparison to its industry peers, the company trails behind with a growth rate lower than the average among peers in the Consumer Discretionary sector.

Net Margin: The company's net margin is a standout performer, exceeding industry averages. With an impressive net margin of 1.93%, the company showcases strong profitability and effective cost control.

Return on Equity (ROE): Ford Motor's ROE surpasses industry standards, highlighting the company's exceptional financial performance. With an impressive 2.03% ROE, the company effectively utilizes shareholder equity capital.

Return on Assets (ROA): Ford Motor's ROA stands out, surpassing industry averages. With an impressive ROA of 0.32%, the company demonstrates effective utilization of assets and strong financial performance.

Debt Management: The company faces challenges in debt management with a debt-to-equity ratio higher than the industry average. With a ratio of 3.59, caution is advised due to increased financial risk.

Analyst Ratings: Simplified

Ratings come from analysts, or specialists within banking and financial systems that report for specific stocks or defined sectors (typically once per quarter for each stock). Analysts usually derive their information from company conference calls and meetings, financial statements, and conversations with important insiders to reach their decisions.

Some analysts will also offer forecasts for metrics like growth estimates, earnings, and revenue to provide further guidance on stocks. Investors who use analyst ratings should note that this specialized advice comes from humans and may be subject to error.

Breaking: Wall Street's Next Big Mover

Benzinga's #1 analyst just identified a stock poised for explosive growth. This under-the-radar company could surge 200%+ as major market shifts unfold. Click here for urgent details.

This article was generated by Benzinga's automated content engine and reviewed by an editor.