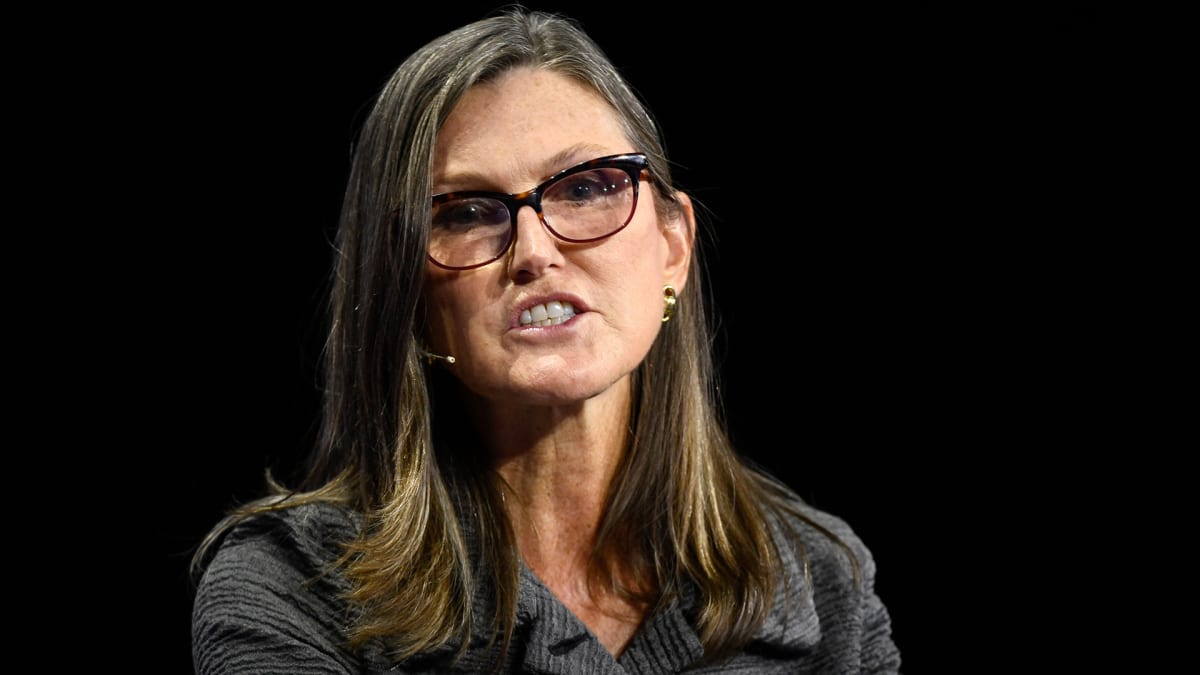

Popular money manager Cathie Wood of Ark Investment Management has seen her young-technology-stock funds hit the skids this year amid weak earnings.

Wood’s flagship Ark Innovation ETF (ARKK) has lost 68% in 2022 and is down 81% from its February 2021 peak.

The Ark chief executive has defended her strategy by noting that she has a five-year investment horizon. But the five-year annualized return of Ark Innovation totaled a negative 2.66% through Dec. 26, against the S&P 500’s positive return of 9.38%.

The fund’s performance also doesn’t come close to Wood’s goal for annualized returns of 15% over five-year periods.

Acknowledgement of Losses

In a year-end letter to investors, Wood doesn’t apologize for her performance. But she does address it, if a bit obliquely.

“We acknowledge that a risk-off market environment has pushed investors back toward benchmarks during the last two years, disadvantaging strategies that focus on disruptive innovation,” she wrote. Wood focuses on “disruptive innovation” stocks.

“While innovation solves problems and typically gains traction during difficult times, some companies may be cutting back on research and development and other investments to build cash as a buffer against the fallout from higher interest rates,” she said.

“Fear of the future is palpable these days, but crisis historically has created opportunities.”

Wood sees a strong environment for her stocks. “According to the latest [Bank of America] Fund Manager Survey, cash levels have not been this high since the 9/11 crisis in 2001,” she said. “And investors are overweight bonds for the first time since April 2009.”

Further, “the CBOE equity put/call ratio [has] surged above 2.0, the highest level on record, surpassing the ratios in both the tech and telecom bubble [2000-01] and the global financial crisis [2008-09],” Wood said.

“In hindsight, both of those times were terrific opportunities to put funds to work in highly differentiated ways.”

Rah, Rah for Innovation

And what about now? “To the extent investors have reserves of cash to put to work, Ark believes that this time will be no different and that innovation strategies will be prime beneficiaries when equity markets recover,” Wood said.

Meanwhile, Ark Innovation ETF’s subpar returns may finally be starting to push investors away. The $6.1 billion fund registered a net investment outflow of $308 million in the past month, according to ETF research firm VettaFi.

But it has still notched a $1.33 billion inflow for the year to date.

You might wonder why so many investors have stuck with Wood. The fact that she had one spectacular year certainly helps. Ark Innovation ETF skyrocketed 153% in 2020.

Also, Wood has become something of a rock star in the investment world, appearing frequently in the media. She explains financial concepts in ways that novice investors can understand.

Not everyone is enamored with her. Earlier this year, Morningstar analyst Robby Greengold issued a scathing critique of Ark Innovation.

“ARKK shows few signs of improving its risk management or ability to successfully navigate the challenging territory it explores,” he wrote.

Wood countered Greengold’s points in an interview with Magnifi Media by Tifin. “I do know there are companies like that one [Morningstar] that do not understand what we're doing,” she said.

Give Yourself the Gift of Future Returns!

You’re invited to join Action Alerts PLUS for just $79.99/yr. Don’t miss this chance to unlock best-in-class investing guidance from trusted portfolio managers -- without the management fees.