An official statement published by the Cyberspace Administration of China (CAC) says that operators of critical information infrastructure "should stop purchasing Micron products." The decree, spotted by Wen-Yee Lee, comes after a network security review of Micron's products sold in China.

Apparently, the Chinese government security review found that "Micron's products have relatively serious potential network security issues, which pose a major security risk to my country's critical information infrastructure supply chain." However, no detail of any specific security risks presented by the usage of Micron products is given. As a matter of "national security," we assume the Micron products ban will be implemented swiftly and thoroughly.

At the end of its statement, the CAC asserts that all companies from all countries are welcome to enter the Chinese market, as long as they abide by local laws and regulations. Again, there is no hint given about how the US-based Micron has broken any regulations.

Without some detail behind its claims about Micron, it is natural to wonder whether China has a political and/or economic motivation for its ban on the firm's products. It is, therefore, worth looking at some contemporary Micron / China news to provide some context to the decision.

Firstly, let us consider the political background. The additional US trade restrictions implemented last October meant that emerging Chinese DRAM and NAND giants (Yangtze Memory Technologies Co YMTC and ChangXin Memory Technologies CXMT, respectively) have far narrower markets to address. The biggest visible fallout from the US government decision last year was when, after a period of close cooperation, Apple had to abandon plans to use YMTC NAND in its iDevices. If US sanction activity motivated China's new Micron ban, then it would be a pretty clear tit-for-tat exchange.

Another possibility is that China's industrial efforts and investments have already started to pay dividends in DRAM and NAND production. Thus the country now feels alternative supplies are adequate enough that it can shun US-based Micron's products without issues.

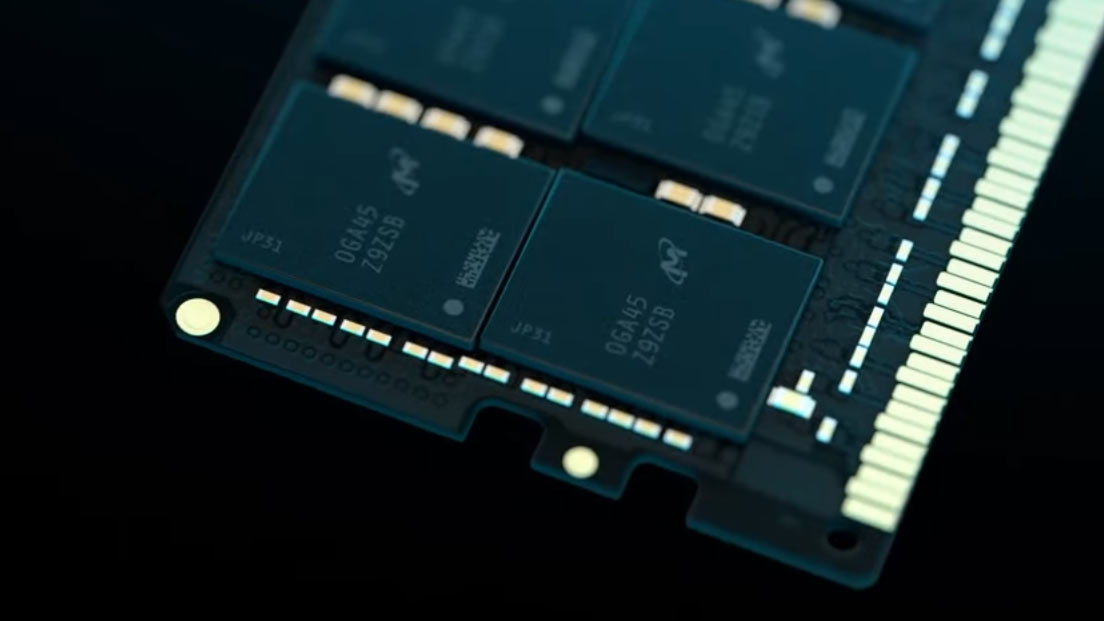

We also must think about how Micron may be affected by this China ban. Micron is one of the big three memory makers, but DRAM and NAND are commodity products where brands hold little cachet. Recent financials suggest that 25% of Micron's 2022 revenue was generated by sales in China. However, in a commodity market, the flow of DRAM and NAND ICs should be able to adjust quite quickly.

There were signs that these semiconductor commodities were primed for further steep declines in 2023, but there has been a surge in positivity more recently, off the back of the interest in companies that enable/serve the AI technology sector. Thus Micron shares have seen some ups and downs in recent months, but are still up nearly 20% in the last six months, and the last five days have accounted for half of that gain. Some of the positivity behind Micron also stems from its recent substantial investment in Japan, with local government support.

At the time of writing, Micron shares have not reacted at all to the China ban in after-hours trading. As this is fresh breaking news, we can't rule out more of a reaction on Monday.