Financial giants have made a conspicuous bullish move on AbbVie. Our analysis of options history for AbbVie (NYSE:ABBV) revealed 10 unusual trades.

Delving into the details, we found 70% of traders were bullish, while 10% showed bearish tendencies. Out of all the trades we spotted, 4 were puts, with a value of $232,684, and 6 were calls, valued at $237,200.

Expected Price Movements

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $125.0 to $185.0 for AbbVie during the past quarter.

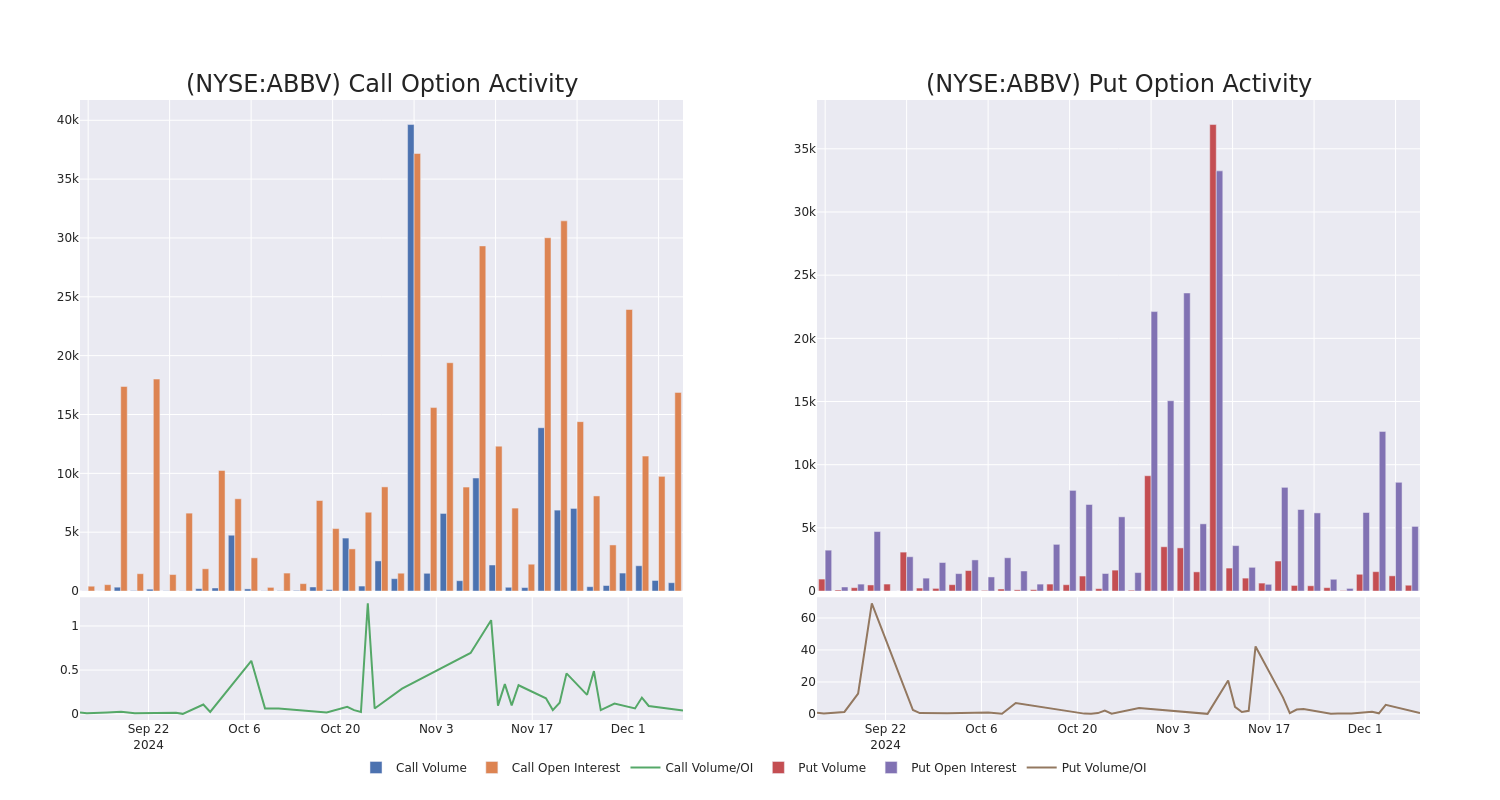

Volume & Open Interest Development

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for AbbVie's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across AbbVie's significant trades, within a strike price range of $125.0 to $185.0, over the past month.

AbbVie 30-Day Option Volume & Interest Snapshot

Significant Options Trades Detected:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ABBV | PUT | SWEEP | NEUTRAL | 05/16/25 | $14.6 | $14.55 | $14.55 | $185.00 | $115.1K | 309 | 81 |

| ABBV | CALL | TRADE | NEUTRAL | 06/20/25 | $54.7 | $53.25 | $54.02 | $125.00 | $54.0K | 30 | 10 |

| ABBV | PUT | SWEEP | BULLISH | 02/21/25 | $4.2 | $4.15 | $4.17 | $170.00 | $46.9K | 1.6K | 115 |

| ABBV | CALL | SWEEP | BULLISH | 03/21/25 | $8.1 | $7.5 | $8.1 | $180.00 | $40.5K | 2.7K | 208 |

| ABBV | CALL | TRADE | BULLISH | 03/21/25 | $8.0 | $8.0 | $8.0 | $180.00 | $40.0K | 2.7K | 158 |

About AbbVie

AbbVie is a pharmaceutical firm with a strong exposure to immunology (with Humira, Skyrizi, and Rinvoq) and oncology (with Imbruvica and Venclexta). The company was spun off from Abbott in early 2013. The 2020 acquisition of Allergan added several new products and drugs in aesthetics (including Botox).

After a thorough review of the options trading surrounding AbbVie, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

Current Position of AbbVie

- With a volume of 1,167,374, the price of ABBV is up 0.56% at $177.18.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 53 days.

What Analysts Are Saying About AbbVie

In the last month, 5 experts released ratings on this stock with an average target price of $211.6.

Turn $1000 into $1270 in just 20 days?

20-year pro options trader reveals his one-line chart technique that shows when to buy and sell. Copy his trades, which have had averaged a 27% profit every 20 days. Click here for access. * Showing optimism, an analyst from Leerink Partners upgrades its rating to Outperform with a revised price target of $206. * Consistent in their evaluation, an analyst from Citigroup keeps a Buy rating on AbbVie with a target price of $215. * Reflecting concerns, an analyst from Wolfe Research lowers its rating to Outperform with a new price target of $205. * Maintaining their stance, an analyst from Morgan Stanley continues to hold a Overweight rating for AbbVie, targeting a price of $224. * An analyst from BMO Capital has decided to maintain their Outperform rating on AbbVie, which currently sits at a price target of $208.

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

If you want to stay updated on the latest options trades for AbbVie, Benzinga Pro gives you real-time options trades alerts.