Cathie Wood is among the most popular investors on Wall Street, primarily investing in growth companies that are part of disruptive business verticals. Over the years, Wood’s growth-focused investment funds have attracted billions of dollars from investors.

In 2025, Wood is doubling down on artificial intelligence despite market chaos. The Ark Invest CEO just acquired more than $30 million worth of Nvidia (NVDA) shares as the chipmaker plunged last week amid President Donald Trump’s tariff-induced market selloff.

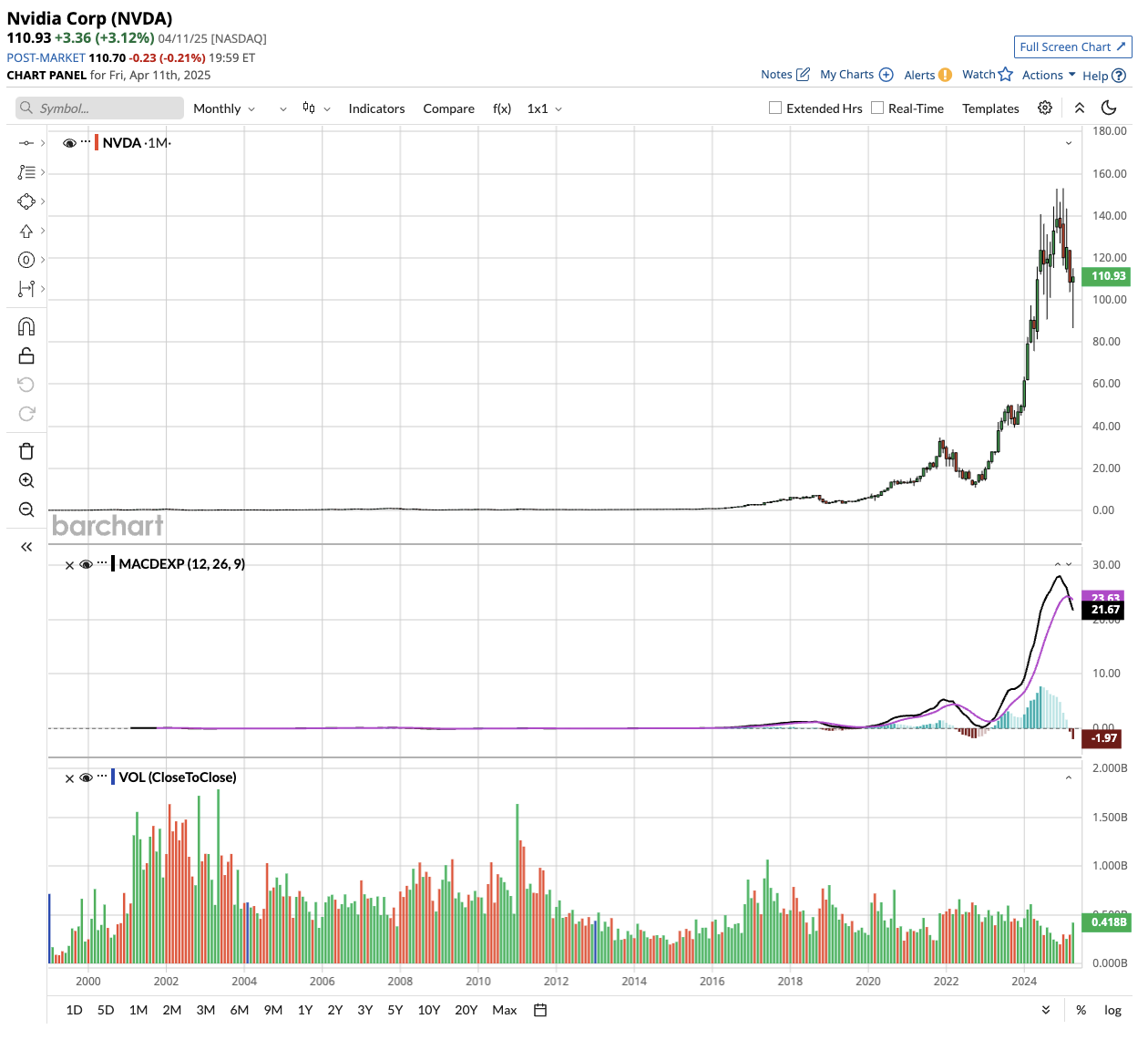

The move marks a shift for Wood, who typically favors under-the-radar tech innovations over established mega-caps. Despite semiconductors being exempted from new tariffs, Nvidia faces certain headwinds. The tech stock has tumbled 17% year-to-date after almost tripling in 2024.

Is NVDA Stock a Good Buy Right Now?

Nvidia has solidified its position as the undisputed leader in AI computing. Moreover, Nvidia posted revenue of $130.5 billion in fiscal year 2025, up from $16.6 billion in fiscal year 2021. The chip maker’s revenue has been primarily fueled by the Data Center segment, which accounts for 88% of total sales, as companies worldwide race to build AI capabilities.

“The $1T installed base of general-purpose CPU data center infrastructure is being modernized to a new GPU-accelerated computing paradigm,” Nvidia states in its investor materials. This shift is creating what Nvidia calls “AI factories” - specialized computing centers designed to transform data into “intelligence tokens,” representing a fundamental change in how computing resources are deployed.

CEO Jensen Huang has positioned Nvidia as much more than a chipmaker, developing a full-stack approach that combines specialized hardware, software libraries, and domain expertise. Its platform spans chips, networking, systems, and algorithms, all delivering performance improvements that “surpass Moore’s law” by orders of magnitude.

Nvidia’s Blackwell architecture represents the latest technological leap, reducing power consumption by 4x compared to its previous Hopper generation while delivering substantial performance gains. This focus on energy efficiency is crucial as computing demands grow exponentially.

Nvidia enjoys dominant market positions across multiple segments, including a 95%-plus share in workstation graphics and a sizeable lead in autonomous driving technology.

What’s Next for Nvidia Stock?

Looking ahead, Nvidia’s roadmap features annual releases of increasingly powerful architectures (Blackwell, Blackwell-Ultra, Rubin) alongside networking innovations designed to scale AI capabilities.

Nvidia views the current AI revolution as just beginning, with potential trillion-dollar opportunities as traditional data centers transition to GPU-accelerated computing and specialized AI factories proliferate across industries.

With operating margins exceeding 66% and free cash flow of $60.7 billion in fiscal year 2025, Nvidia has the financial strength and technological leadership to remain at the forefront of the accelerated computing era for years.

The semiconductor giant is positioned to grow its sales to $310 billion in the fiscal year 2030, indicating a compound annual growth rate of almost 19% over the next five years. Comparatively, earnings are forecast to expand to $7 per share in the fiscal year 2030, up from $2.99 per share in 2025.

Notably, Nvidia is projected to grow its free cash flow from $60.7 billion to $222 billion in the next five years. If NVDA stock is priced at 25x trailing FCF, it will more than double from current levels by April 2030.

Out of the 43 analysts covering NVDA stock, 37 recommend “Strong Buy,” two recommend “Moderate Buy,” and four recommend “Hold.” The average target price for NVDA stock is $173.95, up more than 50% from current levels.