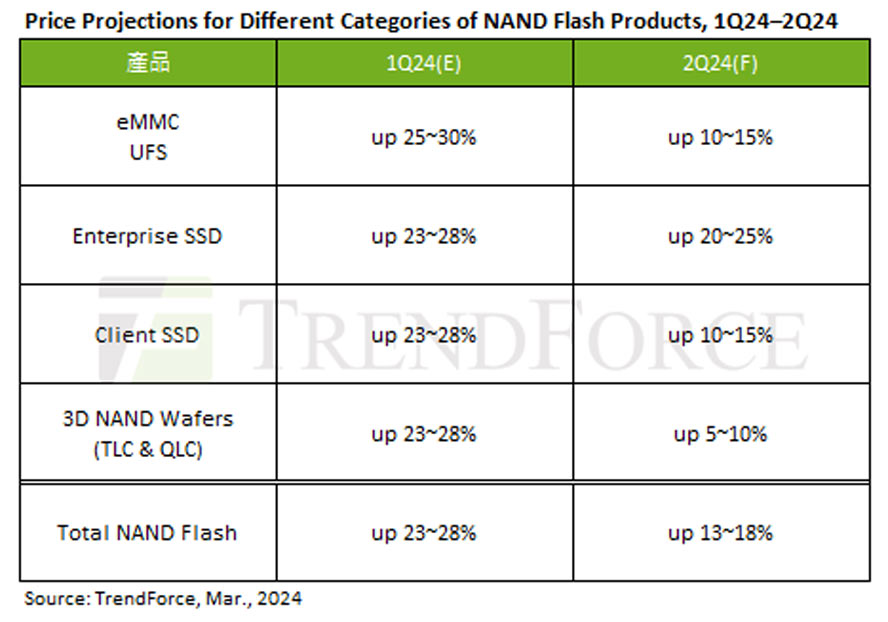

IT market intelligence firm TrendForce has published its latest price trend projections for the NAND flash market. According to its report, Q2 2024 will see further double-digit NAND flash contract price increases, compounding the increases from the previous quarter. However, client SSDs will be up a maximum of 15% in Q2, it says, which is an improvement on the 23-28% rise seen in Q1 2024.

The TrendForce chart above gives an overview and comparison of NAND Flash product price trends covering Q1 (estimate) and Q2 (forecast) this year. The table shows figures for mobile NAND-based products (eMMC and UFS), client and server SSDs, and the NAND flash wafers these products are based upon.

Q1 2024 has been pretty bad for enthusiasts looking to snap up some SSD storage on sale. Pricing across the segment has risen by 23-28% according to TrendForce research estimates, an increase that could add $100s to your PC build or upgrade plans.

Prices aren’t going to settle or go into reverse during Q2 2024, says TrendForce. Instead, we could see a further 10-15% of compounded price increases from now until the end of June.

You will notice from the chart that the client SSD price increase is outpacing that of the key 3D NAND wafers. TrendForce explains that the SSD prices have been negatively impacted by factors such as SSD maker buying strategies, a decline in associated product sales, and a lack of stockpiling in recent months.

Turning to an influence on client SSD pricing and the market as a whole, TrendForce asserts that Kioxia and WDC have boosted their production capacity utilization rates from Q1. However, other major players have been conservative with production strategies.

Things could have been worse for client SSDs. Enterprise customers will face the worst Q2 2024 price increases, according to the predictions of TrendForce analysts. The reasons behind the projected 20-25% increase in enterprise SSD prices in the current quarter are varied. The main contributors to the increases are thought to be the continued strong demand from US and Chinese communications service providers, unfulfilled demand for large-capacity products, and expectations that some will try and build inventory in Q2.

Buyers of eMMC and UFS storage products will see a similar 10-15% compounded price increase in Q2, according to the research.