Transcript:

Conway Gittens: I’m Conway Gittens reporting from the New York Stock Exchange. Here’s what we’re watching on TheStreet today.

Wall Street is keeping a watchful eye on energy prices. Oil is trading higher Monday after the Bashar al-Assad regime was toppled in Syria. Investors are wondering how this might shake-up geopolitics in the oil-rich Middle East.

In other business headlines, a battle for dominance in the semiconductor world is heating up between China and the United States.

Related: Nvidia stock reacts to China's latest shot in the technology trade war

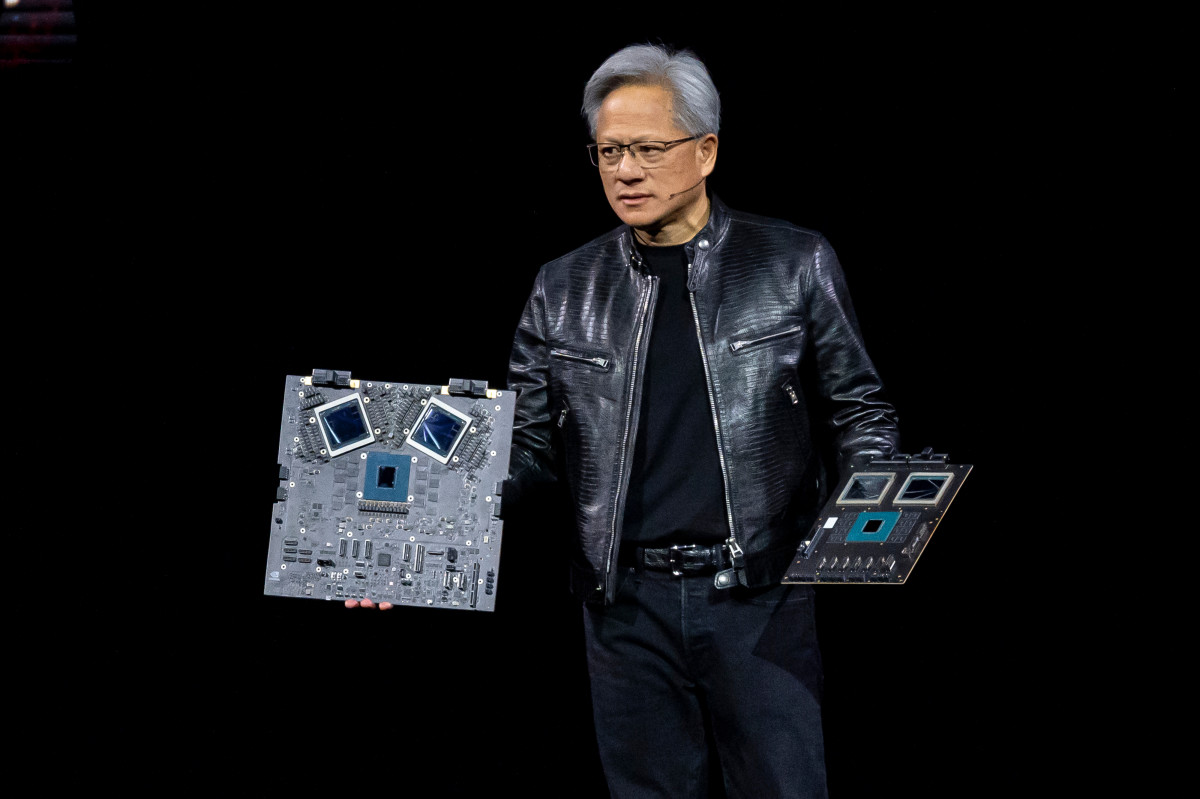

China has opened an investigation into Wall Street AI chip darling Nvidia (NVDA) for possible anti-competitive practices. The probe, while not specific, revolves around Nvidia’s purchase of an Israeli company called Mellanox. Chinese authorities claim the deal could be a violation of its anti-monopoly laws.

Nvidia, right now, is arguably the most-visible leader in the battle to supply chips for artificial intelligence. It is dominating the market and is seen as a symbol of American innovation. For that reason, Beijing may see Nvidia as a pawn in a long-running battle with the U.S. over which country will lead the AI revolution.

In December, the outgoing Biden Administration pushed through a third round of Chinese sales restrictions. Washington has expressed deep concern that Beijing may use AI chips to gain a military advantage. There are also concerns China could be trying to steal vital AI software. China has retaliated by banning exports to the U.S. of certain raw materials that are used to make semiconductors.

That’ll do it for your Daily Briefing. From the New York Stock Exchange, I’m Conway Gittens with TheStreet.

More on Big Tech: