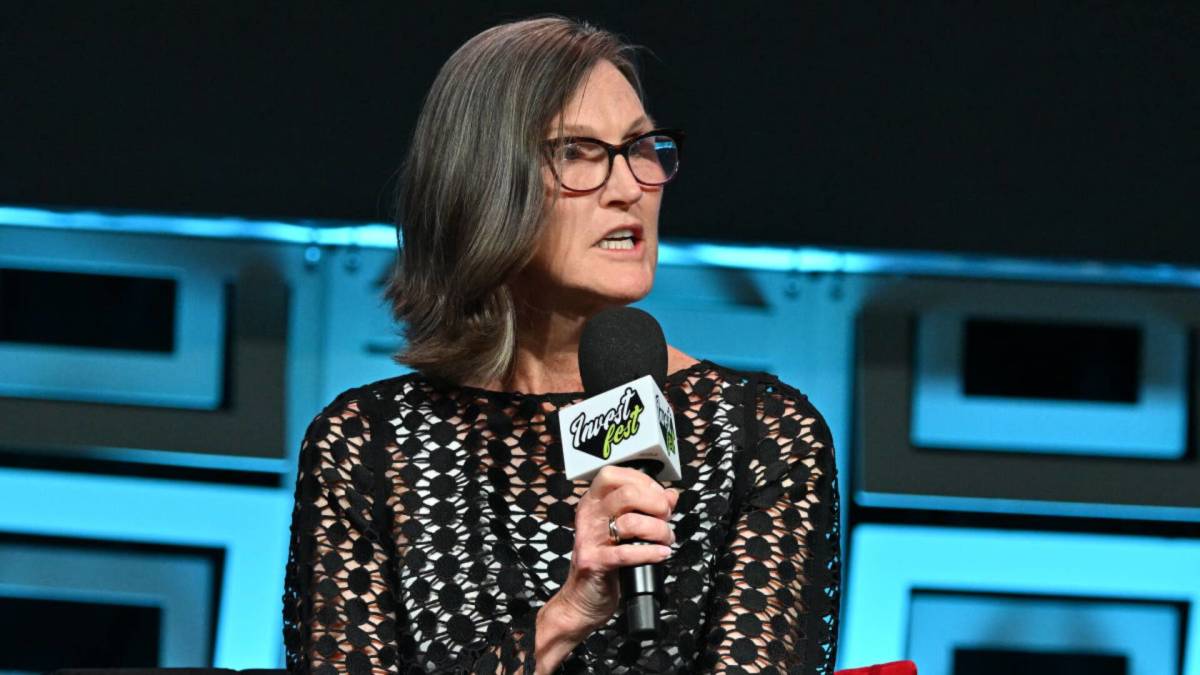

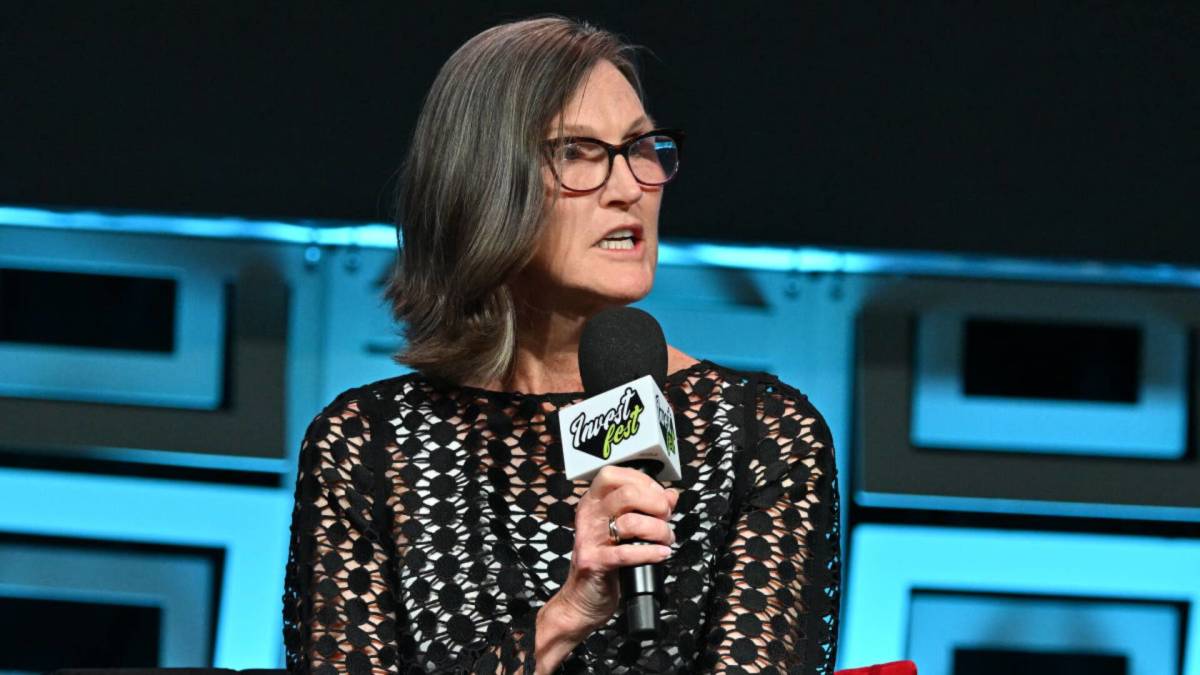

Who is Cathie Wood?

Cathie Wood is an investor whose name is synonymous with ARK Investment Management, or ARK Invest, the fund-management company she co-founded in 2014. ARK’s exchange-traded funds posted spectacular average annual returns through early 2021, but since then, the funds have fallen from their highs. She serves as the company’s chief executive and chief investment officer.

What is Cathie Wood’s net worth?

Cathie Wood’s fortune is largely tied to the performance of the ARK funds. As of June 2022, Forbes estimated Wood to be worth $140 million, down from $400 million in 2021. But other media outlets peg her 2023 net worth at $250 million to $300 million.

What is Cathie Wood known for?

Cathie Wood is best known for making big bets on technology by investing in small and large-cap stocks of companies that are engaged in what is known as “disruptive innovation”— ranging from artificial intelligence and genome sequencing to robotics, clean energy, and blockchain. Investing in disruptive technology, she believes, will improve people’s livelihoods.

Disruptive innovation is a term coined by Harvard Business School faculty that first appeared in a Harvard Business Review publication in 1995 to describe “any situation in which an industry is shaken up and previously successful incumbents stumble.” For example, Tesla (TSLA) -) took on the auto industry by developing and producing electric vehicles on a large scale. Starting in the late 2010s, Tesla siphoned market share from traditional automakers like Ford (F) -) and General Motors (GM) -) as they continued to focus on producing vehicles with internal combustion engines.

Related: Cathie Wood dumps nearly $30 million worth of two beloved tech giants

How did Cathie Wood get her start?

Catherine Wood graduated summa cum laude with a bachelor’s of science degree in finance and economics from the University of Southern California in 1981. During her education, she studied under economist Arthur Laffer, a proponent of supply-side economics.

For a few decades, she worked in investment management at several notable firms in the industry: AllianceBernstein, Alliance Capital, Tupelo Capital Management, and Jennison Associates.

As a portfolio manager, she focused on what’s known as thematic investing — a strategy based on investing in trends that are expected to play out over the long term rather than investing in specific companies — and she carried that thematic strategy over to ARK with the theme of disruptive innovation.

What is ARK?

ARK is an acronym for active research knowledge, and according to the company’s website, refers to: “ACTIVE management to capitalize on the rapid change innovation creates; an open RESEARCH ecosystem that is freed from sectors, geographies, and market caps to capture the convergence of technology; and the sharing of KNOWLEDGE to gain a deeper understanding of the areas we are researching and investing in.”

ARK is an active fund-management firm that buys shares in publicly traded companies, and some of its ETFs are listed on the all-electronic exchange NYSE Arca. As of August 2023, ARK managed eight funds, totaling $14.7 billion in net assets. Its flagship fund is the $8 billion Ark Innovation ETF (ARKK) -). In early 2022, ARK started a thematic fund that focused on transparency, but that was shut down after seven months in July 2022 due to the lack of a benchmark. Assets under management reportedly peaked at more than $60 billion in 2021.

ARK’s funds and their net assets as of the end of August 2023 are:

- ARK Innovation ETF (ARKK): $8,005 Million

- ARK Next Generation Internet ETF (ARKW): $1,372 Million

- ARK Genomic Revolution ETF (ARKG): $2,802 Million

- ARK Autonomous Tech. & Robotics ETF (ARKQ): $1,074 Million

- ARK Fintech Innovation ETF (ARKF): $905.8 Million

- ARK Space Exploration & Innovation ETF (ARKX): $277.1 Million

- The 3D Printing ETF (PRNT): $162.4 Million

- ARK Israel Innovative Technology ETF (IZRL): $99.3 Million

How does Cathie Wood make her money?

Cathie Wood mainly makes her money from the fees charged to investors in managing ARK’s funds. For its actively managed ETFs, ARK’s annual expense ratio, or management fee, is 0.75%. That translates to a fee of $7.5 million for every $1 billion invested.

Barron’s reported in 2020 that Wood owns 50% to 75% of ARK, which indicated that based on the 0.75% expense ratio she would have taken home $3.75 million to $5.63 million for every $1 billion in assets before taxes. It’s not known publicly how much of Wood’s personal money went into ARK’s ETFs.

Among other personal assets, Wood has a home — based on public records — in Wilton, Connecticut, where, according to Zillow, the average home value is $1 million.

What is Cathie Wood’s investment strategy?

Cathie Wood focuses on growth, meaning that her funds invest in shares of companies that are focused on growing their businesses even though many are not likely to be profitable in the short term. ARK was built on her premise of taking advantage of opportunities in advances in technology.

Wood focuses on five areas of innovation in particular: artificial intelligence (AI), energy storage, robotics, DNA sequencing, and blockchain technology. Technologies are ready, she says, and companies can take advantage of these advances, because technology overall has vastly improved in the more than two decades since the dot-com bust, and costs are much lower.

ARK states that “thematic investing can offer a low correlation of relative returns to traditional growth strategies and negative correlation of relative returns to traditional value strategies, offering diversification for investors.”

ARK had success with investments in Zoom and Roku during the Covid-19 pandemic, but as interest rates started to rise in 2022, the market’s fortunes as well as ARK’s portfolio started to decline.

Wood has been criticized for failing to capitalize on the stock market run of graphics processor maker Nvidia from early 2023 as investment in companies related to artificial intelligence started to gain momentum.

In 2023, ARK was trimming and, at the same time, bulking up shares in some companies in its ETFs, by buying Meta Platforms (META) -) and Robinhood Markets (HOOD) -) and selling Tesla and DraftKings (DKNG) -).

How have ARK’s funds performed?

ARK’s funds have endured volatility since before the Covid-19 pandemic. The flagship ARK Innovation ETF rose steadily in market value into 2020 before surging to a record high in early 2021.

The fund’s performance then declined, moving back into 2017 levels in early 2023, as rising interest rates—in response to accelerating inflation—curbed investment in equities. Since its listing in October 2014 to the end of 2022, the fund lost 53%, compared to a 92% gain in the S&P 500 Index.

In the first half of 2023, however, the fund has been on a rebound—gaining 41%.

What is Cathie Wood’s post-Covid strategy?

In addition to focusing on growth, Wood has undertaken a value investing approach. Even though the stock market overall was in a downturn in 2022, ARK added to its positions in existing holdings such as Tesla, despite their poor stock performance, believing that they were undervalued.

Wood maintained her view from late 2022 that over a five-year investment horizon, stocks involved in disruptive technology innovation will outperform—which is in alignment with her thematic investing strategy. At the same time, ARK has also invested in traditional, non-disruptive stocks like GM, betting that the company will eventually switch its focus toward newer tech.

Wood has also doubled down on cryptocurrency, despite steep losses across the industry and failed backers, on the belief that blockchain will lead to decentralized finance and increased transparency in the financial sector.

Still, one prominent investor, hedge fund guru Daniel Loeb, criticized Wood’s comments about focusing on a company’s cash flow for future profitability as outdated. Wood has also disregarded EBITDA, which growing companies such as Uber (UBER) -) use to measure profitability despite reporting losses.