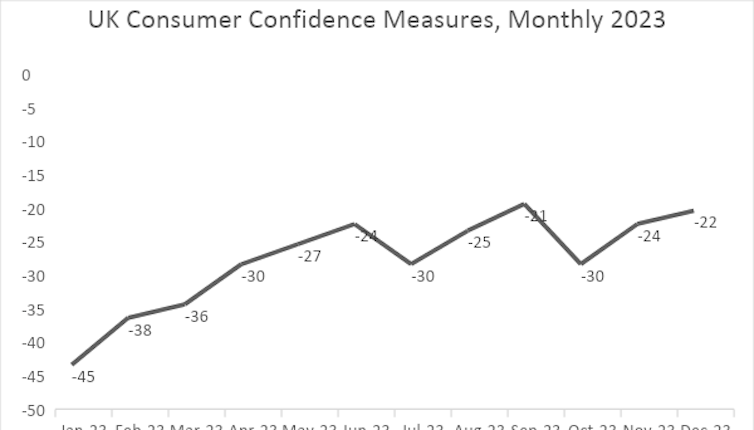

People’s confidence in the UK’s economic outlook improved towards the end of 2023, despite continuing to battle a cost-of-living crisis. Although it has strengthened over the year to December, “consumer sentiment” as this confidence is called, is still in negative territory.

Indeed, UK consumer price inflation remains well above the Bank of England’s 2% target and interest rates are at highs not seen since the wake of the global financial crisis in 2008?. And, of course, the outlook for the UK economy in 2024 is also in the doldrums.

British economist John Maynard Keynes talked about “animal spirits” meaning the psychological factors that drive firm’s investment decisions. But economists also take people’s feelings into account when making predictions about the direction of the economy. So, with consumer confidence rising in spite of all of these negative indicators, what role does this kind of optimism play in economic forecasts?

Traditionally, when trying to gauge the country’s financial prospects, economists focused on households’ ability to consume, arguing that expectations of future household income are a crucial determinant of people’s current consumption. For instance, you’ll be more reluctant to splash out now if you think inflation is going to sky-rocket next year, squeezing your finances in the future.

But willingness to consume is also increasingly important to economists, especially during difficult times. Such “consumer sentiments” describe the psychological state of households, or people, rather than the present reality of their personal finances. When economists know people are optimistic about the economy, they assume they are more willing to spend or consume more and, if not, they are expected to save more instead.

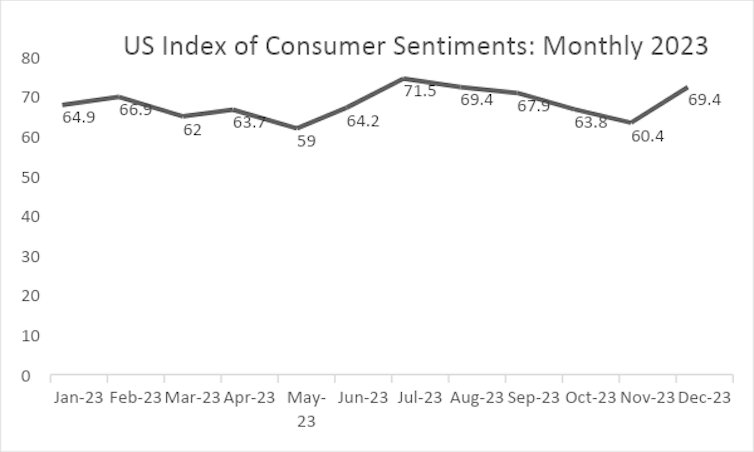

In the US, consumer sentiment is tracked by the University of Michigan’s Surveys of Consumers, which is based on a monthly poll of a sample of households. UK consumer sentiment is represented by the GfK Consumer Confidence Barometer, also a monthly survey of households.

Both measures ask people about their personal finances and their thoughts on the general economy. Participants are asked about plans for large purchases, especially durables such as white goods and cars, as well as their views about what has happened in the past year (backward-looking) and their opinion of prospects over the next year (forward-looking). The US index is more focused on households’ forward-looking views, at least with regards to the overall economy.

Why are these consumer surveys so important?

People’s willingness to spend money is affected by special or extreme events. The financial crisis of 2007-08, the COVID pandemic and Russia’s invasion of Ukraine all dragged down consumer sentiment.

Recent research also shows that good and bad news has an uneven effect on consumer sentiment. In particular, good news about the general economy will have a greater and more lasting impact than bad news.

In the US, for example, recent good news about jobless rates falling to the lowest point since July, together with the future prospect of lower inflation, has boosted households’ willingness to consume. After falling continually for the preceding four months, US consumer sentiment increased sharply in December.

The US Federal Reserve has indicated that interest rates will be held and perhaps even fall in 2024 as inflationary pressures ease. So, the outlook for an easing of inflationary pressures once recent interest rate rises take full effect seems to have had a positive effect on consumer sentiment.

A gloomier outlook for the UK economy

The picture in the UK is somewhat different. While inflationary pressures have eased recently, the current rate of 3.9% is still well above the Bank of England’s 2% target. Also, unlike the US Federal Reserve, the Bank of England is less likely to cut interest rates anytime soon, while recent data on economic growth has been disappointing. In October, the economy shrank by 0.3% and unemployment rates are currently around 4.3%, with pay growth easing.

Nevertheless, consumer confidence has increased in the last two months, after a sharp fall in October. That decrease may have been due to the Gaza conflict and fears about its potential impact on the global economy.

Read more: How the Israel-Hamas war could affect the world economy and worsen global trade tensions

So, both UK and US consumers seem to feel fairly optimistic about their personal finances and the wider economy right now. The obvious common factor among the two economies is the easing of inflationary pressures, which many people will be hoping will reduce the pressures of the cost of living crisis. But even though confidence is growing, neither country is out of the woods yet when it comes to the economic outlook.

Joshy Easaw received a Leverhulme Research Fellowship from October 2007 to September 2008 to study: ‘Microfoundations of how households form subjective macroeconomic expectations: The role of news’.

This article was originally published on The Conversation. Read the original article.