Whales with a lot of money to spend have taken a noticeably bearish stance on GameStop.

Looking at options history for GameStop (NYSE:GME) we detected 54 trades.

If we consider the specifics of each trade, it is accurate to state that 29% of the investors opened trades with bullish expectations and 51% with bearish.

From the overall spotted trades, 34 are puts, for a total amount of $1,322,200 and 20, calls, for a total amount of $1,069,919.

What's The Price Target?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $25.0 to $125.0 for GameStop during the past quarter.

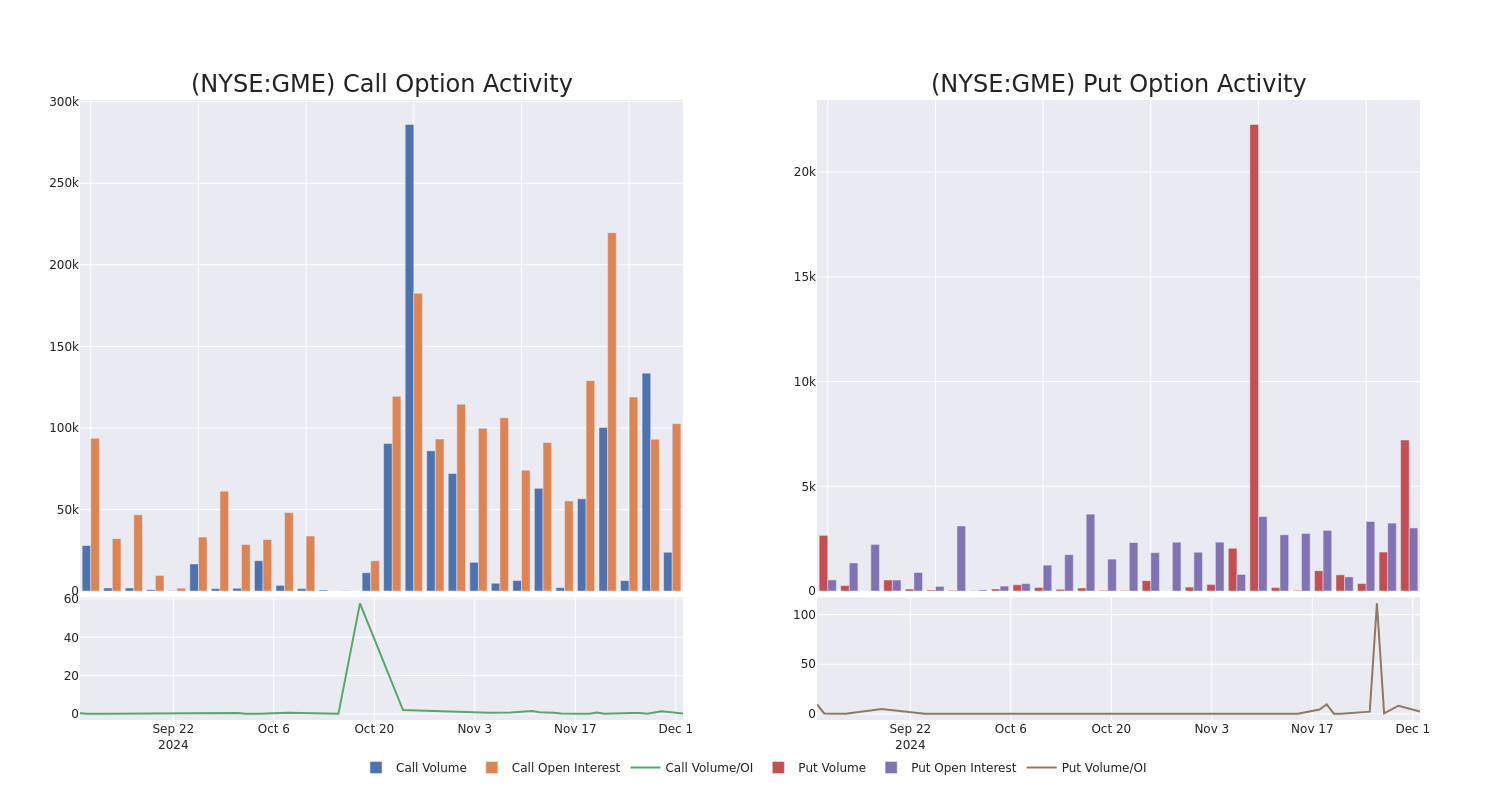

Insights into Volume & Open Interest

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for GameStop's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across GameStop's significant trades, within a strike price range of $25.0 to $125.0, over the past month.

GameStop Call and Put Volume: 30-Day Overview

Noteworthy Options Activity:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| GME | CALL | TRADE | BEARISH | 01/17/25 | $4.8 | $4.65 | $4.65 | $25.00 | $182.2K | 27.8K | 3.0K |

| GME | CALL | SWEEP | BULLISH | 01/15/27 | $11.8 | $7.1 | $11.8 | $55.00 | $88.6K | 94 | 69 |

| GME | CALL | SWEEP | BEARISH | 04/17/25 | $4.05 | $3.8 | $3.8 | $50.00 | $76.0K | 2.8K | 615 |

| GME | CALL | TRADE | BEARISH | 04/17/25 | $6.75 | $6.4 | $6.52 | $30.00 | $65.2K | 3.6K | 461 |

| GME | CALL | SWEEP | BULLISH | 12/06/24 | $1.0 | $0.97 | $1.0 | $30.00 | $63.0K | 14.7K | 6.3K |

About GameStop

GameStop Corp is a U.S. multichannel video game, consumer electronics, and services retailer. The company operates across Europe, Canada, Australia, and the United States. GameStop sells new and second-hand video game hardware, physical and digital video game software, and video game accessories, mainly through GameStop, EB Games, and Micromania stores and international e-commerce sites. The majority of sales are from the United States.

In light of the recent options history for GameStop, it's now appropriate to focus on the company itself. We aim to explore its current performance.

GameStop's Current Market Status

- Currently trading with a volume of 11,210,969, the GME's price is down by -5.03%, now at $27.59.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 8 days.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access.

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest GameStop options trades with real-time alerts from Benzinga Pro.