With a market cap of $133 billion, Comcast Corporation (CMCSA) is a global media and technology company. Headquartered in Philadelphia, Pennsylvania, the company operates through Residential Connectivity & Platforms, Business Services Connectivity, Media, Studios, and Theme Parks segments.

The multinational mass media corporation is expected to unveil its fiscal Q1 2025 earnings results before the market opens on Thursday, Apr. 24. Ahead of this event, analysts expect CMCSA to report adjusted earnings of $0.98 per share, down 5.8% from $1.04 per share in the same quarter last year. However, it has surpassed Wall Street's bottom-line estimates in the past four quarters. In Q4 2024, CMCSA exceeded the consensus EPS estimate by 9.1%.

For fiscal 2025, analysts expect CMCSA to report adjusted EPS of $4.30, a marginal decline from $4.33 in fiscal 2024. However, adjusted EPS is projected to rebound and grow 10.5% year-over-year to $4.75 in fiscal 2026.

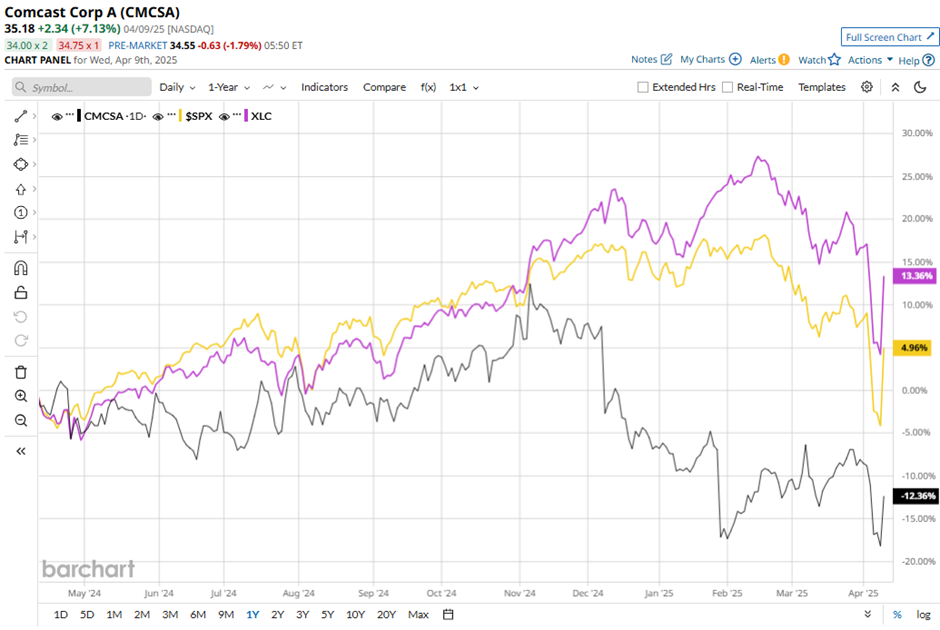

CMCSA stock has slumped 12.4% over the past 52 weeks, lagging behind both the S&P 500 Index's ($SPX) 4.7% gain and the Communication Services Select Sector SPDR ETF Fund’s (XLC) 13.5% surge over the period.

CMCSA shares slid 11% on Jan. 30, even after the company delivered stronger-than-expected Q4 2024 results. Q4 results came in ahead of expectations, with the company reporting an adjusted EPS of $0.96 compared to the estimated $0.88. Revenue also topped forecasts, reaching $31.9 billion against a consensus of $31.6 billion. Comcast ended the quarter with 51.6 million customer relationships in Connectivity & Platforms, down 58,000 sequentially due to a fall in domestic customers.

Analysts' consensus rating on Comcast stock is moderately optimistic, with a "Moderate Buy" rating overall. Out of 30 analysts covering the stock, opinions include 16 "Strong Buys" and 14 "Holds." Its mean price target of $42.92 suggests a 22% upside potential from current price levels.

.jpg?w=600)