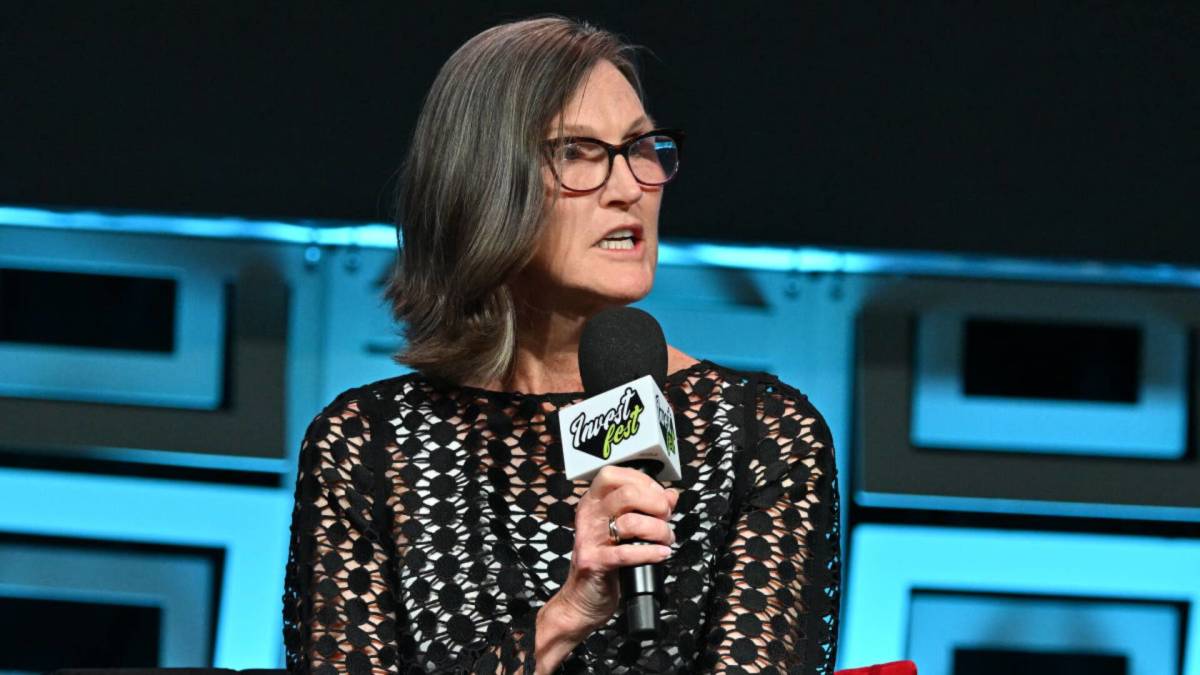

Cathie Wood, head of Ark Investment Management, often seizes opportunities to buy her favorite stocks when they drop. And that’s what she did last Friday.

The investment community has conflicting views toward Wood, who may be the country’s best-known investor after Warren Buffett. Boosters say she’s a technology visionary. Detractors say she’s just a mediocre money manager.

Related: Cathie Wood unloads $8 million of surging tech stock

Wood (Mama Cathie to her followers) rocketed to acclaim after a stupendous return of 153% in 2020 and lucid presentations of her investment philosophy in numerous media appearances.

But her longer-term performance is less impressive. Wood’s flagship Ark Innovation ETF (ARKK) , with $6.4 billion in assets, produced negative annualized returns of 7.94% for the last 12 months, and 26.26% for the past three years and 0.06% for five years.

That’s quite woeful compared to the S&P 500. The index posted positive annualized returns of 22.4% for one year, 10.65% for three years, and 14.95% for five years. Ark Innovation’s numbers also fall well shy of Wood's goal for annual returns of at least 15% over five-year periods.

Cathie Wood’s straightforward strategy

Her investment philosophy is pretty simple. Ark ETFs usually purchase emerging-company stocks in the high-tech categories of artificial intelligence, blockchain, DNA sequencing, energy storage, and robotics. Wood maintains that companies in those categories will change the world.

Of course, these stocks are quite volatile, so the Ark funds’ values frequently fluctuate up and down. Wood adds to and subtracts from her top names frequently.

Investment research titan Morningstar offers a harsh assessment of Wood and the Ark Innovation ETF. Investing in young companies with slim earnings “demands forecasting talent, which ARK Investment Management lacks,” Morningstar analyst Robby Greengold wrote in March.

The potential of Wood’s five high-tech platforms listed above is “compelling,” he said. “But the firm’s ability to spot winners and manage their myriad risks is less so…. It has not proved it is worth the risks it takes.”

Wood's unconventional investing

This isn’t an old school investment portfolio. “Results range from tremendous to horrendous” for Wood’s young, often unprofitable stocks, Greengold said.

Wood has defended herself from Morningstar’s criticism. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she told Magnifi Media by Tifin in 2022.

Related: Cathie Wood sells $25 million of a lagging tech stock

“We do not fit into their style boxes. And I think style boxes will become a thing of the past, as technology blurs the lines between and among sectors.”

But some of Wood’s customers apparently agree with Morningstar. Over the past 12 months, Ark Innovation ETF suffered a net investment outflow of $2.2 billion, according to ETF research firm VettaFi.

Cathie Wood snags CrowdStrike, dumps Tesla

On July 19, Ark funds purchased 38,595 shares of cybersecurity company CrowdStrike (CRWD) . This kitty was worth $11.8 million as of that day’s close.

Recall that a CrowdStrike software snafu brought down much of the global information technology infrastructure Friday. That interrupted all kinds of transportation and commerce. The stock has dropped 23% since July 18.

Wood obviously saw the shares as a buy at their lower levels. She’s not the only one.

“While details are still emerging, CrowdStrike’s initial response emphasized that this incident was not a security breach and the faulty [software] update has been rectified,” Morningstar analyst Malik Ahmed Khan wrote in a commentary.

Fund manager buys and sells:

- Goldman Sachs offers 3 high-conviction stock picks

- Cathie Wood unloads shares of rebounding tech titan

- Veteran fund manager sees world of pain coming for stocks

“We find some credence in this response, considering that within hours of the outage, companies with operations affected by CrowdStrike’s update have been able to gradually resume services.”

The stock’s 11% plunge Friday was “overly punitive, especially considering the update doesn’t represent a breach of CrowdStrike’s security apparatus,” Khan said.

“We think the pullback represents a good buying opportunity for long-term investors looking for high-quality security/software exposure.”

Also last Friday, ARK Next Generation Internet ETF (ARKW) sold shares of electric vehicle titan Tesla (TSLA) for the second session in row.

It unloaded 17,607 shares, valued at $4.2 million as of that day’s close. On Thursday it spewed $8 million of Tesla stock.

The shares have soared 71% over the past three months, despite some negative news for the company. So Wood obviously thought it was a good time to sell.

Related: Veteran fund manager sees world of pain coming for stocks