Cisco Systems (CSCO) was hit hard in after-hours trading on Wednesday, falling nearly 20% after it reported earnings and the stock market had its worst trading session of 2022. At last check the telecom-equipment giant was off 15%.

Clearly Cisco is facing some headwinds, but did it really deserve that sharp a reaction?

Earnings of 87 cents a share beat expectations by a penny, but revenue came in below analysts’ expectations. The company also issued a disappointing outlook after “taking into account the revenue impact of the war in Ukraine and the continuing uncertainty related to the China covid lockdowns."

Even with today's small recoup from after-hours trading yesterday, investors are hesitating to invest in Cisco stock.

And of course, it's just the most recent stock to be battered after a disappointing quarterly result, trailing, for example, retail reports from Target (TGT), Walmart (WMT) and others.

Trading Cisco Stock

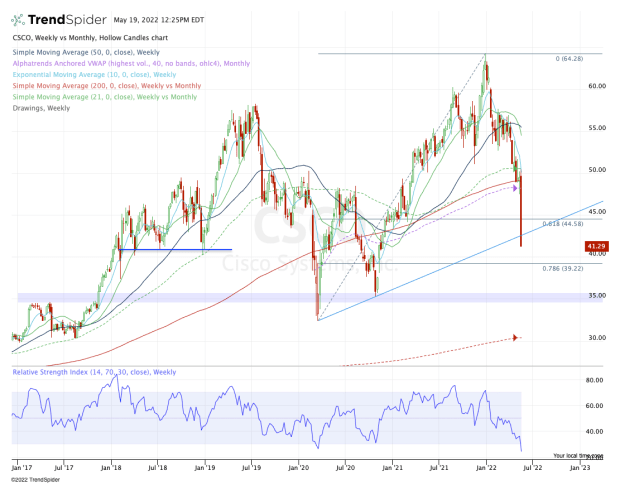

Chart courtesy of TrendSpider.com

The shares are currently in no man’s land.

Previously, the stock was holding in around the $50 area. Although it was struggling with some key areas, it was also holding the 200-week moving average and the monthly VWAP measure.

With today’s drop, though, those levels are out the window. Short of an afternoon bounce ahead of the close, Cisco stock will also close below the 61.8% retracement and looks likely to finish below uptrend support (blue line).

If it can reclaim this arbitrary measure — it’s just a trend line, after all — then the 61.8% retracement could be back in play. That’s far from a high-conviction trade.

Otherwise, a dip down into the $39 to $41 area gives us a little better risk/reward balance. For starters, this was a previous support area before the volatile action in 2020 that stemmed from covid-19. It’s also where the 78.6% retracement comes into play.

Should this area fail as support, our attention shifts to the $35 zone. Below that and we’ll have to focus on the covid-19 low and the 200-month moving average.

While Cisco stock is down big, the technicals don’t point to a lot of nearby support.

So the stock needs to either reclaim a key level — thus giving us a low to measure against while aiming for more upside — or it needs to decline further to a better risk/reward zone.