Garment industry mogul Arthur “Artie” Rabin, an early investor in the Brooklyn Nets who sold his massive Hamptons estate last year for just under $120 million, claims he was improperly stripped of nearly 30 million rewards points — reflecting many millions of dollars in spending — after Citibank “unceremoniously dumped” him as a client.

Rabin is now asking a judge to reverse Citi’s “draconian action of unilaterally closing [his] credit card account,” and force the financial services giant to restore the 29,891,963 ThankYou points he managed to earn over the course of a decade.

In a lawsuit filed Thursday and obtained by The Independent, Rabin says Citi has since refused to budge since it kicked him to the curb in August. The card had a credit limit of $2 million, and Rabin, who has been a Citi Prestige cardholder since 2015, used it for between $200,000 and $300,000 worth of purchases every month, according to the suit. Citi broke a series of consumer protection laws by declaring Rabin’s points null and void, the lawsuit alleges, “all to his extreme prejudice and embarrassment.”

“We certainly regret any inconvenience or difficulty you may have experienced with the closure of your above-referenced account and the loss of earned ThankYou points,” Citi told Rabin in a letter last month, emphasizing with finality that his points “were forfeited at the time of closure.”

On Friday, Larry Hutcher, Rabin’s attorney in the matter, described Citi’s conduct toward his client as “abhorrent.”

“Citibank’s arbitrary decision to simply termninate Mr. Rabin’s account, and, in essence, steal 29 million points from him is abhorrent and beyond unfair,” Hutcher told The Independent. “We are going to pursue this in order to ensure that he receives everything to which he is entitled. If they can get away with taking someone’s 29 million points, they can do it to anyone, at any time. So, we feel this is an important issue to address.”

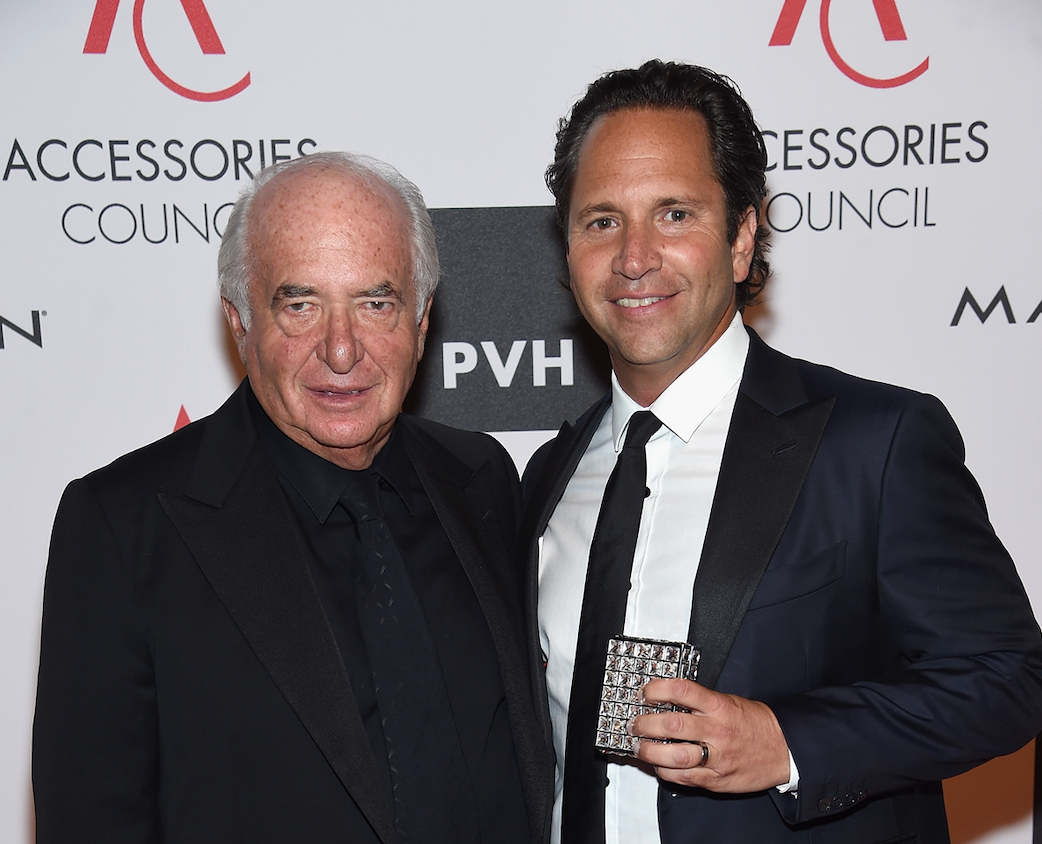

Rabin’s suit calls him “a substantial and highly successful businessman,” which may in fact undersell his position in the world of the One Percent. When former Brooklyn Nets star Jason Kidd was inducted into the NBA Hall of Fame, he said in his acceptance speech that Rabin, who in 1972 founded Wear Me Apparel, was “like a dad to me.” Rabin has close ties to Bill and Hillary Clinton, and was behind the launch of Beyoncé’s first fashion line. His son Jason, who now runs the family business, owns a home on Fisher Island, the private South Florida enclave known as the fourth-richest zip code in the United States.

Citi’s ThankYou Rewards program is one of the “most valuable around,” noting its partnerships with 17 airlines and hotels, Rabin’s lawsuit says. It concedes that under the ThankYou Rewards terms and conditions, if Citi closes someone’s account for any reason other than inactivity, the cardholder’s points “are immediately lost ‘unless prohibited by law.’”

About a year ago, Rabin spotted $30,000 or so in unauthorized charges on his account statement, which Citibank promptly reversed, according to the suit. From then on, when bogus charges periodically appeared, Rabin would notify Citi, the card would be canceled, the charges reversed, and Rabin would be issued a new card, with a new account number, “to prevent further fraud,” the lawsuit states.

“However, in a classic case of blaming the victim, Citibank has now rejected a number of these disputes, even though the amount at issue (approximately $150,000) is a drop in the bucket compared to the amounts that Mr. Rabin has spent on the card on an annual basis since 2015,” the suit goes on.

Instead of performing a “reasonable investigation” of the disputed charges as required by law, Rabin contends in the suit that Citi “has taken the erroneous position that Mr. Rabin authorized the disputed transactions and has taken the draconian action of unilaterally closing Mr. Rabin’s credit card account and declaring his over 29 million ThankYou® Points to be entirely forfeited.”

“Meanwhile,” it continues, “Citibank continues to bill Mr. Rabin for the balance reflected on the account statement, including the unauthorized charges plus interest.”

The crux of the lawsuit can be traced back to early August, when Citi notified Rabin it would not reverse a disputed charge of $8,600. A day after that, Rabin’s suit says he received two more letters from Citi, identical but for the amounts in question, which now totaled $151,887.63. A fourth letter, which the lawsuit says arrived two days later, informed Rabin that his account had been closed and his ThankYou points mothballed “[b]ecause you were not able to” keep it secure.

“Transactions can no longer be made on this account, and any cards associated with it should be destroyed immediately,” the letter stated. “Please be aware you’re still responsible for any remaining balance."

Rabin appealed the closure, pointing out that whoever used his card used various email addresses that weren’t his, and asked Citi to reinvestigate his claim. That’s when Citi dug in its heels, according to the lawsuit, telling Rabin that it was sorry he lost his ThankYou points but that its “position remains unchanged.”

“[W]e’re unable to reinstate your account due to the number of times it was closed within the last several months due to a lost/stolen card or unusual activity,” the denial letter said. “... The frequent security closures on your account within a short period of time are cause for concerns and could lead to additional financial loss to Citibank. We respectfully decline to provide 29,891,963 ThankYou points earned on the above-referenced account because they were forfeited at the time of closure.”

Rabin’s suit accuses Citibank of having violated New York State banking laws, and seeks an injunction directing Citi to “restore and activate [Rabin’s] 29,891,963 earned ThankYou® Points for a period of at least ninety (90) days,” or pay him the $300,000 he says they’re worth, at a stated equivalent cash value of $0.01 per point, according to Citi’s terms and conditions.

“Any reasonable investigation of the unauthorized charges would have resulted in their permanent removal from Plaintiff’s account, rather than the closure of the account and the forfeiture of over 29 million ThankYou® Points,” the lawsuit argues.

Rabin is also demanding the $151,887.63 in allegedly fraudulent charges to be wiped out, along with at least $600,000 in punitive damages.

A Citibank spokesperson declined to comment.