A couple say they were forced to sell their house despite three MPs stepping in to help with their mortgage nightmare.

Now Stephen Neale, 75 and Julie Neale, 64, are speaking out to raise awareness of their case and to give a sense of solidarity to people with similar problems who may be suffering in silence.

The Neales bought a house in Stoke on Trent in 2001 with a standard repayment joint mortgage.

The couple lived there happily with their three children for several years.

By 2005 the couple had come under financial pressure after Stephen’s early retirement in 2000 due to ill health.

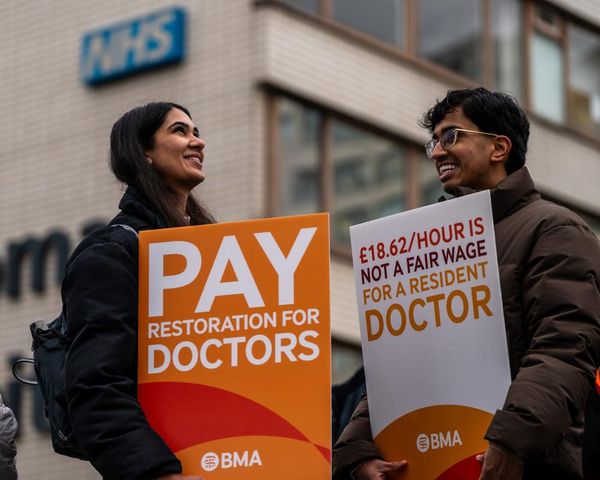

This had reduced the couples' income from £40,000 to £24,000. Although by 2005 Julie had found work with the NHS, they still needed to reduce their outgoings.

So the couple decided to refinance their home.

“We were stretched to the limit so we were looking to consolidate our debts and remortgage," Stephen said.

In November 2005 the couple went to a mortgage broker – that The Mirror cannot name for legal reasons.

The Neales say the broker they spoke to recommended an interest-only mortgage which was significantly cheaper at the time than their repayment homeloan.

This is because borrowers only pay off the interest, not the interest plus the loan.

At the end of the mortgage term, the homeowner either has to sell the house or come up with the cash to buy the property outright – normally with cash raised from savings or investments.

But the Neales say their broker never asked them how they would repay the loan.

The Neales only found out the truth in 2016 when Julie uncovered files from their mortgage lender, Northern Rock.

The shocking files – seen by The Mirror – show that their original application for an interest-only mortgage was declined as unsuitable.

Northern Rock files show their application was only accepted when the broker phoned the lender to swap the mortgage to a self certification, or “self cert", mortgage.

The Neales say they never knew about this - or that their first application had been declined.

A transcript of the exchange between the broker and Northern Rock shows that the intermediary told the lender that the house could be sold to repay the mortgage - something the Neales say they were never told.

Self-cert mortgages were controversial homeloans which let borrowers effectively fill in their own income.

These homeloans were meant to help self-employed people who do not have a regular income.

But in practice many borrowers exaggerated their income to get a bigger house and a bigger mortgage, and many lenders did not check.

This led to many struggling to keep their homes in the 2007/8 financial crisis.

The so-called “liar loans" were later banned in 2014 by the financial regulator, the Financial Conduct Authority.

The Neales’ broker initially told Northern Rock that the couple had maturing ISAs that would help repay the mortgage.

The broker later changed their story and advised Northern Rock that the ISAs were not yet up and running, but would mature in ten years, according to a transcript of the conversation.

However, the Neales say they never had any ISAs.

Three MPS have, over the years, stepped in to help the Neales with their claim to the FSCS – Fiona Bruce, Owen Paterson and Helen Morgan.

But despite this heavyweight backing, the FSCS has refused to budge.

Morgan told the FSCS that the homeloan “was not the right mortgage for my constituents' circumstances and that it looks like straightforward mis-selling to me”.

But in an email to Morgan sent in May this year, a FSCS worker said that “there was no obligation to the broker to ensure a suitable repayment vehicle was in place and the repayment vehicle would not have been verified by the lender”.

The worker added that the FSCS cannot assume the reason why Mr and Mrs Neale chose to self certify their mortgage with Northern Rock.

Stephen said: "We spent hundreds of hours on this as well as £4,000 in solicitors' fees.

“But more importantly it devastated us mentally, physically, and financially.

"Julie had to give up her job as a counsellor in the NHS. It's ruined our retirement and has dominated our lives for the last seven years."

The Neales reported the broker to Action Fraud in 2015 and went to the Financial Ombudsman Service initially, which could not help them.

The Neales say they to drop legal action because of the cost and because the FSCS was not engaging with their evidence.

In 2020 the FSCS said there was no evidence of broker fraud or negligence.

After MP Owen Paterson stepped in, the FSCS carried out the Neales' appeal.

But this failed.

The Neales state that the FSCS did not even bother to contact Northern Rock.

Nor did the FSCS examine the Neales' tax records, which would have shown their incomes and that they never had ISAs.

Now the Neales feel they are in limbo and have run out of ideas on how to get redress.

“The obvious one would be to start a High Court Action but that’s way beyond our means,” Stephen said.

A spokesperson for the FSCS said: "FSCS is only able to pay compensation for mortgage advice where there is evidence that the firm gave negligent advice to its customers, causing them to lose money.

"Each claim is assessed on a case-by-case basis using the evidence provided. We would encourage anyone who believes they have been a victim of fraud to report it to Action Fraud."