Chen Nanxiang, the head of Chinese 3D NAND champion Yangtze Memory Technologies (YMTC) that got into the U.S. trade blacklist late last year, asked producers of wafer fab equipment to buy back tools the company cannot use. In his keynote speech at Semicon China conference he also warned that the global semiconductor industry is entering an era of turmoil and disarray due to increasing geopolitical tensions.

Buy It Back

According to Bloomberg, Chen Nanxiang, chairman and CEO of YMTC, gave a speech in Shanghai, China, that directly addressed machine suppliers, and how they should buy back the legally purchased equipment and components if they cannot be used.

While many companies are slowing down spending on wafer fab equipment these days, makers of chip production equipment have huge backlogs, so selling off fab tools may not be a problem for YMTC, if it really wants to get rid of them.

YMTC got hit by the U.S. government twice last year. In October, YMTC was blocked from acquiring wafer fab equipment (WFE) with American technology necessary for producing 3D NAND with 128 or more layers as part of the broad sanctions imposed by the U.S. government on the Chinese semiconductor industry. The restrictions also oblige U.S. citizens to obtain a license from the U.S. Department of Commerce to support development or production of said memory devices in China. As a result, four prominent chipmaking tool companies — ASML, Applied Materials, KLA, and Lam Research — ceased their work with YMTC due to the requirement of obtaining relevant export licenses from the DoC.

In December, YMTC got into the U.S. DoC Entity List and can no longer procure equipment, software, and other technologies from U.S.-based companies (or other companies selling technologies developed in America) — unless the latter secure a special export license from the DoC. Such export licenses are reviewed with a presumption of denial.

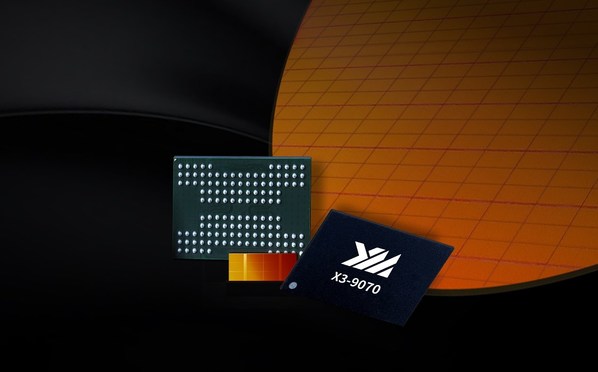

As a result of the two hits, YMTC cannot obtain, install, and use the latest tools it acquired from WFE producers that it needed to make 232-layer 3D NAND, a type of memory that could power some of the best SSDs with a PCIe 5.0 interface. Furthermore, the company has troubles servicing its existing tools. Some analysts believe that Yangtze Memory might have to abandon production of 3D NAND and turn itself into maker of specialty 2D NAND or even a contract chipmaker.

Turmoil and Disorder

Chen stated that globalization is effectively dead, and the previously established rules, balance, and harmony have been disrupted. This shift is predicted to greatly impact the supply chain, industry practices, and business models. The head of YTMC believes that key aspects of globalization such as competition, innovation, and the free movement of talent and resources have been affected.

According to reports via Nikkei, Chen believes that globalization is dead and that government interventions and that existing rules and past balances are now broken. Chen continues, stating that the semiconductor industry could see a period of turmoil. A period which could see a tremendous and profound impact on the supply chain and industry practices.

The chief executive and chairman of the troubled 3D NAND maker highlighted the importance of global cooperation in the semiconductor industry. He emphasized that the complex chip supply chain involves 25 countries and has indirect ties with another 23.

Chen also indicated that semiconductor markets in China and the U.S. — which benefited from contributions from foreign investors and inventors — do not solely belong to their respective countries, but are global assets. Similarly, he brought example of NAND flash memory, which was invented by Toshiba in Japan back in the 1980s, and which is perfected by South Korea-based Samsung and SK Hynix.