Despite reporting an adjusted loss of $76 million for the second quarter of the year, Archer Aviation (ACHR) -) received a landmark Airworthiness Certificate from the Federal Aviation Administration earlier in August, lighting up the runway for the company to begin daily testing of its Midnight electric air taxi.

Archer's CEO Adam Goldstein said at the time that the company was planning to conduct daily flights throughout the fall as the first step on a mission to reach commercialization by 2025.

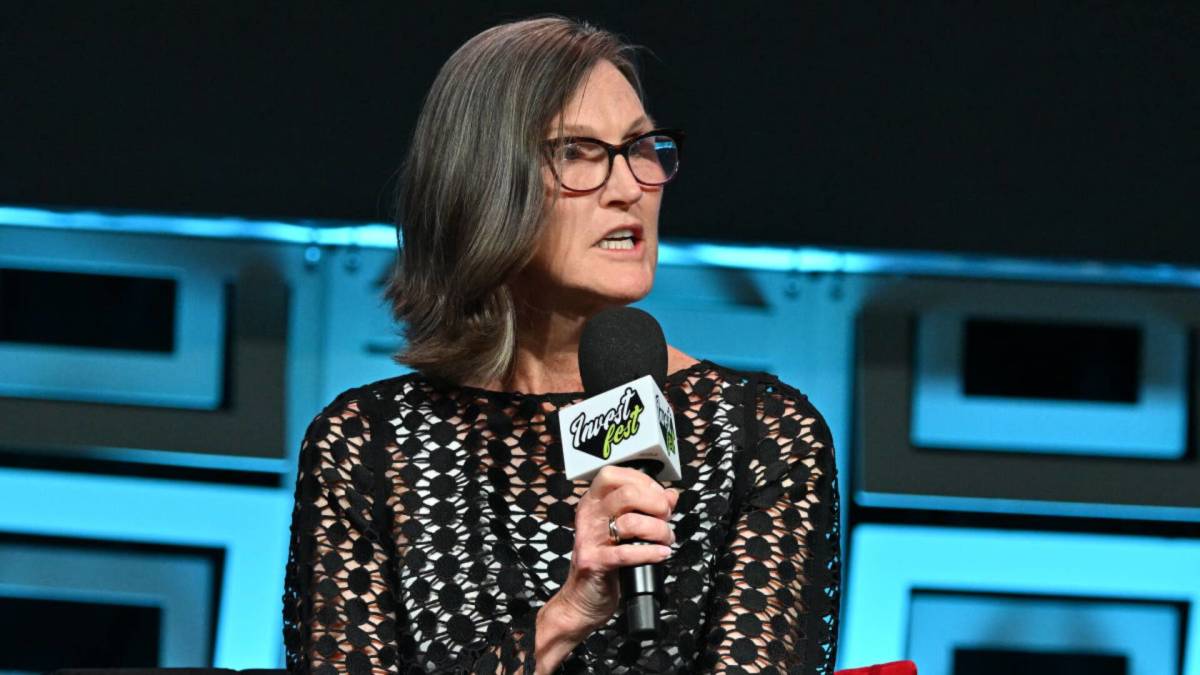

Related: Cathie Wood buys $3.8 million worth of Archer Aviation stock

As the company eyes that fast-approaching goal, Archer on Oct. 4 received the first $1 million of a $142 million contract with the U.S. Air Force. This initial payment is focused on a mobile flight simulator, something that will allow Archer and Air Force officials to begin training pilots.

"Archer’s eVTOL technology can help maintain the United States’ position as a global leader in aviation," Goldstein said in a statement. "To see our historic contract with the U.S. Air Force move from signature to execution at a rapid pace is a reflection of the strong commitment that the U.S. Department of Defense has made to securing our country's future by investing in transformational technology."

In the midst of Archer's efforts to expand, the company is facing a new class action lawsuit, which was filed earlier in October. The suit alleges that, between Sept. 17 2021 and Aug. 15 2023, Archer misled investors by using highly edited videos of earlier flights and misrepresenting the profitability of its business.

Still, shares of Archer are up 176% for the year, though the stock has dipped slightly over the past month.

Related: Archer Aviation CEO says Elon Musk has helped boost the air taxi industry

And Ark Invest, bullish on disruptive technologies, shored up its investment in Archer Monday, buying up a total of around $846,000 in the company. The bulk of the purchase was completed by Ark's Innovation ETF, which alone snapped up 139,858 shares. This boosted Ark Innovation's total Archer investment to 12.6 million shares, worth around $65 million and weighted at just under 1% of the fund.

Following Archer's FAA approval in August, Ark picked up a total of close to $20 million in the company.

Shares of Archer fell more than 2% in after-hours trading Tuesday.

Get investment guidance from trusted portfolio managers without the management fees. Sign up for Action Alerts PLUS now.