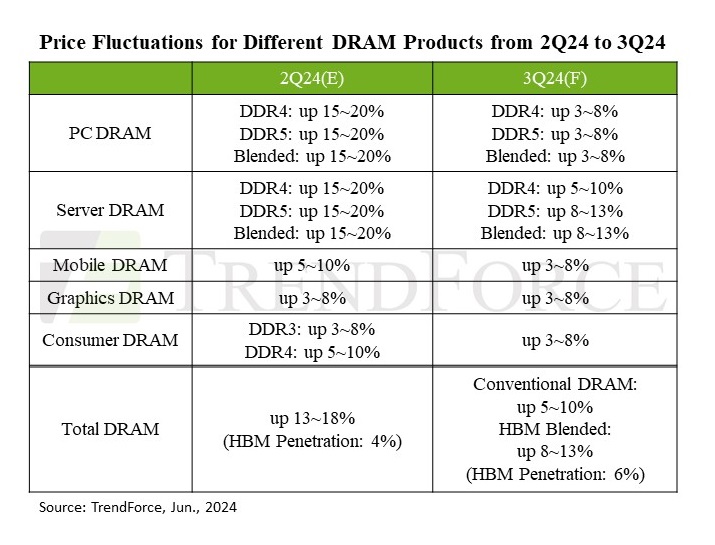

As demand for AI computing power and data centers continues to grow, so does the need for certain key computer components, including memory. This serious server demand boost, and the increase of HBM share in factory production, means PC DRAM prices could jump between 3% and 8% QoQ, according to market research firm Trend Force.

Price rises are never welcome, but forecast rises are smaller in scale compared to price increases seen in the previous quarters, with prices rising by 10% to 15% between January and March. It’s estimated that many manufacturers and retailers still have significant inventory of PC DRAM, plus the consumer demand for memory remains stable, so there isn’t much pressure on the consumer and retail side for DRAM. We can see this with spot pricing for DRAM, which is continuing with its downward trend since the end of May.

PC DRAM production is a different story, however. Both SK hynix and Micron HBM supplies sold out until late next year. While this might not directly affect the production line for PC DRAM, companies might switch over production to HBM, thus reducing output for consumer memory modules.

Aside from system memory, VRAM is also affected by HBM and server RAM demand, with its price expected to increase by the same 3% to 8% QoQ, according to TrendForce figures. But the biggest driver of this increase is the pending arrival of next-generation RTX 50-series GPUs, which are rumored to arrive in Fall 2024. These graphics processors are set to come equipped with GDDR7 VRAM.

Even Intel’s second-generation Battlemage Arc GPUs, which are expected to arrive before the holidays, are rumored to use the newer VRAM tech. As GDDR7 is 20% to 30% more expensive than GDDR6, they will push the average prices of VRAM up. This is especially true as graphics card manufacturers and their board partners order more GDDR7 memory as they start to verify the performance of their latest products.

Mobile device markets are also forecast to feel the influence of modest increases in RAM prices. Although manufacturers seem intent on increasing prices for smartphone manufacturers, most buyers still have ample supply, so they’re unlikely to engage in negotiations with RAM suppliers for now.

Price increases are unwelcome, but they’re part and parcel of inflation. As long as supply keeps up with demand, we should not see any shocks that will cause PC part costs to skyrocket in the near term.