Charlie Ergen has completed the reunification of his satellite empire, with a merger officially closing that makes Dish Network a wholly owned subsidiary of EchoStar.

Chairman Ergen and his fast-changing executive team are trying to fuel an expensive transition from a failing core pay TV operation into a full-fledged 5G wireless business, and they're billing the move as a connectivity play.

“This merger brings us one step closer to our goal of offering ubiquitous connectivity to people, enterprises and things, everywhere,” said Hamid Akhavan, the recently appointed president and CEO of EchoStar, in a statement.

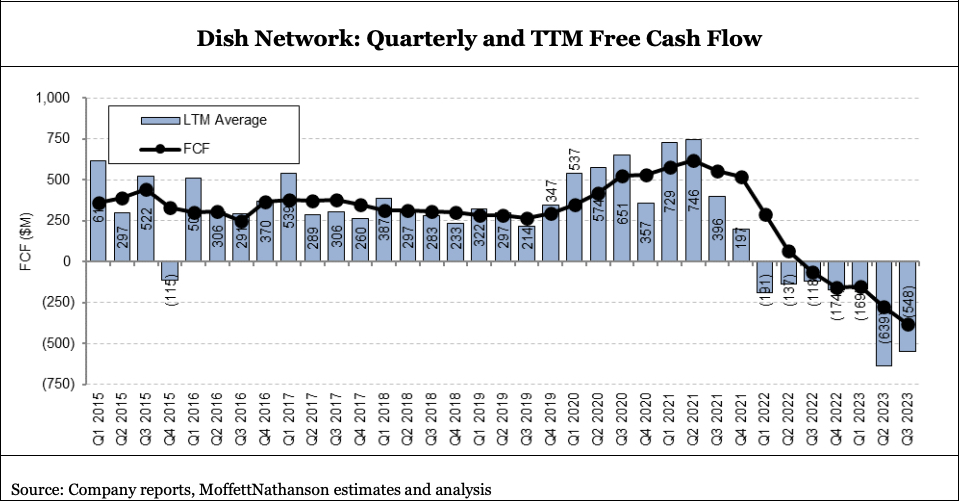

But what the deal really does is buy a little time for Dish, which is burning through $2 billion of cash annually and had been cut off from capital markets.

The EchoStar satellite business was spun off from Dish back in 2008 — back when Dish touted nearly 14 million satellite TV customers. These days, Dish has fewer than 9 million subscribers spread across its core satellite TV operation and the lower-margin Sling TV vMVPD business.

Earnings before interest, taxes, depreciation and amortization (EBITDA) were down 58% year-over-year through the third quarter.

Also read: Struggling Dish Network Lays Off More Than 500 Workers

Dish is also the middle of a challenging swim, trying to build from scratch a 5G wireless network. Its short- and long-term debt has reached $24.6 billion, and it’s estimated the company will need around $16 billion more through 2026 to keep operating and building.

EchoStar provides Ergen with around $1.9 billion in cash and an additional $265 million in free cash.

Following Dish’s rough third-quarter earnings report, equity analyst Craig Moffett predicted the company will wind up in bankruptcy within the next few years, even with the EchoStar merger.

“Against this dire picture, the cash on EchoStar's balance sheet — there can be no argument that the merger was conceived simply for access to a bit of cash to keep Dish going a little longer — is little more than a drop in the bucket,” Moffett wrote.