Despite heavy paper losses endured through five rounds of stock buybacks since 2020, Charter Communications will not change its investment strategy, according to chief financial officer Jessica Fischer.

“We continue to be confident in the long-term trajectory of the business,“ Fischer said Wednesday at Deutsche Bank’s annual Media & Telecom Conference. Mentioning that share buybacks "where that's appropriate" are part of Charter's capital-structure management, she said there's “no change to the way that we've approached those things.” (You can access a replay of the event here.)

Also read: Are You Kidding Me? Charter CEO Chris Winfrey Made More Than Shohei Ohtani Last Year

As noted in longtime ACA Connects coms executive Ted Hearn’s new Policyband Substack newsletter on Monday (you can sign up for that here), Charter’s share price descended to a five-year low last week of $270 a share, versus a high of $825 in September 2021 and an average price of $535.

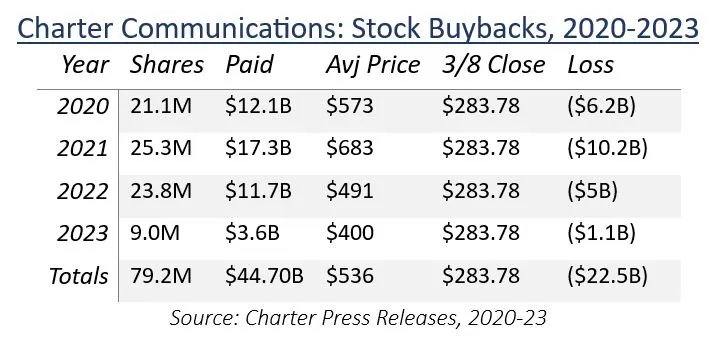

Hearn included this compelling graphic highlighting Charter’s recent stock buybacks that have generated around $22.5 billion in paper losses:

“Of course, if Charter’s stock rallies, the paper losses from the buybacks would shrink,” Hearn wrote. “But it’s a long climb — 89%, in fact — to get back to $535, much less $825.“ And as the veteran cable business observer also pointed out, $22.5 billion “would be nice to have about now with Altice USA in search of a buyer and Cable One a potential acquisition target.”

Things could be looking up for Charter. As Hearn also noted, CEO Christopher Winfrey paid $1.5 million in February for 5,050 Charter shares at an average price of $295.29. It was his first such share purchase in two years, Hearn said, citing Barron's.

For her part, Fischer believes Charter’s business trajectory is about to change, starting with competition from fixed wireless access.

As FWA operators T-Mobile and Verizon Communications rationalize the consumer price of fixed wireless service versus the true costs of actually delivering the product, “we’re going to get a large share of those customers back,” she said.

Currently, FWA is priced by a kind of found-money concept: T-Mobile and Verizon are merely monetizing excess capacity, an excess that will dry up over time.

"The reality is, this is not a costless product,” she added.

Also read: Charter CEO Chris Winfrey Dismisses FWA as ‘Cellphone Internet’

Fischer also expressed bullishness on Spectrum Mobile, noting the service has only claimed around 8 million wireless lines out of 130 million available in Charter's footprint.

“I think mobile can make up a meaningful portion of our EBITDA growth in the next five to six years,” she said.