Someone with a lot of money to spend has taken a bearish stance on Simon Property Group (NYSE:SPG).

And retail traders should know.

We noticed this today when the big position showed up on publicly available options history that we track here at Benzinga.

Whether this is an institution or just a wealthy individual, we don't know. But when something this big happens with SPG, it often means somebody knows something is about to happen.

So how do we know what this whale just did?

Today, Benzinga's options scanner spotted 13 uncommon options trades for Simon Property Group.

This isn't normal.

The overall sentiment of these big-money traders is split between 7% bullish and 92%, bearish.

Out of all of the special options we uncovered, 2 are puts, for a total amount of $85,200, and 11 are calls, for a total amount of $514,359.

What's The Price Target?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $100.0 to $125.0 for Simon Property Group over the last 3 months.

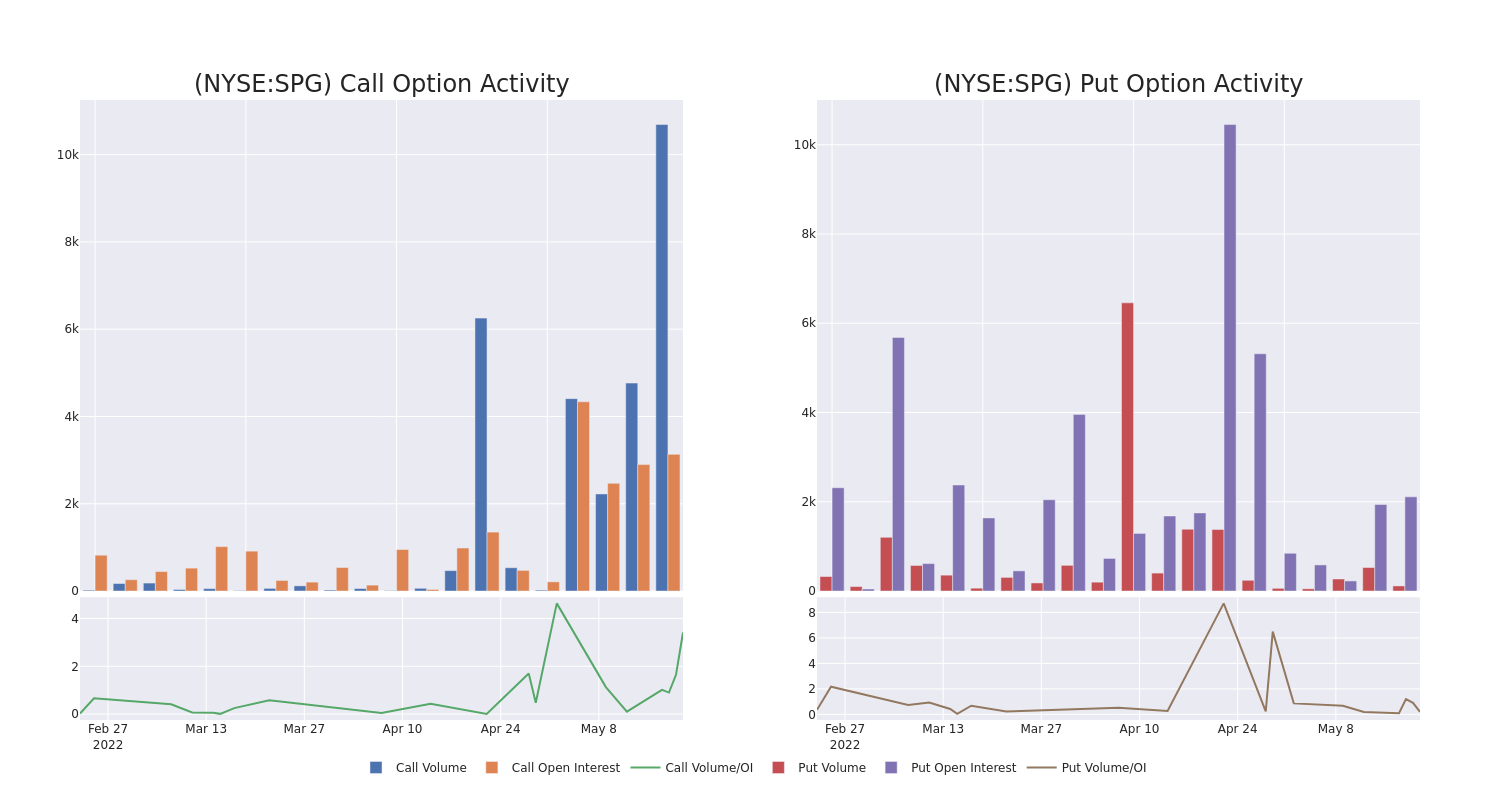

Volume & Open Interest Development

In terms of liquidity and interest, the mean open interest for Simon Property Group options trades today is 1048.6 with a total volume of 10,802.00.

In the following chart, we are able to follow the development of volume and open interest of call and put options for Simon Property Group's big money trades within a strike price range of $100.0 to $125.0 over the last 30 days.

Simon Property Group Option Volume And Open Interest Over Last 30 Days

Biggest Options Spotted:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|

| SPG | CALL | SWEEP | BEARISH | 06/17/22 | $110.00 | $89.5K | 2.7K | 604 |

| SPG | CALL | SWEEP | BEARISH | 06/17/22 | $110.00 | $78.0K | 2.7K | 1.3K |

| SPG | PUT | SWEEP | BEARISH | 05/20/22 | $125.00 | $54.0K | 1.6K | 40 |

| SPG | CALL | TRADE | BEARISH | 07/15/22 | $120.00 | $50.0K | 197 | 601 |

| SPG | CALL | TRADE | BEARISH | 06/17/22 | $110.00 | $40.5K | 2.7K | 1.0K |

Where Is Simon Property Group Standing Right Now?

- With a volume of 1,600,374, the price of SPG is down -3.3% at $106.41.

- RSI indicators hint that the underlying stock may be approaching oversold.

- Next earnings are expected to be released in 73 days.

What The Experts Say On Simon Property Group:

- Morgan Stanley has decided to maintain their Overweight rating on Simon Property Group, which currently sits at a price target of $145.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for {d[company_name]}, Benzinga Progives you real-time options trades alerts.