The story in crypto has been decisively bearish in 2022, although that’s not unusual given the state of the stock market.

The Nasdaq has now suffered a larger peak-to-trough decline than it did during the covid-19 selloff in Q1 2020, while bitcoin is hitting multi-year lows and suffering through one of its largest declines.

While bitcoin continues to break down (and is potentially coming into a major support zone), Coinbase (COIN) has one positive viewpoint: It hasn’t made new lows on the move.

Put another way, while cryptocurrencies and U.S. stock markets are making new lows, Coinbase surprisingly isn’t. That's even after this morning's news, which includes a downgrade, job cuts and a warning from the CEO regarding a "crypto winter."

That shouldn’t dull the reality, which is that the stock is down 88% from its all-time high, and at the low it had suffered a peak-to-trough decline of more than 90%.

But at the moment one piece of good news is better than none.

Trading Coinbase Stock

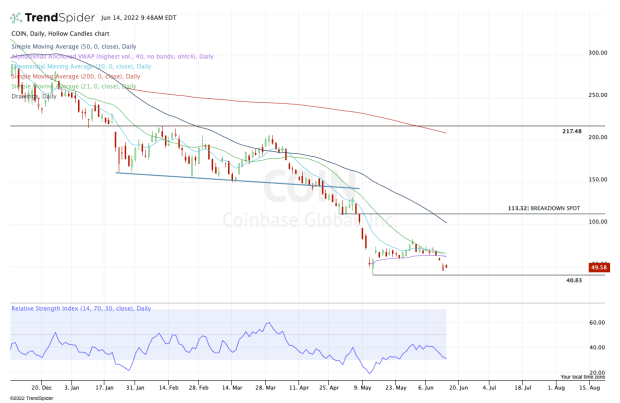

Chart courtesy of TrendSpider.com

And even so, we can't lose sight of the fact that the one small positive that Coinbase stock has going — that it hasn’t made new lows against a backdrop of new lows in crypto and stocks — could be gone in an instant.

That would happen if it traded below the $40.83 mark, which it hit last month.

Although it traded lower in five straight sessions coming into Tuesday, it continues to cling to the $50 area. But a break of Monday’s low (and so far, this week’s low) at $46 could open the door down to the all-time low.

If that’s the case, then the bulls need to be on the lookout for a potential reversal. That’s especially true as bitcoin and ethereum hover near support.

Short of a break below $40.83 and a reversal higher, the bulls must be careful with Coinbase stock at or below this level. Even though it would be down by roughly 90% from the highs, that doesn’t mean it can’t get worse from here.

On the upside, a number of potential resistance zones show up, but none are more immediate than $63 to $66. In this zone, Coinbase stock finds its 10-day and 21-day moving averages, along with the daily VWAP measure.

If it can clear this zone, then the $83.32 level is in play — the high on May 31 — followed by a potential push to $100 and the 50-day moving average.

I know that a rally to this area sounds crazy -- and maybe right now it is.

But the reality is that Coinbase stock could double from current levels to $100 and still be down 76.6% from the high, 60% year to date and 33.3% from the first-quarter low.

That puts in perspective just how much pain this stock has endured.