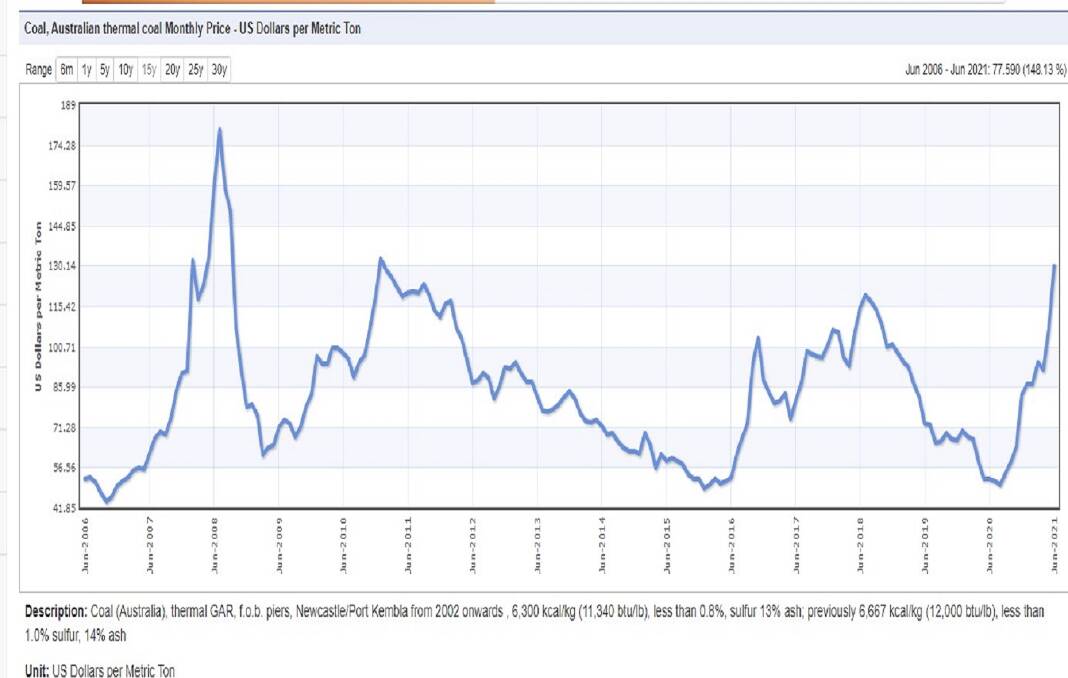

TOP quality Newcastle coal selling for less than $US50 a year ago is bringing more than $US150 a tonne on the spot market, according to the latest market figures in the weekly Australian Coal Report.

The steeply rising prices are approaching the July 2008 spike when Newcastle thermal coal bound for Asia briefly rocketed to $US180 a tonne before falling to $US60 in March 2009.

Prices peaked at $US130 a tonne in January 2011, then bottomed in January 2016 at under $US50.

They rose again to $US120 in July 2018 before falling to their July 2020 low.

The heavy demand indicates the Chinese ban of Australian coal has had little impact.

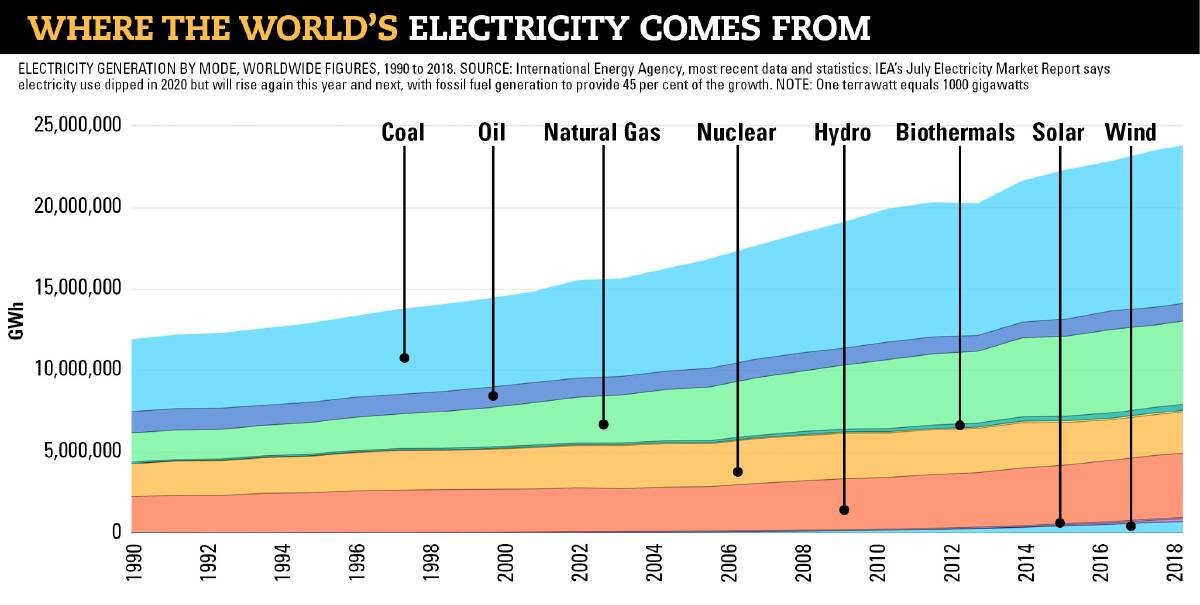

Big growth in power demand was detailed by the International Energy Agency in its July Electricity Market Report, which said: "Despite record additions of renewable generation capacity, fossil fuel-based generation and associated emissions are rising along with electricity demand.

"The electricity sector sits at the centre of the net zero pathway, requiring rapid and deep decarbonisation even as electricity demand grows more than 2.5 times, partly due to massive electrification of end-uses now served by fossil fuels."

The agency put global power use at more than 25,000 terrawatt-hours of electricity last year, with China accounted fora accounting for more than 7000 terrawatt-hours and the United States next on about 4000 terrawatt-hours.

Australia is in about 18th position, globally, consuming about 250 terrawatt-hours. Agency data shows we use about twice as much power, per person, as China, but less than the US.

The July report says power demand is expected to rise by almost 10 per cent between 2020 and 2022, with coal and gas providing about 45 per cent of the extra electricity.

On new capacity in China, it says: "This means that for 2021 and 2022 combined, absolute coal-based electricity generation is growing faster than all renewables combined."

The Australian Coal Report says coal price rises have been so steep that some customers for Australian coal are booking profits by on-selling contracted cargoes into "a frenzied spot market".

Iron ore and steel prices are also up substantially, with Australian profits magnified because the $A has remained at about $US0.75 or less.

Historically, the Aussie tended to rise with commodity prices, cancelling out some of the increases for commodities sold in US currency.

Iron ore is above $US200 a tonne and above its 2011 and 2008 peaks.

READ the full IEA report here