Investors should not be surprised by the drop we’re seeing in Costco Wholesale (COST) on Friday. At last check, Costco stock was down 3.1% after the wearhouse-club retailer reported earnings Thursday evening.

The lack of surprise regarding the Costco stock drop stems from the industrywide struggle. Costco is a stalwart in the industry, but even the best names in retail have had disappointing post-earnings reactions. They include Target (TGT), Home Depot (HD), Walmart (WMT), Lowe’s (LOW), Kohl’s (KSS) and others.

Don't Miss: Salesforce Stock Rips on Earnings. Here's the Trade.

Further, Costco provides monthly updates, so in that sense there wasn’t much in the tank for an upside surprise.

As for the quarter, Costco turned in a mixed result, missing on sales expectations as Chief Financial Officer Richard Galanti said, “We've seen some weakness in what I'll call big ticket discretionary items.”

That’s got the stock under some selling pressure, but two key levels stand out on the downside.

Trading Costco Stock on Earnings

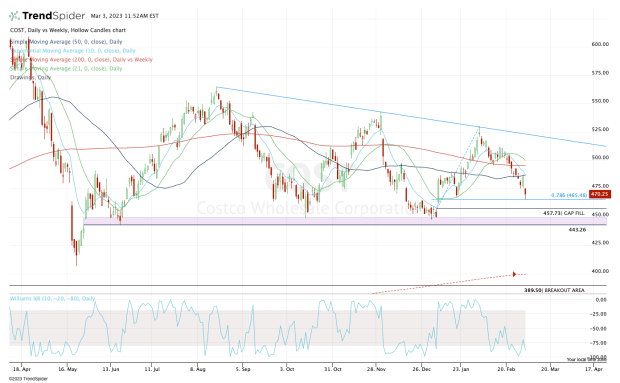

Chart courtesy of TrendSpider.com

Take a second look at this chart. Notice the way that Costco stock has continued to put in a series of lower highs, a bearish technical development.

Also notice the way that the stock was below all its daily moving averages ahead of the earnings report. While a positive report could have changed that scenario, it did not set a good tone ahead of the event.

Instead, the stock took out the low from the past few days.

Don't Miss: Will Snowflake Stock Keep Melting? Here's Where Key Support Is.

One silver lining is the fact that Costco stock is finding support at the 78.6% retracement near $465 and bouncing.

What bulls would like to see from here is a move back above $475. That was the two-day low coming into Friday and is approximately the post-earnings high.

Regaining this level would open the door back to the 50-day and 10-day moving averages, currently near $487.

If the 78.6% retracement can’t hold as support, bulls need to look for a lower potential entry if they’re still trying for a long position in Costco stock.

Specifically, there’s the gap-fill near $457.75, followed by major support between $440 to $450.

The bottom line is this: Look for support near $465, which is near the post-earnings low and the 78.6% retracement. If that fails, $450 to $457 is the next focus area, with a preference toward the lower end of that range.