Investors with significant funds have taken a bearish position in IBM (NYSE:IBM), a development that retail traders should be aware of.

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in IBM usually indicates foreknowledge of upcoming events.

Today, Benzinga's options scanner identified 19 options transactions for IBM. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 21% being bullish and 68% bearish. Of all the options we discovered, 18 are puts, valued at $1,419,415, and there was a single call, worth $131,768.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $220.0 to $250.0 for IBM during the past quarter.

Insights into Volume & Open Interest

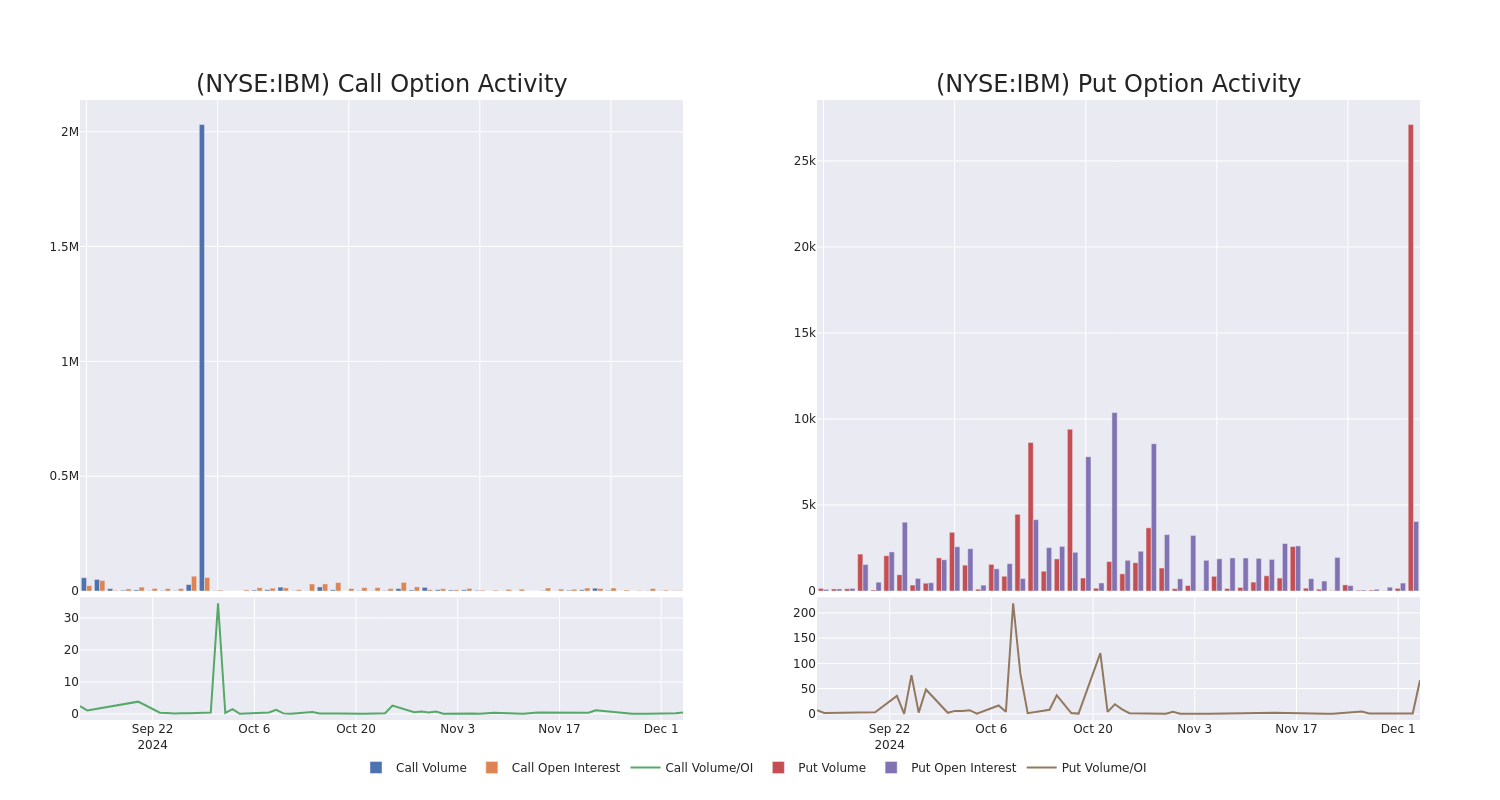

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for IBM's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of IBM's whale trades within a strike price range from $220.0 to $250.0 in the last 30 days.

IBM Option Volume And Open Interest Over Last 30 Days

Largest Options Trades Observed:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| IBM | PUT | SWEEP | BEARISH | 02/21/25 | $7.4 | $7.3 | $7.4 | $225.00 | $368.6K | 406 | 2.0K |

| IBM | PUT | SWEEP | BEARISH | 02/21/25 | $7.45 | $7.4 | $7.45 | $225.00 | $192.2K | 406 | 2.3K |

| IBM | CALL | SWEEP | BEARISH | 12/06/24 | $1.57 | $1.3 | $1.31 | $232.50 | $131.7K | 2.3K | 1.0K |

| IBM | PUT | SWEEP | BEARISH | 02/21/25 | $7.35 | $7.2 | $7.42 | $225.00 | $121.5K | 406 | 1.5K |

| IBM | PUT | SWEEP | BEARISH | 02/21/25 | $7.45 | $7.4 | $7.45 | $225.00 | $104.0K | 406 | 2.4K |

About IBM

IBM looks to be a part of every aspect of an enterprise's IT needs. The company primarily sells software, IT services, consulting, and hardware. IBM operates in 175 countries and employs approximately 350,000 people. The company has a robust roster of 80,000 business partners to service 5,200 clients, which includes 95% of all Fortune 500. While IBM is a B2B company, IBM's outward impact is substantial. For example, IBM manages 90% of all credit card transactions globally and is responsible for 50% of all wireless connections in the world.

Present Market Standing of IBM

- Currently trading with a volume of 860,540, the IBM's price is up by 1.52%, now at $232.48.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 49 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for IBM, Benzinga Pro gives you real-time options trades alerts.