MBIE reports increased fuel company profit margins contributing to rising petrol and diesel prices this summer – but from next month, the companies face new regulations to protect motorists.

Maria Humphreys hasn't had to fuel her little silver Toyota Yaris hatchback too often in Auckland's past few months of lockdown. "I've hardly been travelling, with Covid. I haven't filled up the tank so much."

So when she pulled into the GAS service station on the city's Dominion Rd this week, the price on the board was an unpleasant shock: an unprecedented $2.749 a litre for unleaded 91. "I did wonder, when I saw the price," she says. "That's why I'm only filling up a little bit."

That service station was charging the city's highest petrol prices, according to price app Gaspy – though within 24 hours it has been overtaken by a couple of nearby Mobil and Z Energy outlets.

Just 1200 metres down the road from the GAS station, Mobil Dominion Rd is charging the highest diesel price in Auckland: $2.069 a litre. It's only this week that diesel prices have topped $2 and already, that milestone seems a long way behind.

(These prices don't count the Challenge station on Waiheke Island, where regular 91 is $3.069 and diesel is $2.229 a litre – that's typically highest in the country, for perhaps understandable reasons).

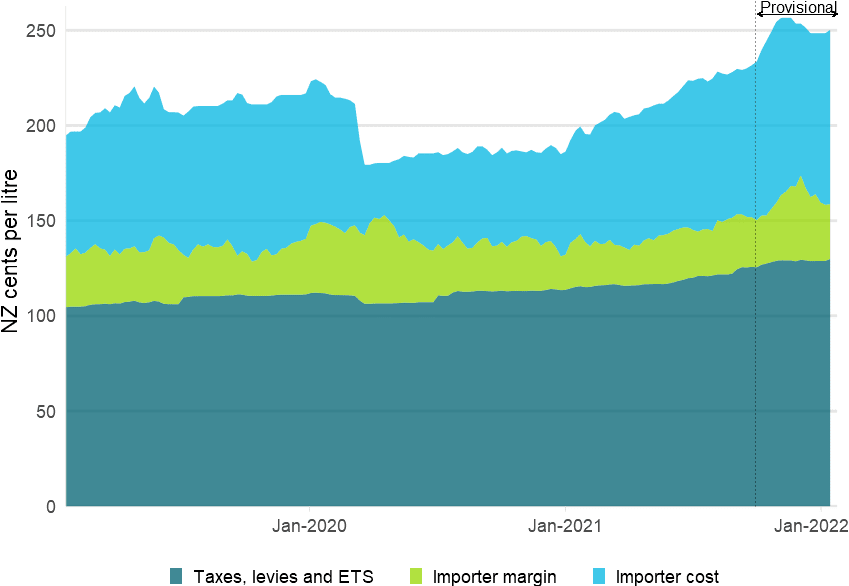

Pump prices are the highest New Zealanders have ever seen, and this summer they are surging even further. What is worrying is that, according to provisional data from the Ministry of Business, Innovation and Employment, most of this rise is made up of increased importer margins. If MBIE is to be believed, the fuel companies are just pocketing more profits at the expense of New Zealand motorists.

That's a big "if". The country's biggest fuel retailer, Z Energy, "categorically" rejects pulling in bigger margins.

"The lag in this data has been a source of frustration for ourselves and our stakeholders for some time as it does not accurately reflect the trading conditions that Z is currently experiencing in the market," says the company's general manager of retail, Andy Baird.

Retail margins expanded and compressed consistent with previous cycles, he says. The company's margins were just one cent per litre higher in the December quarter. "We can categorically state that Z is not achieving the margins indicated by MBIE’s data and we continue to raise our concerns in regards to this data with MBIE."

He defends that, pointing out that when New Zealand shutdown, the company's costs did not reduce. "Z as a business is largely made up of fixed costs but did not apply for Government support during the quarter, despite meeting the criteria for the wage subsidy."

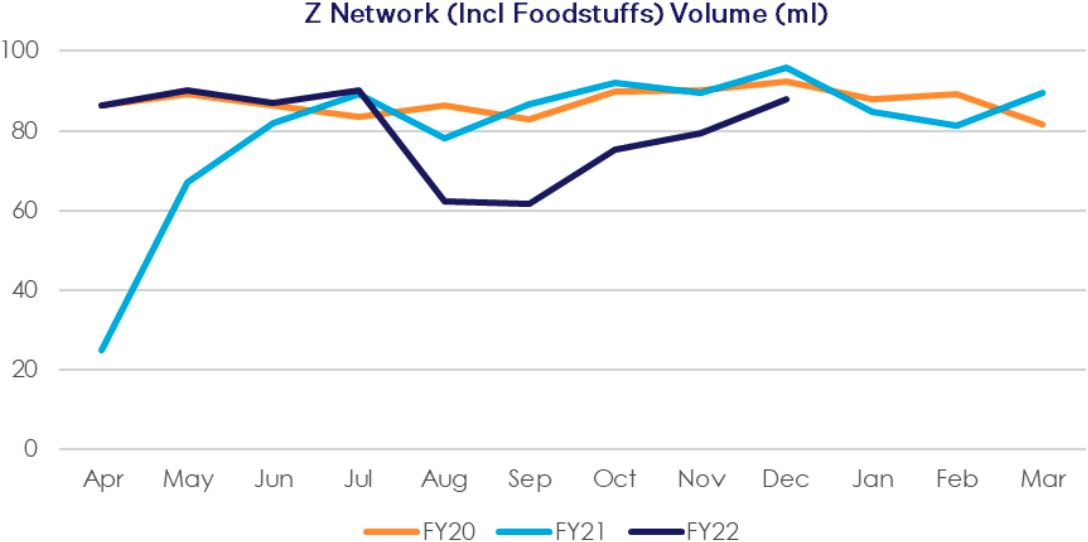

The company's chief executive Mike Bennetts made that point to NZX investors just yesterday: "Covid-19 related lockdowns in Auckland and other regions throughout the quarter, coupled with high pump prices due to increased crude oil costs and weaker NZD exchange rates, has reduced retail volumes compared to the same quarter last year,” he said.

The fuel volumes sold by Z Energy's service stations were down 12.2 percent in the December quarter, Bennetts said.

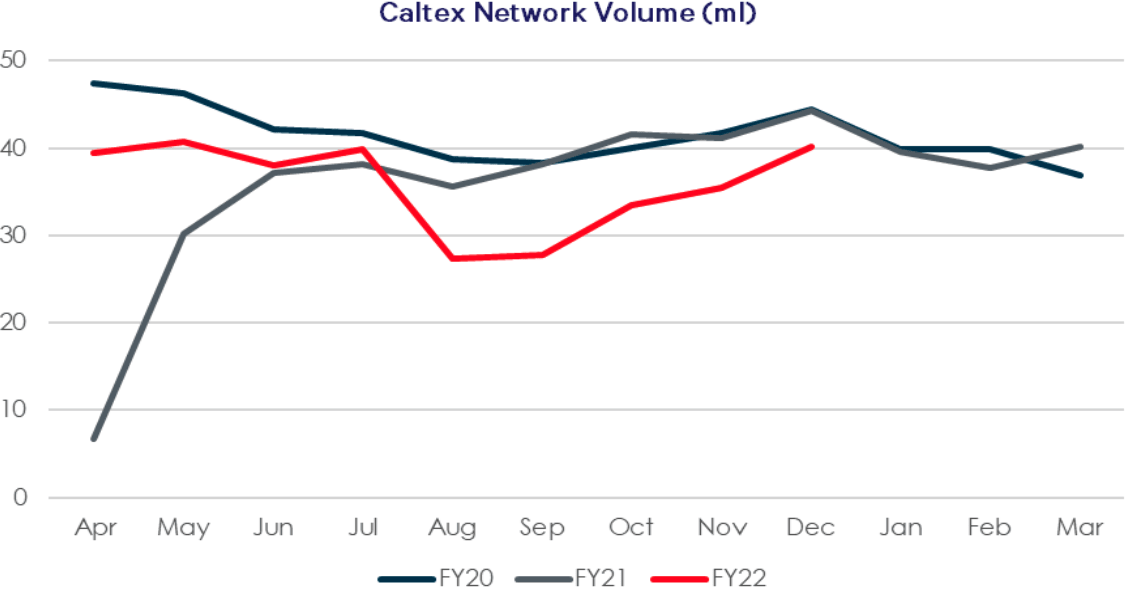

The numbers of litres pumped at Caltex service stations, which are also operated by Z, were down 14.1 percent.

"High fuel prices – like house prices – hit Kiwis who least can afford it. Come spend a few hours pumping gas with me to get good taste of how tough it is for many Kiwis just trying to put food on the table." – Jimmy Ormsby, Waitomo Group

As expected, retail volume increased in December as lockdowns were lifted and the holiday driving season started, Bennetts added, but were still slightly down on the previous corresponding period.

"This is more likely to be a consequence of record high pump prices during December than Covid-19 related factors," he admitted.

So who's right about pump profits? MBIE or the fuel companies? That was a key question investigated by the Commerce Commission, in its market study into the retail fuel market. It published its report in December 2019: it found that an active wholesale market does not exist in New Zealand, and that is weakening price competition in the retail market.

It made several recommendations for improving competition, primarily in the wholesale market, as well as recommendations to help consumers make more informed purchasing decisions. But it's only now that some of those measures are coming into force.

From February 11, service stations will be required to advertise the standard prices of all their fuel grades on their roadside price boards – not just their best deals. Baird says Z Energy has set this in place already: all Z service stations now display all fuel grades on forecourt price boards, and all but three Caltex sites.

One of the findings from the Commerce Commission's market study was that many stations didn’t display the prices of premium fuel, which made it hard for motorists to shop around and understand the prices that different fuel retailers were offering.

Commission chair Anna Rawlings says that having to display the prices of all fuels they sell will encourage retailers to compete for customers by offering a better deal at the pump and pass any savings from increasing wholesale competition on to consumers.

More importantly, the new Fuel Industry Amendment Regulations taking effect in February will also require fuel companies to report their costs, prices and sales volumes to the Commerce Commission starting this year.

"This information will help the Commission monitor and report on the competitive performance of the fuel market, including whether fuel companies are making excessive margins at the expense of consumers." – Anna Rawlings, Commerce Commission chair

The Commission will analyse that information to monitor the competitive performance of fuel markets. It's not clear how much of that information will be made public; the commission says it may publish its analysis.

And if fuel companies are shown to be acting anti-competitively, the Commerce Commission will be able to take them to court and demand penalties of up to $5 million for not complying with the regulations.

"This information will help the Commission monitor and report on the competitive performance of the fuel market, including whether fuel companies are making excessive margins at the expense of consumers," Rawlings tells Newsroom. "Having to reveal this information to the Commission on an ongoing basis improves transparency and can also help incentivise fuel companies to behave in a way that is consistent with the long-term interests of consumers."

Asked if the Commission is concerned to see importer margins contributing so significantly to price rises, at least according to MBIE's provisional data, Rawlings says she's not yet prepared to comment – "but we will regularly report on issues relevant to the information disclosed under the requirements from July this year."

She says: "The Fuel Industry Act does not directly limit the prices that fuel companies set or the profits they can earn. Rather, the Act aims to promote greater competition in the fuel market, and greater competition can be expected to deliver the right prices."

The new law also introduces a wholesale pricing regime, known as “terminal gate pricing”, requiring wholesale fuel suppliers to offer a spot price to wholesale customers at storage terminals, and rules governing contracts between wholesale fuel suppliers and their wholesale customers to allow greater contractual freedom for resellers to compare offers and switch suppliers.

Andy Baird welcomes the law changes, saying they create meaningful competition in the wholesale market. As a publicly listed company, he says they're already subject to continuous disclosure rules on both the New Zealand and Australian stock exchanges, but they will now seek Commerce Commission advice on whether they should publicly disclose additional information that is being supplied to the commission.

Will tougher regulation work?

Consumer NZ chief executive Jon Duffy says he hopes the new rules will make a difference.

The Automobile Association is more dubious. It's not convinced by the grand assurances from either the Commerce Commission or the fuel companies. Terry Collins, the AA principal adviser on motoring policy, says what's really driving down prices is not regulation, but the entry of small low-cost, low-service players into the market.

Smaller companies like Waitomo, Allied, Challenge and Gull have expanded their presence across New Zealand in the past few years, and claim to force prices lower at the big brands. That's apparent even within towns and suburbs.

In Masterton, for instance, both Mobil and Caltex have service stations at either end of town. But their petrol and diesel prices are much cheaper at their outlets at the south end, where there are also Gull, Waitomo and Pak'nSave service stations.

BP communications manager Gordon Gillan says there are a number of factors that influence the company's prices. According to the company's website, 38 percent is made up the cost to buy the product, 2 percent is international shipping, 6 percent is the carbon cost under the Emissions Trading Scheme (which is going up steadily), 44 percent is tax, and 10 percent is the retailer's operating costs and margin. That breakdown is starkly different from that reported by MBIE.

"Operating costs include the cost of storing and handling fuel, transporting it throughout New Zealand, operating our service stations' loyalty programme, employing our staff around the country and paying for all operational costs (eg rent, rates, electricity), as well as margin that reflects a return on our investment," the BP website says.

Gillan adds that some pump prices are set out of head office, though there are also a number of independent BP operators around the country who set their own prices and manage their own operations.

"We review BP Connect prices every day to ensure competitiveness in the market," he says.

"While BP independently sets a national price for company-owned stores, we can often change our prices in different locations to ensure competitiveness. This may lead to price variations even within similar geographies – a characteristic of competition at the retail level, highlighted in the findings of the 2019 Commerce Commission retail fuel market study."

Family-owned Waitomo Group likes to talk about its "Waitomo Price". Australian-owned Gull boasts of "the Gull Effect" driving down prices wherever the open up – though it should also be noted that Gull are as guilty of exploiting their market dominance as anyone else, in communities like Matakana where they have a monopoly. ($1.969 a litre for diesel, and $2.709 for regular 91 at Gull Matakana yesterday).

Waitomo Group is one company that's unafraid to speak publicly about the distortions in the market, and the importance of regulation.

Indeed, the company's managing director Jimmy Ormsby blogged on social media as early as October that fuel prices were troublesomely high. "High fuel prices – like house prices – hit Kiwis who least can afford it," he wrote. "Come spend a few hours pumping gas with me to get good taste of how tough it is for many Kiwis just trying to put food on the table."

This week, he says there's more competition in the fuel market that he's seen in 20 years – but all the companies are also facing the same challenges of higher priced fuel, and upward pressure on operating costs.

Participants are also looking at quite a bit of uncertainty ahead, he says, not only from Covid-19, but the structural reforms from the Fuel Industry Act, the Biofuels Mandate, Marsden Point refinery being closed down and replaced with an import terminal, the unwinding of the national inventory scheme where the major companies shared product, and finally Z Energy being purchased by Ampol. (Ampol, the largest fuel retailer in Australia, presently owns Gull in New Zealand but will have to divest it).

Ormsby says New Zealanders should "definitely" shop around for their petrol or diesel – but he can't resist an oblique dig at overseas-owned challengers. "Have a thought for who brings competition to the market, and support Kiwi companies that are keeping the market honest," he says.

"We reset the market in Wellington – dropped the price by 20-30 cents per litre across all brands – and then in the South Island when we opened in Christchurch and Dunedin," he claims. "This is based on our low-cost and sustainable operating model. Of course, other participants have dropped to match and retain their customers."

A just transition

The big and uncomfortable question for New Zealanders is how they reconcile the environmental harm caused by cheap fuel with the social damage wrought by high petrol prices to the most vulnerable members of the community.

Ormsby says New Zealand faces a difficult balance. "The impact of higher energy costs for Kiwis that can least afford it is what keeps me up at night," he says.

It's not just about rich and poor, but about the different impacts on different industries (farmers and tradies with their obligatory utes) and different regions of the country. A so-called just transition means ensuring the cost of reducing climate emissions does not weigh unfairly on certain communities.

"This is a social issue. Particularly in a country like ours, where – you can insert the adjective – but we're pretty rat-shit at public transport, right? So it's pretty hard if you need a vehicle to work. Auckland's a prime example where if you live in certain areas, and you've got to get to work by 7am, you need a car. And if it's a low paying job, you've potentially got a a cheaper, less fuel efficient car." – Jon Duffy, Consumer NZ

At present, small rural communities often pay less for their petrol and diesel, perhaps because they are more price sensitive, perhaps because the proprietor of the local service station is likely to be a well-known member of the community.

"Most smaller rural communities are serviced by independents like Waitomo – the oil majors exited these markets ages ago," says Ormsby.

"Kiwis are not in the habit of ripping each other, so it’s doubtful that an independent like us is not able to justify what they are charging for the investment and risk they are taking in their business, as well as the cost of providing that product to remoter areas."

Terry Collins agrees. He points to regions like Manawatū and Whanganui, or communities like Atiamuri and Gisborne, where independents Gull and Allied have often offered the lowest prices in the country. And this summer, data from pump prices app Gaspy shows the cheapest petrol and diesel could be found at the Allied service station in Burnside, outside Dunedin.

Collins argues that these low prices are a result of the operators' connections to the local community – as contrasted with places like Dominion Rd in central Auckland. There, it's less about personal connection and more about providing a full range of services, like espresso coffee and toilets, to commuters who may be less price sensitive.

That's of little consolation to those struggling to get by, especially those living in expensive cities like Auckland and Tauranga.

Jon Duffy says: "This is a social issue. Particularly in a country like ours, where – you can insert the adjective – but we're pretty rat-shit at public transport, right? So it's pretty hard if you need a vehicle to work. Auckland's a prime example where if you live in certain areas, and you've got to get to work by 7am, you need a car. And if it's a low paying job, you've potentially got a cheaper, less fuel efficient car."