/Palantir%20by%20rblfmr%20via%20Shutterstock.jpg)

When Cathie Wood’s ARK Invest makes a move, Wall Street pays attention. The renowned investment firm recently raised eyebrows by trimming its position in data analytics powerhouse Palantir Technologies (PLTR). According to regulatory filings, Ark Invest sold $15 million worth of PLTR stock across several of its exchange-traded funds including the Ark Innovation ETF (ARKK) and the Ark Next Generation Internet ETF (ARKW).

With a market capitalization of $153 billion, Palantir stock has surged nearly 300% in the last 12 months, primarily due to the artificial intelligence (AI) boom. However, Wood’s decision to book profits presents an intriguing question: Is the firm simply rebalancing its portfolio, or does one of tech’s most influential investors see storm clouds on the horizon for PLTR?

Is Palantir Stock a Good Buy?

Palantir Technologies is a software company specializing in data analytics and artificial intelligence. Founded in 2003, the Denver-based company has evolved from its roots in counterterrorism and intelligence work to serve both government and commercial clients.

Palantir’s flagship platform, Gotham, helps intelligence agencies and analysts uncover patterns in complex datasets and coordinate operational responses. Its Foundry serves as a central operating system for enterprise data, assisting organizations in integrating and analyzing information in one place. Its latest offering, Artificial Intelligence Platform (AIP), bridges the gap between traditional data analytics and AI by connecting various large language models (LLMs) with an organization’s data and processes.

Palantir has demonstrated its ability to handle complex and sensitive data analysis at scale for companies across sectors. It has also successfully leveraged its government expertise to build commercial applications, particularly in the emerging field of AI integration.

A key reason for Palantir’s recent gains is its strong revenue growth and improving profit margins. In the last 12 months, Palantir has reported revenue of $2.64 billion, an increase of 24.5% year-over-year. In 2023, Palantir increased sales by 16.7% to $2.22 billion. In addition to top-line acceleration, Palantir is reporting consistent profits.

For instance, its free cash flow rose to $980 million in the last year, up from $183.7 million in 2022.

A Strong Performance in Q3

Palantir delivered a knockout third quarter as the data analytics giant saw revenue surge 30% year-over-year to $726 million. Moreover, U.S. business grew 44% yearly due to demand from the commute social and government sectors.

Palantir’s commercial segment in the U.S. increased sales by 54%, and its customer count increased by 77%. Comparatively, sales from the U.S. government climbed 40% year-over-year, the most substantial growth in 15 quarters.

Notably, Palantir posted an adjusted operating margin of 38%, generating a whopping $435 million in adjusted free cash flow. The management raised its 2024 revenue guidance to $2.807 billion and expects U.S. commercial revenue to grow at least 50% for the year.

With 104 deals over $1 million closed in the quarter and customers reporting improvements in efficiency (like reducing insurance underwriting time from two weeks to three hours), Palantir appears to be cementing its position as a key player in the enterprise AI revolution.

Is PLTR Stock Overvalued?

Analysts expect Palantir’s sales to increase from $2.25 billion in 2023 to $4.25 billion in 2026. Comparatively, adjusted earnings per share are forecast to expand from $0.25 in 2023 to $0.60 in 2026. Its FCF is also projected to improve to $1.5 billion in 2026.

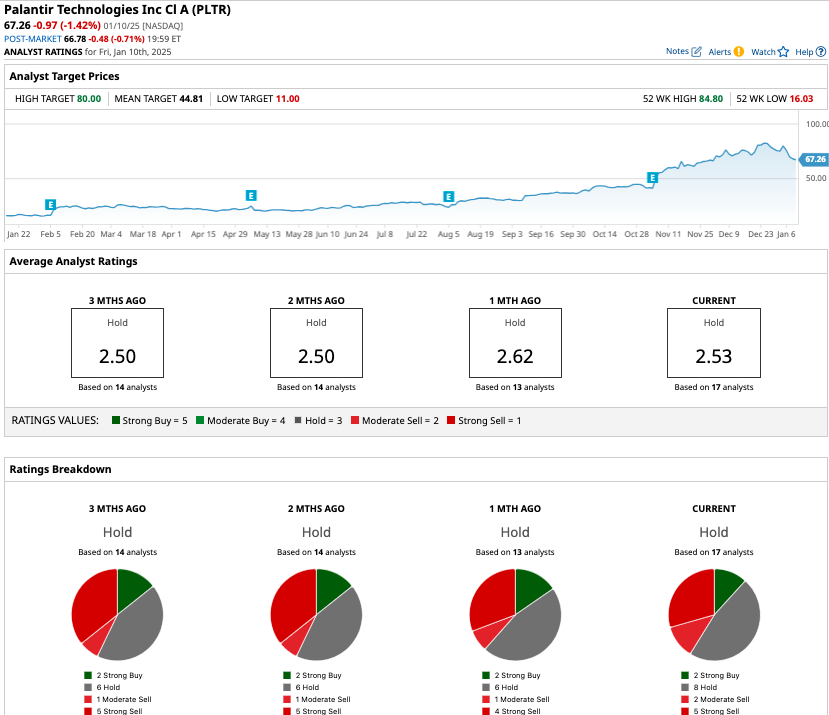

So, priced at 36x forward sales, 258x forward earnings, and 102x forward FCF, PLTR stock trades at a hefty premium. Out of the 17 analysts covering Palantir stock, two recommend “Strong Buy,” eight recommend “Hold,” two recommend “Moderate Sell,” and five recommend “Strong Sell.” The average target price for PLTR stock is $44.81, down over 30% from current levels.