Navigating what he described as the most competitive broadband market he has ever seen, Dave Watson, chief executive for the cable side of Comcast’s business portfolio, believes investor focus should remain on Comcast's stable revenue picture, and not the currently volatile visage of customer additions.

“Our No. 1 focus is growing revenue,” Comcast Cable president and CEO Watson said Tuesday, while appearing in Boston at the JP Morgan Media and Communications Conference. (A full audio playback is available here.)

Also read: U.S. Broadband Customer Growth Slows to Pre-Pandemic Levels in Q1, With Every Sector Losing Steam

It has been noted by equity analysts for some time that Comcast has the data to back up this narrative.

Also read: Comcast Prices StreamSaver Bundle at $15 a Month

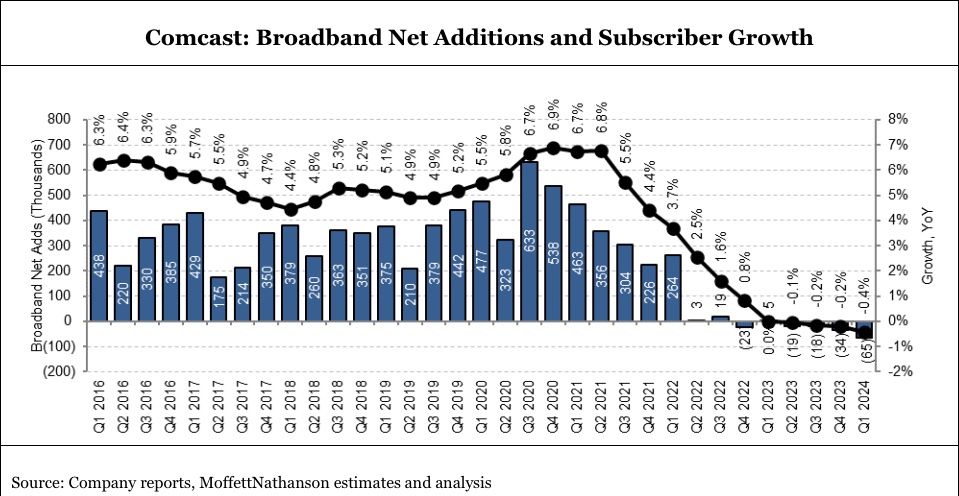

Amid a toxic milieu of increased competition from fiber and fixed wireless, combined with the slowing creation of new households, Comcast’s broadband customer growth — once so robust during the pandemic — has reached negative quarterly terrain. The company lost 65,000 high-speed internet users in the first quarter.

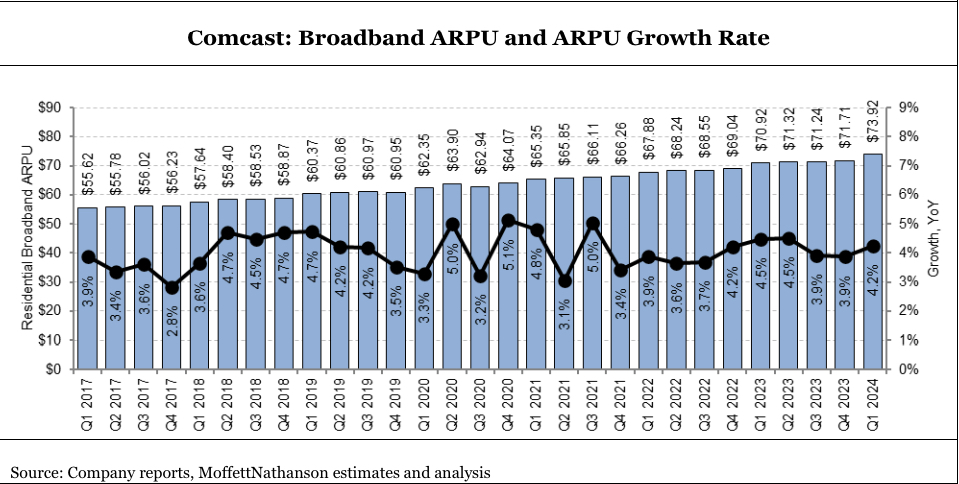

For Comcast, however, there has been no significant corresponding decline in average revenue per broadband customer, which was 4.2% in Q1.

That represented a slight drop versus the 4.5% reported for the first three months of last year, but fits the “3-4%” range Watson referenced several times during Tuesday’s JP Morgan sitdown.

“We've been focused on the value between volume and rate,” said Watson, who played up the importance of market segmentation.

On the higher end of that spectrum, Watson said that by the end of 2024, 50% of his company's footprint will be covered with the labor- and cost-intensive process of conducting “mid splits” of optical nodes, a process necessary to integrate multi-gig symmetrical broadband service via Full Duplex DOCSIS 4.0 conducted over a virtualized network.

Watson said this capital-intensive upgrade is the best response to fiber-to-the-home, which he believes poses Comcast's greatest long-term competitive threat.

On the low end, he believes the company’s recently introduced Now Internet and Now Mobile prepaid services are a solid hedge amid the sunsetting of the Affordable Communications Act, which he also believes will further cut into broadband growth over the coming quarters as less well-off customers see their subsidies disappear.

"We are competitive in every segment,” Watson said, reiterating that Comcast “feels confident“ it will be able to maintain its 3-4% quarterly ARPU, regardless of the market circumstance.