What are CEOs thinking right now?

To find out, Fortune once again ran a CEO survey, conducted in collaboration with Deloitte. We invited the top executive at Fortune 500 companies, Fortune Global 500 companies, and some members of our global Fortune community to participate.

In total, 149 CEOs representing more than 15 industries responded to the survey. It was fielded in February (i.e. prior to the SVB failure).

The numbers to know

45%

- … of CEOs say they expect their firm's growth to be strong (32%) or very strong (13%) over the coming 12 months. Another 44% said modest, while 12% said either weak (10%) or very weak (2%).

85%

- … of CEOs think "energy transition and energy resilience" would be best achieved through business collaboration rather than competition. While 15% said competition rather than business collaboration.

61%

- … of CEOs said inflation is likely to disrupt their business strategy over the next 12 months. 51% of CEOs said geopolitical instability is likely to disrupt their business, and 48% pointed to labor/skills shortage.

55%

- … of CEOs said "identifying the right use cases" is a barrier to creating business value with A.I.

Big picture

CEOs are still worried about inflation. While inflation has decelerated from its peak 2022 readings, CEOs aren't convinced inflation will make a fast exit. Among the CEOs we surveyed, 61% expect inflation to continue disrupting business strategy over the coming 12 months. That said, that's down from 74% who said the same thing in our September poll.

CEOs are a little bearish, and a little bullish

Among surveyed CEOs, 37% say they have a pessimistic 12-month outlook for the global economy compared to 12% who have an optimistic or very optimistic view.

Meanwhile, only 5% of CEOs we surveyed have a pessimistic 12-month outlook for their own company.

Can both be true? Or are CEOs simply seeing through rose colored glasses when it comes to their own firm?

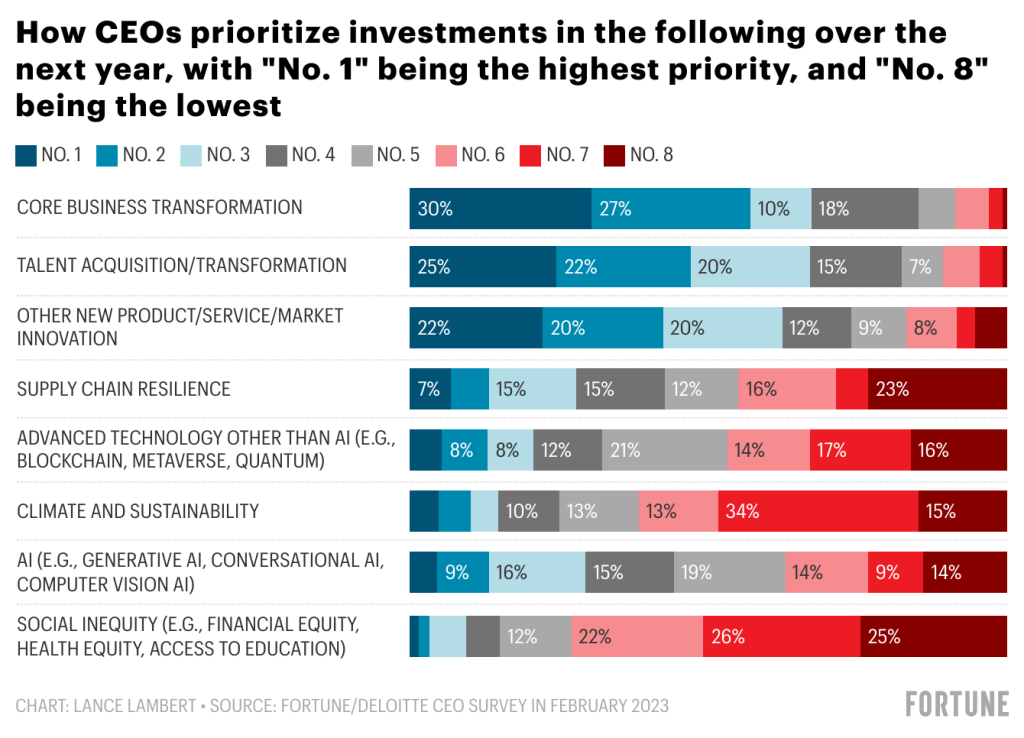

No. 1 business transformation, No. 2 talent

We asked CEOs how they personally prioritize investments in eight specific areas in 2023. Among CEOs surveyed, most ranked "core business transformation" as their top priority (30% put it as No. 1). That was followed by "talent acquisition" (25% put it as No. 1) and "new products/market innovation" (22% put it as No. 1).

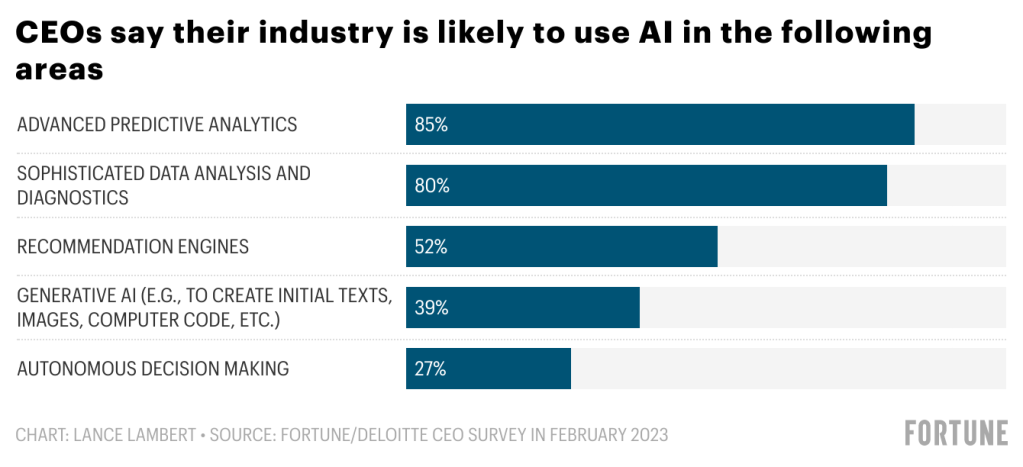

CEOs don't expect A.I. to take over leadership decision making

Since its launch, ChatGPT has caused a stir as the business world learned that artificial intelligence chatbots have progressed faster than previously thought. That said, 85% of CEOs still expect advanced predictive analytics to be the top use case for A.I. in their industry. While only 39% of CEOs expect their industry to use generative AI.

As a perk of their subscription, Fortune Premium subscribers receive Fortune Analytics, an exclusive newsletter that shares in-depth research on the most discussed topics in the business world right now. Our findings come from special surveys we run and proprietary data we collect and analyze. Sign up to get them in your inbox.