When Coinbase (COIN) reported earnings on Tuesday after the close, the stock initially popped higher and the gains faded.

Then at one point in Wednesday's regular session, the shares were up 9.1% -- and again the sellers stepped in. At last check the stock of the crypto-services provider was down about 4%.

Don't Miss: Here’s Where Home Depot Stock Has Support Amid Earnings Selloff

The decline comes as the company “posted a surprise fourth-quarter loss amid a slump in crypto dealing volumes,” as previously reported by TheStreet.

And the drop is not that surprising when we look at the numbers. Trading volume fell 73% year over year in the fourth quarter, while revenue fell almost 75%. Further, the company lost more than $550 million in the quarter.

Despite the recent rally in bitcoin and even as Cathie Wood’s Ark has been a buyer of Coinbase stock, the shares are struggling for upside.

Trading Coinbase Stock on Earnings

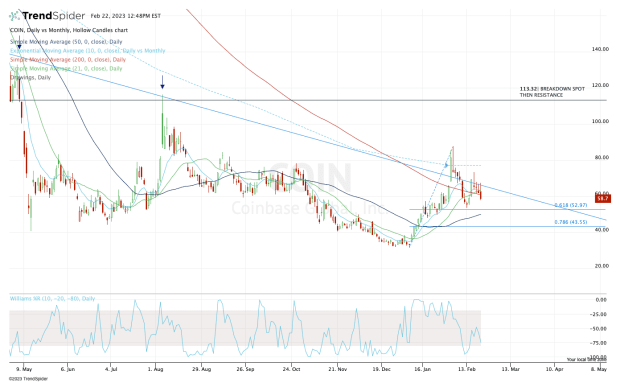

Chart courtesy of TrendSpider.com

Coinbase stock has had a brutal stretch, suffering a peak-to-trough decline of 92.5%. The low was made in late December and for a moment in 2023, Coinbase was enjoying a huge rally, nearly tripling (up 175%) at one point.

Now the stock is back under pressure, and the bulls must be disciplined and control their risk. That means stopping out when their stops are hit and protecting some of the big gains they've seen to start the year.

Right now the shares are breaking below the 10-day, 21-day and 200-day moving averages. As the stock loses the $60 level, traders may notice that it was never really able to power through downtrend resistance (blue line).

On the downside, keep a close eye on the February low near $53.50, as well as the 61.8% retracement near $53.

Ideally, Coinbase stock will find some support in this area, particularly with the 50-day moving average just below, near $50.

Should all these measures break, the shares could be heading back down to the 78.6% retracement, near $43.50.

On the upside, keep it simple. If the stock recoups above $67, it moves above recent resistance and the post-earnings high, as well as the 10-day, 21-day and 200-day moving averages.

In that scenario, the bulls would be back in control, putting $75 back in play, potentially followed by $85.

.jpg?w=600)