China has announced new export controls on antimony, a metal used in semiconductor manufacturing, starting September 15, 2024. From now on, exports of antimony in all forms require government approval, which could impact global markets, as China supplies nearly half of the world’s antimony, according to DigiTimes.

The new regulations will cover various antimony-related products, including raw ore, metal, and compounds like antimony oxides and hydrides. They also extend to high-tech materials used in semiconductor production, such as indium antimonide, ultra-hard materials, like synthetic diamonds and cubic boron nitride, and the technology needed to produce them.

Antimony’s significance lies in its unique properties, which make it essential for producing hardened alloys used in weaponry and a key component in semiconductors, displays, and flame retardants.

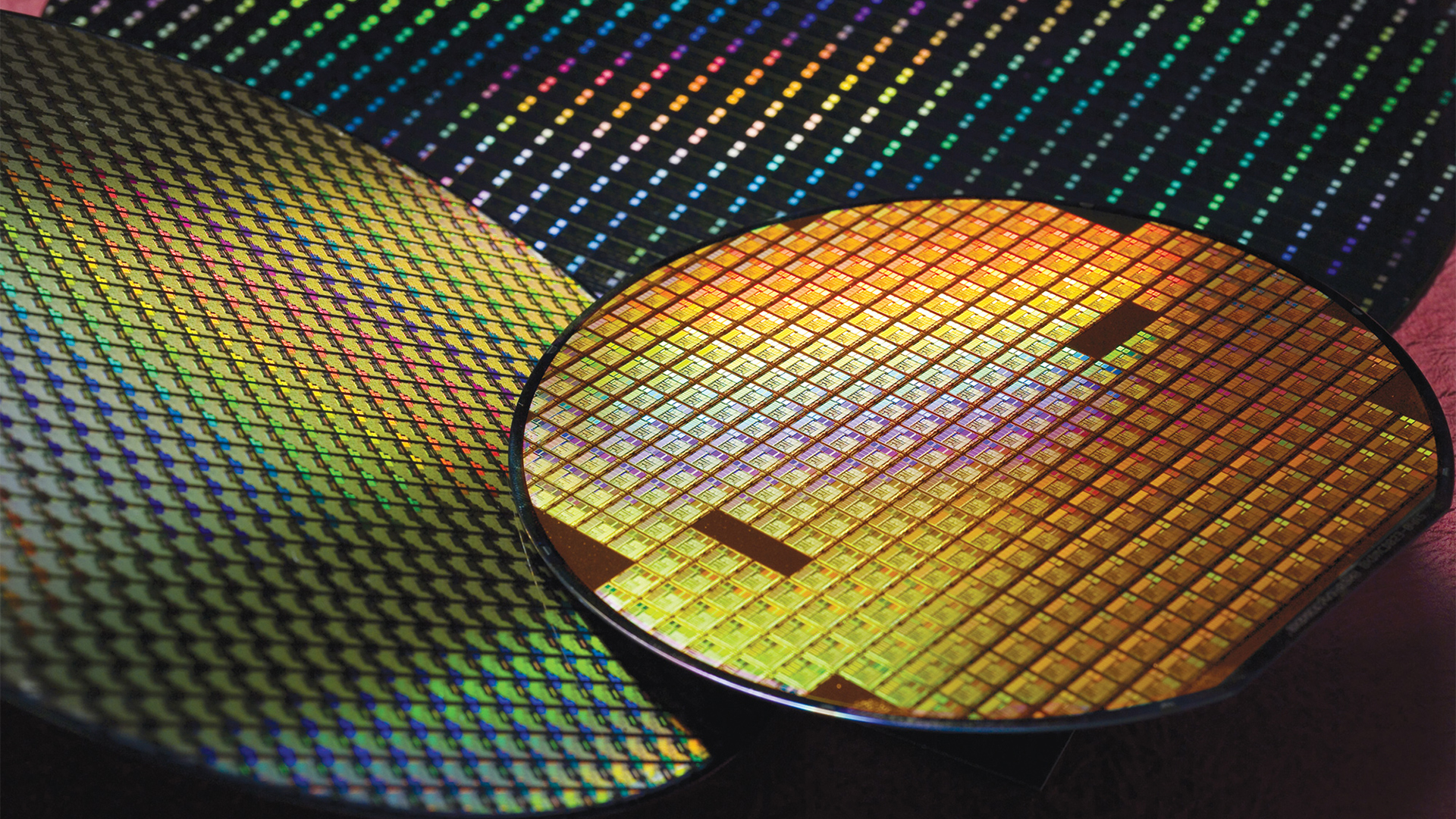

Antimony is commonly used in semiconductor manufacturing to dope silicon to create n-type semiconductors. In n-type doping, antimony increases the semiconductor’s conductivity and, thus, performance.

Antimony is also used to produce indium antimonide, a compound semiconductor material. Indium antimonide is known for its high electron mobility and sensitivity to infrared light, making it useful for infrared detectors, thermal imaging cameras, infrared LEDs, and optoelectronic devices. Finally, antimony-based materials make thin-film transistors in LCDs and OLEDs.

China controls about 50% of antimony supply. Its dominance in the global antimony market means its move will impact all the markets dependent on antimony. According to the Ministry of Commerce, these measures align with international norms and are not directed at any specific country or region. According to a spokesperson from China’s Ministry of Commerce, these controls aim to ensure the security and stability of global supply chains and prevent foreign misuse that could threaten China’s interests.

Meanwhile, this action is widely viewed as China’s response to recent restrictions imposed by the U.S., Netherlands, and Japan on China’s access to advanced chipmaking tools. It follows a pattern of China tightening control over other essential materials, such as gallium, germanium, and graphite.

The announcement comes amid already growing concerns about antimony supply shortages. A report by Project Blue in May 2024 projected a global shortfall of about 10,000 tons, exacerbated by sanctions on Russia that disrupted its antimony production. This shortage has increased reliance on alternative suppliers from Tajikistan, Vietnam, and Myanmar.

As China’s new controls take effect, market analysts expect antimony prices to rise significantly. European refineries and other global consumers have already sought to diversify their sources to reduce dependency on China. Still, these efforts may not prevent price spikes in light of China’s latest measures.