It’s early Sunday morning, and the silence of a long week is broken by the sound of Mr. Smith’s cell phone on his nightstand. It’s the hospital calling about his daughter, who has been injured and is in intensive care.

Mr. Smith rattles off question after question about how his daughter is doing with only vague generalities in response. The attending doctor asks whether Mr. Smith happens to have a HIPAA authorization or health care surrogate for his daughter. Mr. Smith ignores the question and repeats his concerns about his daughter’s injuries. The doctor continues to skirt around the issue and go back to what seems to be an unnecessary discussion about legal documents. How could this be?

Legal Matters

A lot of changes when your child turns 18 and heads off to college. Going out on their own is a huge stepping stone in achieving individuality, but what most parents and students don’t realize is that there are huge legal changes that take place when your child becomes an adult.

When your child turns 18, you can no longer make legal decisions for them or retrieve information about them that is considered private without their written permission. And unfortunately, there isn’t just one single legal document to address this problem. In fact, there are four critical documents that every adult should prepare. These key legal instruments can help to ensure that any unexpected circumstances your family faces can be a little less burdensome.

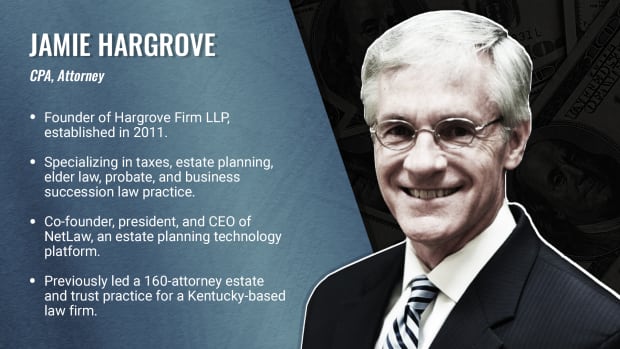

BIO| Jamie Hargrove, CPA, Attorney

Healthcare Power of Attorney

Also known as a healthcare proxy, this document gives parents the ability to make decisions about their child’s healthcare. If a student goes to school out of state, it’s prudent to have a healthcare power of attorney from both states, since some healthcare professionals may be hesitant to accept an authorization form they don’t recognize.

HIPAA Authorization

This document allows healthcare professionals to share a student's otherwise confidential healthcare information with the person or persons the student desires.

Living Will Declaration

Sometimes called an advanced care directive, the living will declaration is a critical document that, according to a 2020 Gallup poll, fewer than half of the U.S. adult population possesses. This essential document does the following:

- Tells physicians and medical teams, as well as family members, how a patient wants medical care handled in a critical situation. It specifies the patient’s values and what’s important in treatment, especially when conditions are life-threatening.

- Protects patients from unwanted and, in some cases, an unnecessary medical intervention which may only prolong death and can result in continued pain and suffering.

Financial Power of Attorney

When parents wish to help manage their child’s finances, this document can authorize them to do so. It allows parents to act on a child’s behalf in all financial matters. A financial power of attorney can be useful in many situations. For instance, if a student has an accident or falls ill, leaving him or her either temporarily or permanently unable to make financial decisions, a designee can step in to manage bank accounts, file tax returns, make loan payments, and so on.

As mentioned earlier, a lot changes when your child turns 18 and heads off to college. Even if your child has little or no assets, there are healthcare and financial decisions that need to be made and documented. So pack your student’s bags, load up the car, fly the school banner, and call your lawyer.

Taxes, taxes, taxes

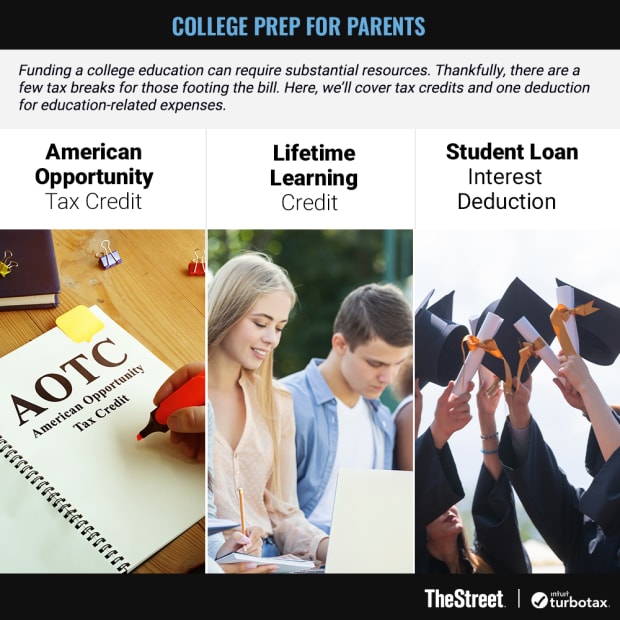

Funding a college education can require substantial resources. Thankfully, there are a few tax breaks for those footing the bill. Here, we’ll cover tax credits and one deduction for education-related expenses.

American Opportunity Tax Credit (AOTC)

A tax credit of up to $2,500 is available per eligible student per year beginning in the tax year 2021 for qualified education (QE) expenses. The credit is for 100% of the first $2,000 in QE expenses and 25% of the next $2,000 in QE expenses. You can qualify for the credit if your 2022 modified adjusted gross income (MAGI) is $90,000 or less ($180,000 or less for married filing jointly). (For most people, MAGI is simply their adjusted gross income.)

Also, unlike the LLC discussed below, a portion ($2,000 of the $2,500) of the AOTC is a refundable credit. That means if you don’t owe any taxes, you can get up to $2,000 of the AOTC refunded to you. Yep, that means Uncle Sam sending you a check. Nice!

It is important to note that there is a four-year maximum limitation per eligible student (including any years of the former Hope credit claimed).

Lifetime Learning Credit (LLC)

While the AOTC is targeted toward undergraduate education, the LLC is directed toward both undergraduate and graduate education and for courses to acquire or improve job skills that are not a part of the AOTC. Here are some other differences:

- AOTC has a four-year limit per student. The LLC has no time limits.

- AOTC requires at least half-time enrollment whereas the LLC can be for a single course.

- AOTC has a refundable credit while LLC does not. So, the LLC can only offset taxes due.

- For tax year 2022 the MAGI phase-out range for AOTC and LLC are the same ($90,000 or less for single and $180,000 or less for married filing jointly). To receive the full credit (no phase-out), the amounts are $80,000/$160,000.

- The AOTC is per student, while the LLC is per taxpayer.

While there is no “double dipping” with the two credits, you can use the credits on the same return as long as they are not for the same expenses and the same student. So, you may use the AOTC for expenses for a child going into her freshman year of college while you utilize the LLC for expenses related to an online graduate course of your own, for example.

Student Loan Interest Deduction

Even well after a student has walked across the graduation stage, student loan payments can be a substantial budget line item. If you are paying interest on a student loan, you may be able to deduct up to $2,500 of your interest expense per year. The phase-out based on MAGI starts at $70,000 and is eliminated at $85,000 for single filers ($145,000 - $175,000 for married filing jointly filers).

This student loan interest deduction cannot be used for either AOTC or LLC. But just like you can take advantage of both an AOTC and LLC on the same return, you can also take an interest deduction on your student loans.

In addition to the tax credits and deductions available, it’s also prudent to consider maximizing tax benefits by planning for educational expenses early and setting aside funds to invest with tax-free earnings in qualified plans (such as 529s or Coverdells). Even if you’re planning to support a grandchild’s education, for example, the tax savings possible by setting aside funds well in advance with qualified plans will easily eclipse the tax credits from funding for education expenses as they’re incurred.

One of the most rewarding experiences for a parent is sending your child off to college after years of preparation. While this can be an exciting time for parents and students alike, knowing what legal changes to expect can help your family be ready for unexpected circumstances of many kinds. Similarly, tax incentives for such a meaningful investment in a child’s future can lessen the financial burden. As with many major life events, the advice of your family’s financial planner, accountant, and attorney can guide you through this transition.

Read More From Our Partners at TurboTax:

- About Student Loan Tax Deductions and Education Credits

- How to Report FAFSA College Money on a Federal Tax Return

- Take Advantage of Two Education Tax Credits

- Guide to Tax Form 1098-T: Tuition Statement

Editor's Note: The opinions expressed in this article are those of the authors. The content was reviewed for tax accuracy by a TurboTax CPA expert.